In Bittensor’s alpha (dTAO) market, price alone doesn’t tell the full story. A token can pump today and collapse tomorrow, especially if a whale sells. But if the subnet isn’t producing real value or revenue, there’s no natural reason for anyone to defend the price. That’s why TAO Templar argues (in the YouTube video below) that the liquidation price is quickly becoming one of the most important metrics to watch when investing in subnet alpha tokens, especially for lower-priced subnets.

Liquidation price represents the amount holders would receive if a subnet were deregistered and its TAO pool were redistributed to alpha holders. In simple terms, it’s the TAO backing behind the subnet. If a subnet collapses or gets deregistered, liquidation price is the real floor value you fall back to. And if liquidation price is far below the current price, investors are exposed.

What Liquidation Price Actually Means

TAO Templar explains liquidation price as the value at which alpha holders are paid out if the subnet is deregistered. The subnet’s TAO pool is distributed proportionally to everyone holding the subnet’s alpha token, and liquidation price determines what that payout looks like.

Sometimes liquidation price sits close to the current market price. Other times, it’s far below, meaning the market is pricing the subnet far above what it’s actually backed by. And that gap becomes dangerous when confidence drops.

Why Liquidation Price Is Becoming a “Magnet”

As subnets approach death, their market price tends to gravitate toward liquidation price. When a subnet looks weak, traders stop treating it like an asset and start treating it like a liquidation event waiting to happen. That’s when liquidation price becomes a psychological anchor.

If liquidation price is significantly lower than market price, the risk is simple: investors will prefer selling now rather than waiting for deregistration and taking a guaranteed haircut.

The Post-Halving Shift: Why Liquidation Prices Started Falling

One of the most important insights in the video is that the liquidation price behaved very differently before and after the halving.

Before the halving, liquidation prices in many subnets were rising steadily, especially in subnets running 100% miner burn. That made liquidation-based investing profitable: traders could buy subnets with strong liquidation backing and ride the gradual climb.

After the halving, the liquidation price across many subnets began trending downward. The reason is structural: the halving reduced the amount of TAO being injected into subnet pools. With less TAO entering pools, liquidation price growth slowed down or reversed entirely.

The result is that the liquidation price is no longer a guaranteed upward trend. In many cases, it’s now a slow descent.

Miner Burn and Sell Pressure: The Hidden Lever

Subnets with 100% miner burn have a key advantage: reduced sell pressure. Normally, emissions are split between miners, subnet owners, and validators/stakers. Miners receive around 41%, and miners tend to sell to cover operating costs.

But if miners receive zero emissions, that 41% sell pressure disappears. In practice, this helps stabilize price and slows the decline of liquidation price. That’s why some 100% miner burn subnets maintained stronger liquidation price stability compared to others.

However, even those subnets are not immune post-halving. They may decline more slowly, but the halving still reduced the pool inflows that support liquidation price over time.

Why Low Liquidation Price Subnets Are the Most Dangerous Trades

The worst place to be is holding low-priced subnets with extremely weak liquidation backing. These are the subnets most likely to collapse if whales dump, because there’s no safety net.

Many subnets nearing deregistration have very low liquidation prices. Once dereg approaches, the liquidation price becomes the reference point, and the market begins pricing the subnet as if it’s already dead.

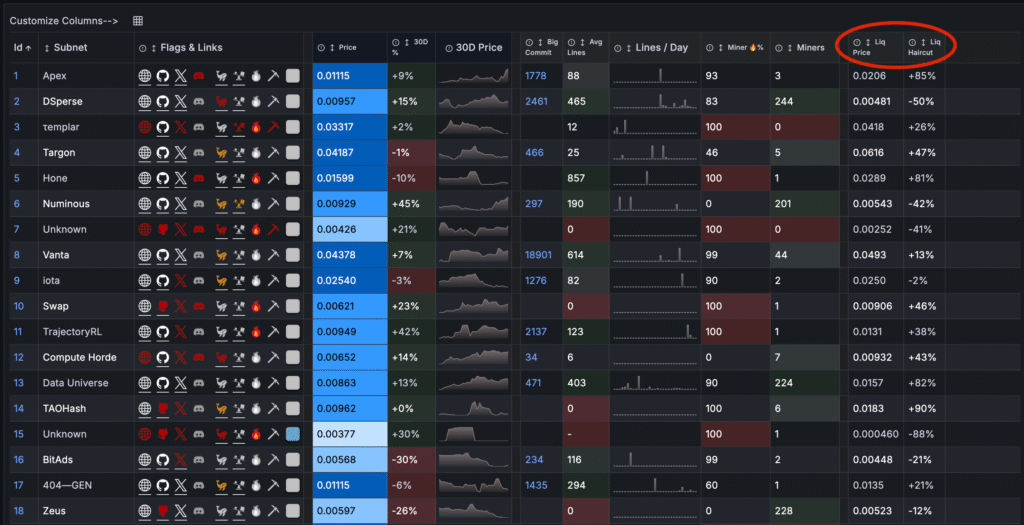

This is where liquidation haircut becomes crucial. If liquidation price is lower than current price, holders would lose money if the subnet were deregistered today. That makes the token unattractive, because rational investors will exit early.

