MANTIS has always carried an unusual weight inside the Bittensor ecosystem. It is neither a hype-driven subsystem nor a narrative-driven experiment. It is a mathematically disciplined, information-theoretic machine designed to measure something most networks only pretend to evaluate, the true predictive value of intelligence.

As a validator subnet on Bittensor’s Subnet 123, MANTIS incentivizes miners to produce encoded forecasts about future price movements. The system evaluates how much each miner’s contribution improves the global prediction of next-hour returns across a basket of assets, starting with BTCUSD.

In practice, this creates the first cooperative, decentralized, incentivized prediction engine for real market prices.

This article is adapted from work by Punisher ττ, whose documentation helps contextualize MANTIS’ evolution for the broader community.

A Quiet Machine That Suddenly Activated

After months of low-profile refinement, Barbarian (the developer behind MANTIS) announced a series of updates that signal the beginning of the subnet’s public phase. They are:

a. A live demonstration of a six-hour $BTC volatility forecast generated by MANTIS metamodels

b. A 25 $TAO transfer from the owner wallet to begin listing signals on external markets

c. A commitment to publish public short-term predictions during periods of extreme volatility

These steps confirm that the “signal machine” is now operational. For early followers of MANTIS, it marks the moment long preparation turns into public measurement.

A Subnet Built With Scientific Discipline

Most prediction-oriented subnets attempt to reconstruct accuracy by comparing outputs, scoring correlations, or using validation heuristics. MANTIS rejects that approach entirely because its design is rooted in information theory.

The subnet measures a miner’s value by “How much does this miner reduce the model’s error?”

The process operates as follows:

a. Miners submit feature vectors representing their encoded predictions

b. The validator computes the model’s error using all miners’ entry

c. The system recomputes the error with each miner removed

d. The difference becomes the miner’s marginal contribution

e. Rewards flow only to those whose intelligence improves the model

There is no reward for noise, volume, or activity; only signal survives.

This architecture aligns MANTIS with the original intent of Bittensor (reward intelligence that demonstrably improves a shared model).

The Forecast Itself: Predicting Future Returns

The prediction target for MANTIS is clear: the next one-hour return of key financial assets, beginning with BTCUSD.

This is a difficult horizon; short enough to require precise signal extraction and long enough that naïve trend following breaks down.

The subnet intends to expand to additional assets and FOREX pairs, creating a multi-asset prediction engine capable of operating at scale.

By treating each miner as an information input to the metamodel and paying miners based on the measurable utility of their contributions, MANTIS functions as a decentralized research cluster. It is not just predicting markets, it is evaluating the informational value of every participant in real time.

Why Veteran Builders Are Paying Attention

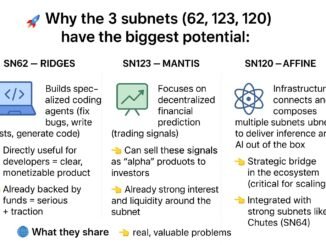

Several respected developers across Bittensor have noted the seriousness of what Subnet 123 is attempting.

Arrash from Subnet 8 summarized it succinctly:

a. The system looks capable of scaling beyond prediction markets into traditional financial markets

b. The signal quality is high enough that other subnets could integrate it

c. Barbarian’s work resembles the foundation of a future quantitative trading pipeline

Barbarian himself has emphasized that the benchmark will be spot and futures markets and not prediction platforms such as Polymarket.

This indicates a clear intention to build scalable intelligence suitable for high liquidity environments.

From Subnet 50 to Subnet 123: The Next Tier of Predictive Infrastructure

Synth (Subnet 50) introduced the ecosystem to the value of coordinated predictive modeling.

MANTIS is the next tier; a more surgical, information optimized approach built with tighter constraints and higher scientific rigor. Everything released before now was groundwork.

Subnet 123 is entering its performance phase, where public outputs, benchmark comparisons, and volatility forecasts will begin to define its reputation.

If the subnet performs as expected, it has the potential to bring external visibility to Bittensor through results rather than marketing narrative.

Where MANTIS Goes From Here

The trajectory of MANTIS has been deliberate from the beginning. It is slow, precise, and methodical. Now the acceleration phase begins.

With the metamodel live, new signals emerging, and market facing integrations starting, the subnet enters the stage where its performance will be measurable and public.

The machine is turning on and the next phase will determine how far it goes.

Useful Links

X (Formerly Twitter): https://x.com/MANTISBittensor

Telegram: https://t.me/MANTIScommunity

Be the first to comment