By: TAO Galaxy

As Bittensor’s decentralized economy matures, a new investment challenge is taking shape. With more than 100 subnets competing for capital, attention, and emissions, traditional approaches to crypto investing are starting to show their limits.

In a recent research piece by TAO Galaxy, the team argues that dTAO (dynamic TAO) should not be approached like a conventional stock-picking market. Instead, they propose that momentum, shaped by information flow and capital movement, is becoming one of the most reliable signals for navigating this early and reflexive ecosystem.

Their findings point to a simple but important conclusion: in dTAO, how capital moves often matters more than where it ultimately settles.

Why Traditional Subnet Picking Falls Short

Many investors approach dTAO with the mindset of finding long-term winners early. The logic is familiar: identify the subnet that becomes the dominant platform, hold it long enough, and capture outsized returns.

The problem is that dTAO does not yet behave like a mature equity market.

Two structural issues stand out:

a. Subnet Data is Fragmented: Key information is scattered across on-chain activity, emissions behavior, development progress, and off-chain ecosystem signals. There is no standardized disclosure layer, which makes objective comparison difficult.

b. Price Action is Not Purely Fundamental Driven: Even when fundamentals are strong, subnet prices often move faster than the underlying progress. Attention, narratives, and short-term capital flows frequently dominate valuation, especially over shorter time horizons.

Because of this, TAO Galaxy argues that relying solely on long-term conviction can be inefficient. In an early market like dTAO, adaptability often matters more than prediction.

Why Momentum Fits dTAO’s Market Structure

Momentum is one of the most well documented effects in financial markets. Assets that outperform their peers tend to continue doing so for a period of time, especially when information spreads unevenly.

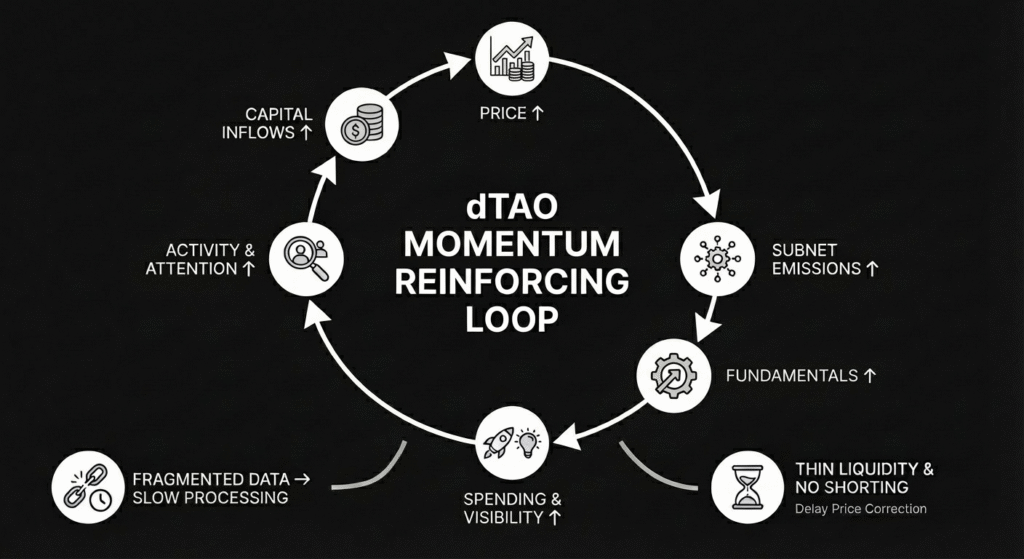

According to TAO Galaxy, dTAO exhibits conditions that make momentum particularly powerful:

a. Information Travels Slowly and Unevenly: Subnet developments are not absorbed by the market all at once, different participants react at different speeds.

b. Capital Flows Directly Affect Fundamentals: In dTAO, capital inflows increase emissions. Higher emissions can fund development, incentives, and ecosystem growth, reinforcing performance.

c. Liquidity is Thin and Shorting is Limited: Without efficient mechanisms to correct prices, relative strength can persist longer than expected.

