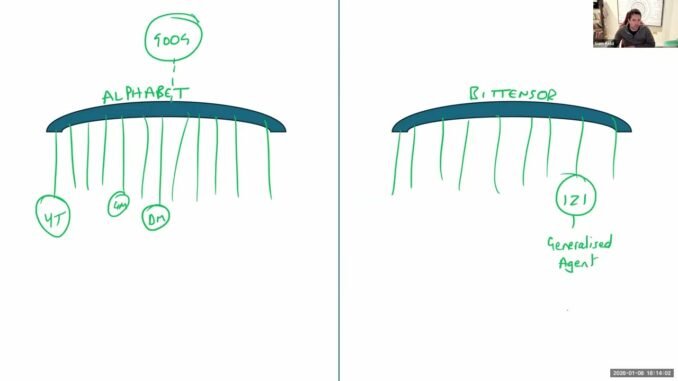

SUMMARY: Mark Creaser and Siam Kidd explained Bittensor as a decentralized protocol that functions like the “S&P 500 of AI startups,” where 128 independent AI projects (called subnets) compete to solve real-world problems using a proof-of-useful-work incentive mechanism.

They noted that unlike Ethereum, Bittensor has a mandatory value-capture system requiring all subnet ‘$ALPHA’ token purchases to flow through $TAO (the main token), meaning even one breakout subnet success drives value across the entire ecosystem. The protocol is currently in its infrastructure-building phase, with subnets already delivering competitive products like coding assistants rivaling Anthropic’s Claude Code, GPU rental at 70% below market rates, and world-leading video compression technology.

Early investors benefit from substantial yields that compound occasionally, combined with downside protection through rising deregistration floors that return most invested capital even if subnets fail.

Bittensor represents a globally scaled network for intelligence transfer, similar to how the internet revolutionized information sharing and Bitcoin enabled decentralized wealth transfer.

Be the first to comment