In contrast, subnets with a positive liquidation haircut (where liquidation price is higher than current price) are structurally safer, because liquidation would actually return more TAO than selling at market price.

The Whale Dump Problem: Why Production Matters

The harsh truth is: if a whale sells and the subnet produces nothing, nobody has an incentive to pump the price back up.

That’s why liquidation price matters. It represents the real capital support behind the token. If the subnet isn’t generating revenue, buybacks, or real demand, then once selling begins, the decline becomes self-reinforcing.

There are instances where whale ownership is high, meaning a single wallet could dump a massive percentage of supply and instantly crash price into liquidation territory. If liquidation price is already low, that crash can be fatal.

TAO Flow and Zero Emissions: Not Instant Death, But a Warning Sign

TAO Templar also covers how TAO Flow introduced a new dynamic: some subnets started receiving zero emissions when more TAO was being withdrawn from their pool than injected.

He argues that zero emissions are not necessarily the end. Some subnets have dipped into zero emissions and later recovered. But the mechanism is still painful because alpha continues being distributed to miners, subnet owners, and validators, while TAO inflows stop. Meaning alpha supply inflates against a stagnant pool.

That causes downward price pressure until conviction returns and someone starts injecting TAO back into the subnet pool.

What To Look Out for Before Buying Any Subnet Alpha Token

TAO Templar weighs in: he checks liquidation price before investing in any subnet. His reasoning is that liquidation price helps estimate downside risk. If liquidation price is collapsing rapidly, the subnet is structurally weakening, and any price rally becomes fragile.

He also watches whether subnet teams are actively shipping, committing code, adjusting incentives like miner burn, and showing signs of eventual revenue or buyback mechanisms. In his view, liquidation price is only part of the story, but it’s the part that tells you whether the token is backed by real capital or just market hype.

How To Check the Liquidation Price of Subnets

There are two simple ways to check a subnet’s liquidation risk before buying.

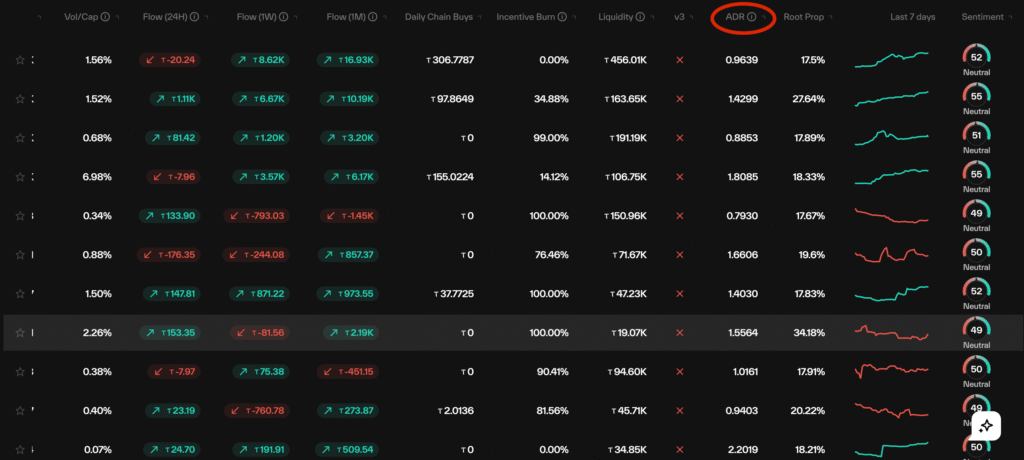

First, you can use Taostats and look at the subnet’s ADR (Alpha Distribution Ratio). If ADR is above 1, it means the subnet is trading at a premium relative to its backing; and if liquidation happens, you’d receive less TAO than what you paid (meaning you take a loss on liquidation).

Alternatively, you can check taoflute.com, where TAO Templar provides the exact liquidation price for each subnet. This gives you a clearer view of what the real “floor value” is if the subnet gets deregistered.

Be the first to comment