Together, these dynamics create a reflexive loop where price strength, visibility, and capital reinforce each other. In this environment, momentum is not just a trading artifact. It becomes a structural feature of the market.

The TAO Galaxy Momentum Index Explained

To capture this behavior systematically, TAO Galaxy developed the TAO Galaxy Momentum Index. Rather than relying on price alone, the index aggregates multiple data sources into a single relative strength score.

At a high level, the index combines:

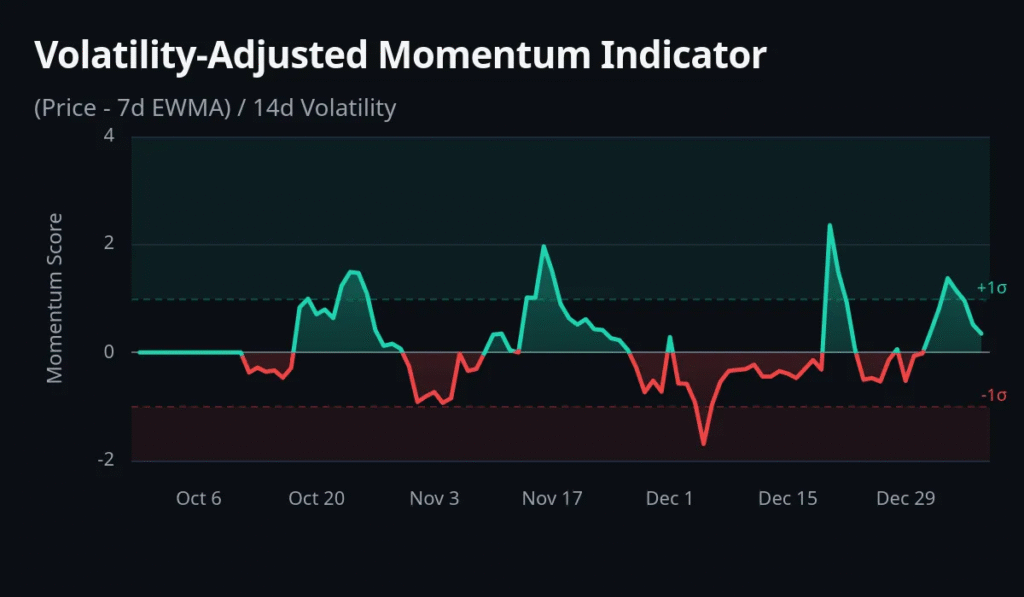

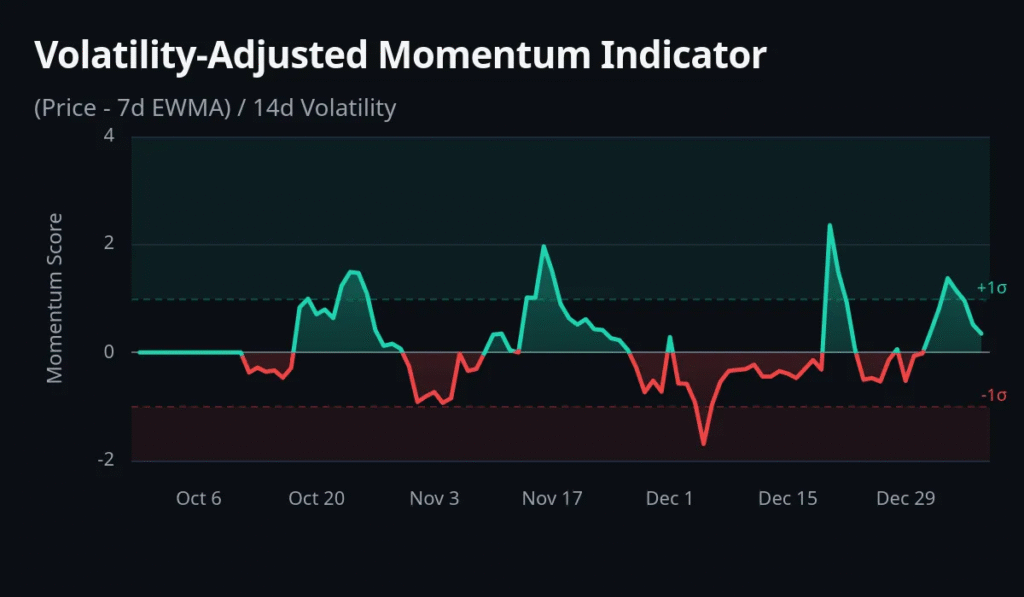

a. Price Behavior Adjusted for Volatility: This captures performance while filtering out excessive noise.

b. On-Chain Miner Activity: This reflects how emissions are being held, sold, or reinvested.

