DeFi audits are less about declaring a protocol “safe” and more about revealing how its architecture holds up under scrutiny. In that sense, the Halborn audit of ForeverMoney (SN98) offers a useful snapshot of the project’s current security posture. The ForeverMoney team shared the full audit report with The TAO Daily, providing transparency into both identified issues and how they were handled.

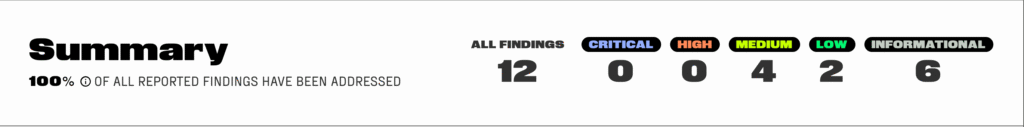

The audit found no critical or high-severity vulnerabilities, but it did surface several medium, low, and informational findings.

That’s why this audit matters.

Halborn reviewed ForeverMoney’s smart contracts between December 22 and December 31, 2025, covering ERC20 Agent Key tokens, liquidity managers, prediction markets, staking rewards, escrows, and a time-weighted BID locking NFT system. The scope focused strictly on core contract logic. Third-party dependencies and economic attacks were excluded. The result was 12 total findings, none of them catastrophic, all of them instructive.

The Medium Issues Were Real Risks, Not Paper Cuts

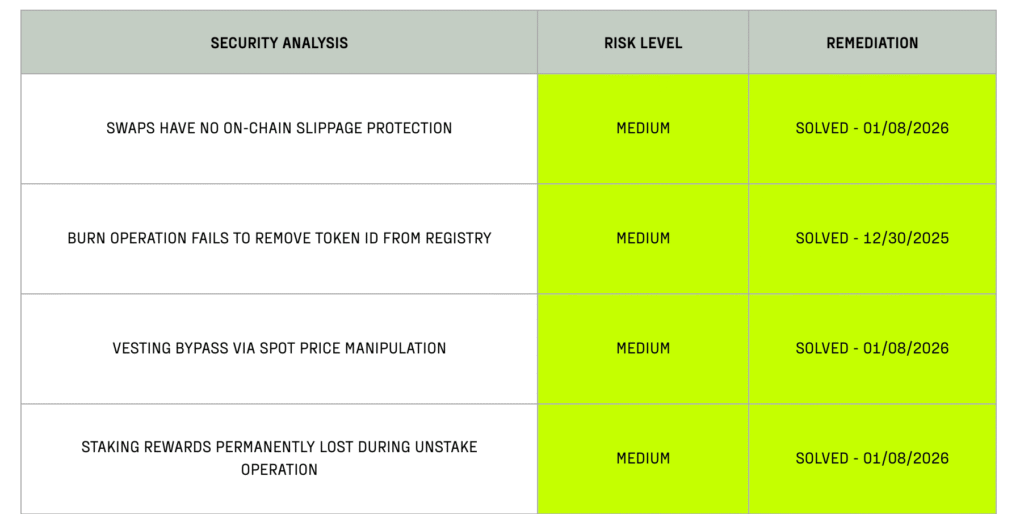

The most important part of the audit sits in the four medium-severity findings, all of which were fixed.

- No on-chain slippage protection in swaps

- Incomplete token ID cleanup on burns

- Vesting bypass via spot price manipulation

- Lost rewards on unstake

Bottom line: These are common DeFi failure points. The fact that all were identified and fixed quickly is a positive signal.

The Low-Severity Issues Were Accepted, Not Ignored

Two low-severity issues were acknowledged and left unchanged.

- Permissionless position manager initialization

- Non-atomic fee splitter initialization

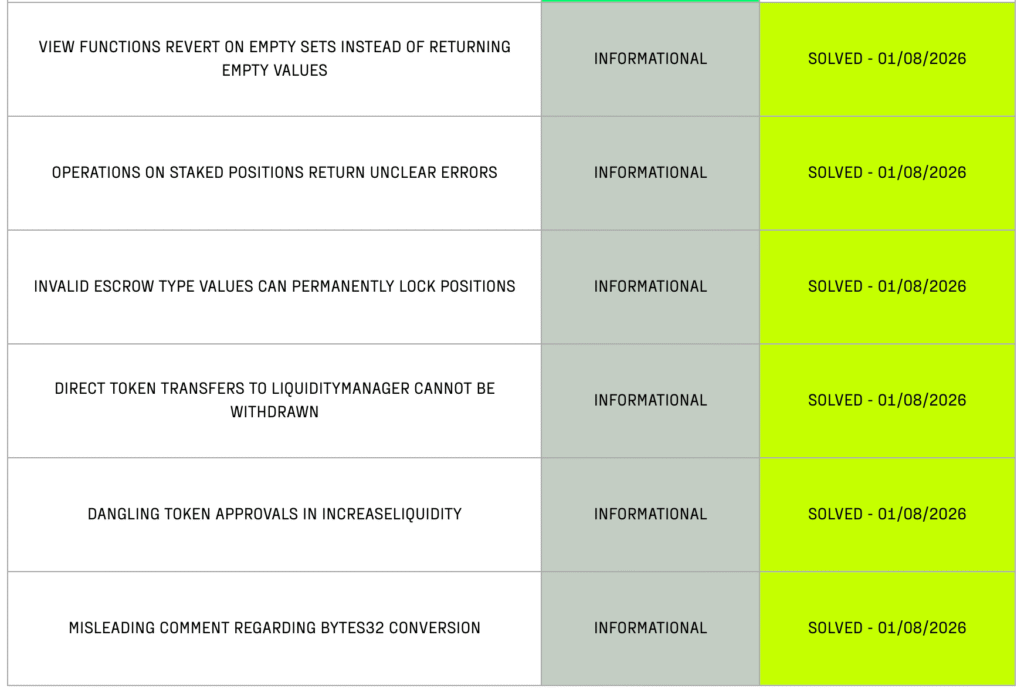

Informational Findings Were About Usability, Not Safety

The remaining six findings focused on usability and maintainability. Things like view functions reverting on empty data, unclear error messages, dangling approvals, and the risk of stuck funds from direct token transfers.

All were fixed.

The Real Takeaway for Users and Investors

The headline is not “ForeverMoney passed an audit.” Many exploits happen after audits anyway.

The real signals are:

- All medium issues were fixed before launch pressure could override safety.

- The team responded quickly and transparently.

- No high-risk logic flaws were found in core contracts.

That puts ForeverMoney in a better position than many DeFi protocols at a similar stage.

Still, caution applies. Remember, audits are snapshots, not guarantees. Follow post-audit commits and updates.

Be the first to comment