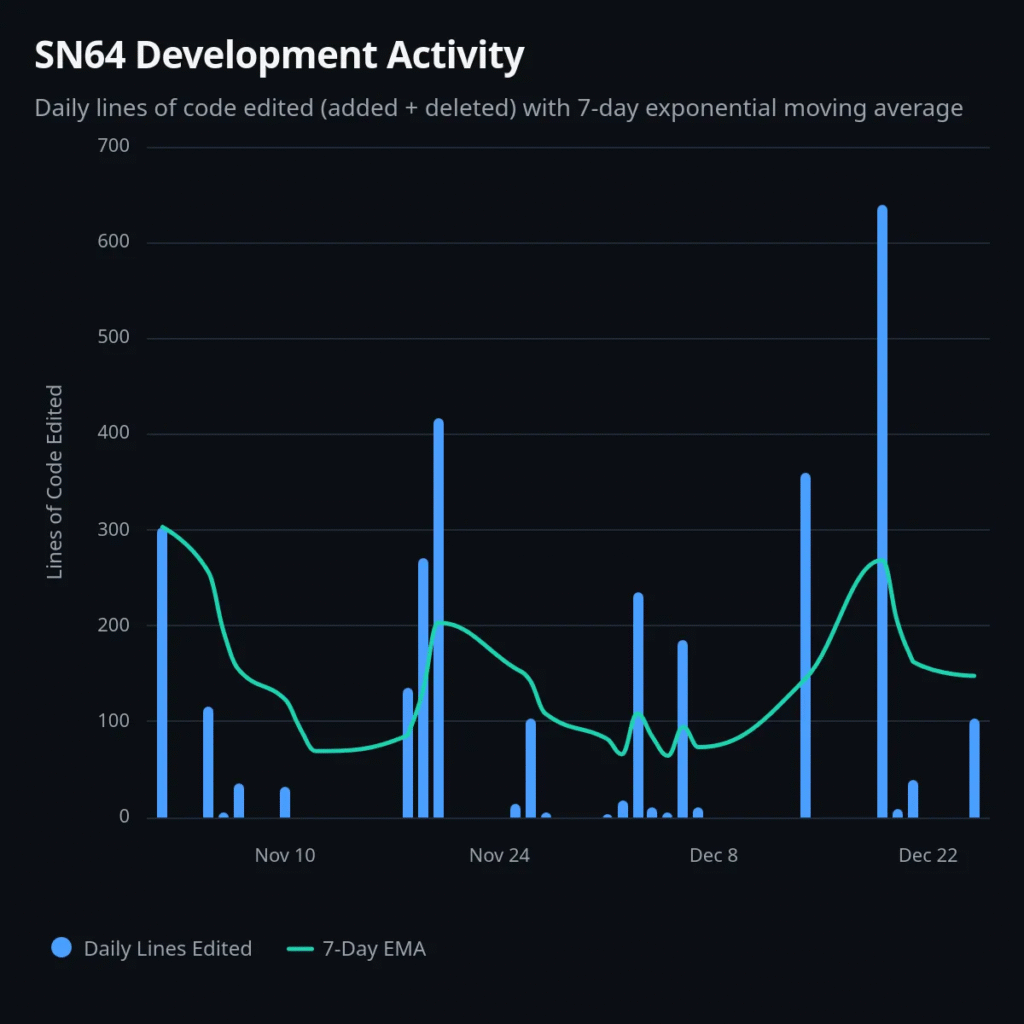

c. Development Signals: Code activity and delivery pace serve as proxies for execution intensity.

d. Ecosystem and Social Signals: Qualitative information is structured into measurable inputs.

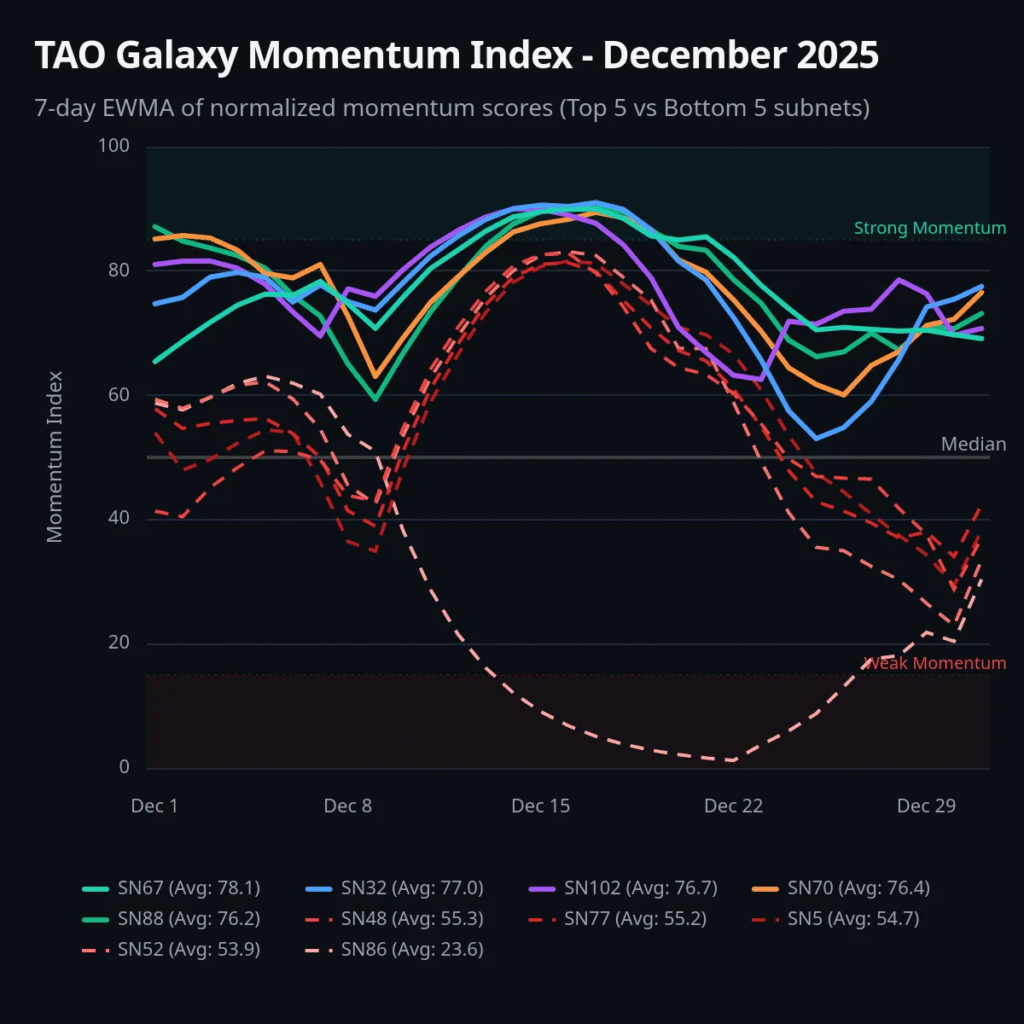

Each subnet receives a daily score between 0 and 100, allowing investors to compare momentum across the ecosystem rather than in isolation.

Does Momentum Actually Predict Performance

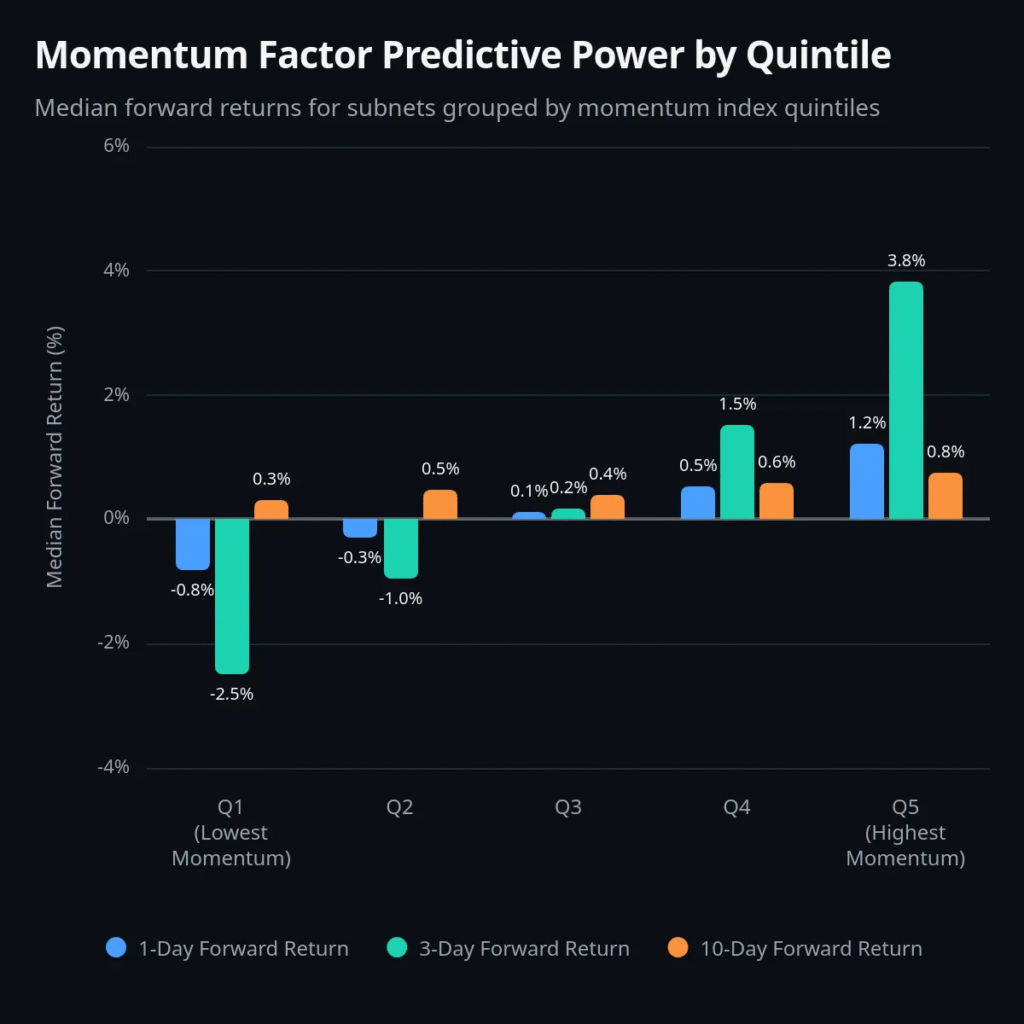

The critical question is whether this signal is predictive or simply descriptive. TAO Galaxy tested the index across liquid subnets between March and December 2025.

Subnets were ranked by momentum score and grouped into tiers, their subsequent performance was then tracked over short-time horizons.

The results were consistent:

a. Subnets with the highest momentum scores tended to outperform,

b. Subnets with the weakest momentum tended to underperform, and

c. The effect was strongest over short periods, particularly around three days.

This suggests that momentum in dTAO moves quickly and decays faster than in mature markets. For active exposure management, however, that speed can be an advantage rather than a drawback.

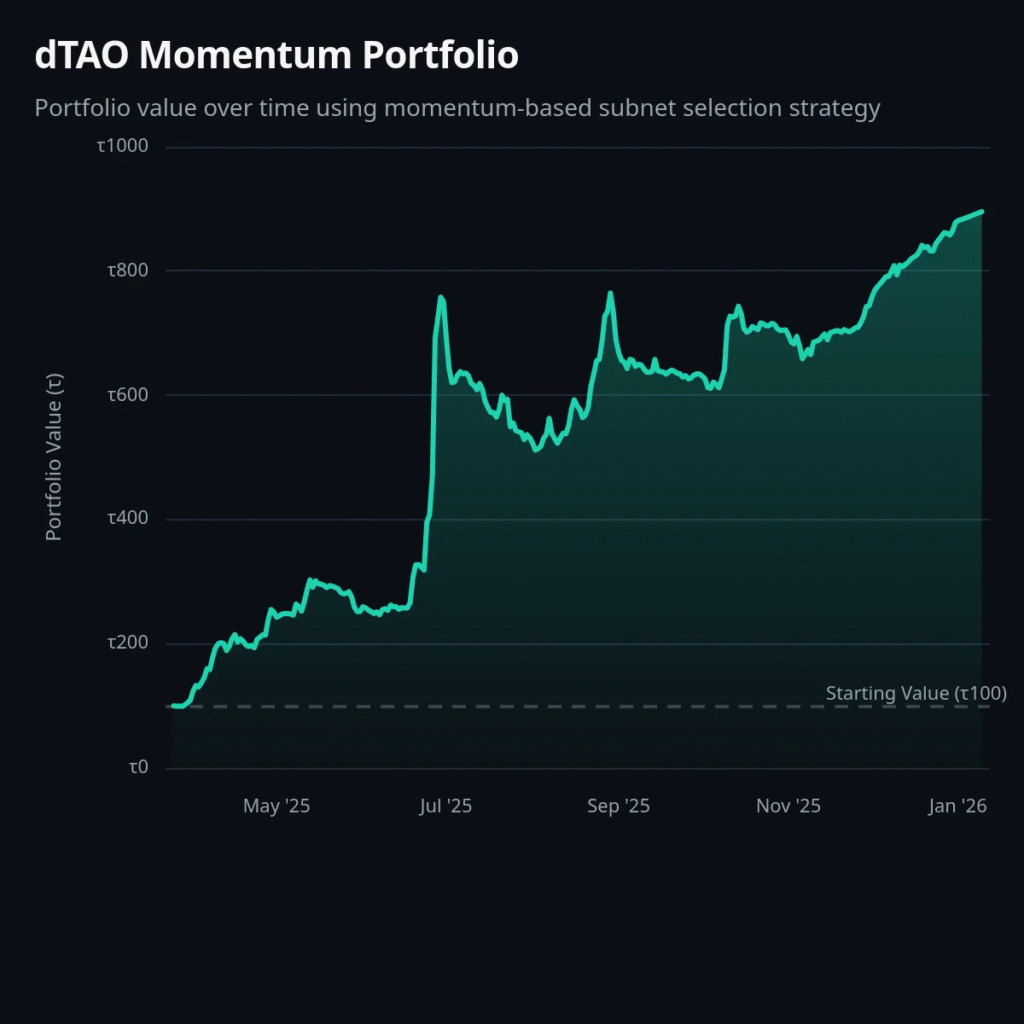

A model portfolio using the momentum signal delivered strong returns over the test period, with controlled drawdowns and high-risk adjusted performance.

From Narratives to Structured Exposure

The broader implication of this research is not that fundamentals do not matter. It is that in dTAO, fundamentals are often reflected through capital flows before they are widely understood.

TAO Galaxy positions its momentum framework as a way to move beyond narratives and intuition. By transforming fragmented on-chain and off-chain signals into standardized metrics, the approach enables more disciplined decision-making in a fast-moving market.

For institutional participants exploring decentralized AI exposure, this represents a shift toward systematic allocation rather than conviction-driven bets.

Conclusion

dTAO remains an early and rapidly evolving market. Information is incomplete, incentives are reflexive, and prices are shaped as much by behavior as by long-term potential.

The work by TAO Galaxy suggests that momentum is not a temporary anomaly but a structural feature of this environment. By measuring how information, attention, and capital move across subnets, investors gain a clearer view of where strength is emerging in real time.

In a market defined by change, adaptability may be the most valuable asset of all.

Be the first to comment