The Bittensor subnet market has matured into one of the most dynamic arenas in DeAI (decentralized AI), especially with the coming of dTAO (dynamic $TAO). Liquidity has since then been growing, competition is intensifying, and allocation strategies are shifting rapidly.

In this kind of environment, the traders who win are the ones who understand information earlier than everyone else.

SubnetStats steps into this emerging landscape as a dedicated intelligence platform designed to help investors trade smarter. It brings clarity to a market where data is often fragmented or difficult to interpret.

With real-time visibility into holders, netflows, liquidity conditions, and whale movements, it delivers the type of structured insight that every serious subnet investor has been waiting for.

What is SubnetStats

SubnetStats is a comprehensive analytics platform built to monitor the entire Bittensor subnet ecosystem. It processes live on-chain activity across all 128 subnets and organizes it into actionable intelligence for traders, allocators, and researchers.

The platform focuses on clarity, instead of raw data, by giving users meaningful interpretation. SubnetStats highlights the movements that shape markets and the behaviours that reveal sentiment, confidence or risk.

Why SubnetStats Matters

Subnet markets move fast and are influenced by a small number of large holders. Without proper analytics, investors are often forced to rely on baseless speculation, community sentiment (FOMO/FUD), or delayed updates.

SubnetStats changes this entirely. It matters because it provides:

a. Transparent insight into who drives market behavior

b. Early detection of accumulation or distribution trends

c. Clear interpretation of netflows that shift price direction

d. Visibility into liquidity conditions that influence entry and exit risk

e. Context for market events through real-time alerts

These insights help users avoid blind spots, reduce guesswork, and position themselves ahead of major movements.

Who SubnetStats Is Built For

SubnetStats is designed for a wide range of participants in the Bittensor ecosystem.

These include:

a. Active subnet traders

b. Long-term $TAO allocators

c. Institutional or fund-based subnet investors

d. Researchers studying network-wide behavior

e. Builders needing visibility into market structure

f. Community analysts who track subnet performance

Each group benefits from a structured view of activity that would otherwise be scattered across multiple sources.

Core Features of SubnetStats

SubnetStats, as a powerful analytics platform, is designed to provide Bittensor ($TAO) investors with deep, actionable insights into the underlying dynamics of all subnets.

It aggregates and dissects on-chain activity in order to provide a comprehensive toolkit that moves beyond simple price feeds.

Thus, at the centre of this tool are analytics focus-points that reveal transparency, concentration, liquidity, and real-time movement, allowing users to understand the balance of power and potential shifts within the Bittensor ecosystem:

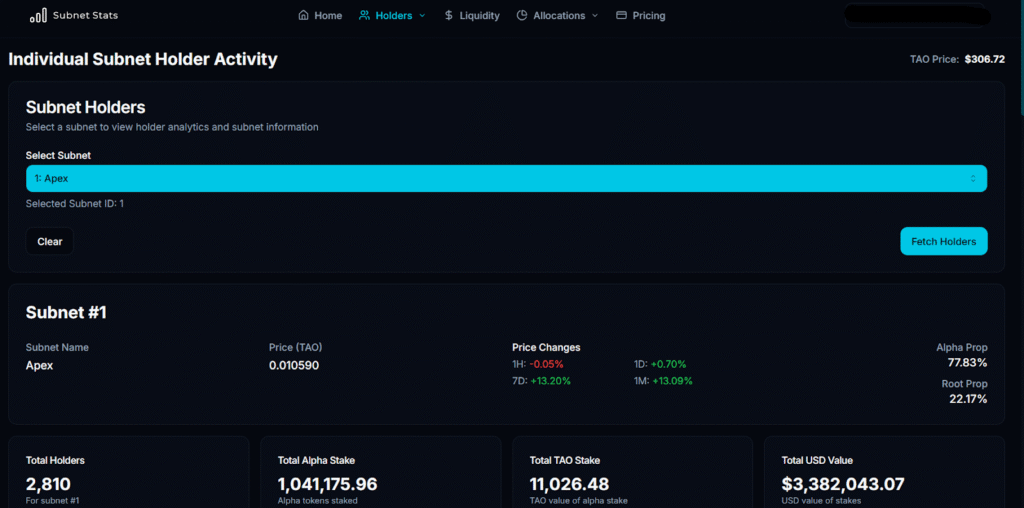

1. Holders Analysis

This module provides a full breakdown of individual subnet holders and their activity. It helps users understand:

a. The largest wallets influencing each subnet

b. How positions change over one day, seven days and thirty days

c. Which groups such as ‘whales’ or ‘dolphins’ are driving movement

d. Where unusual behavior signals early market shifts

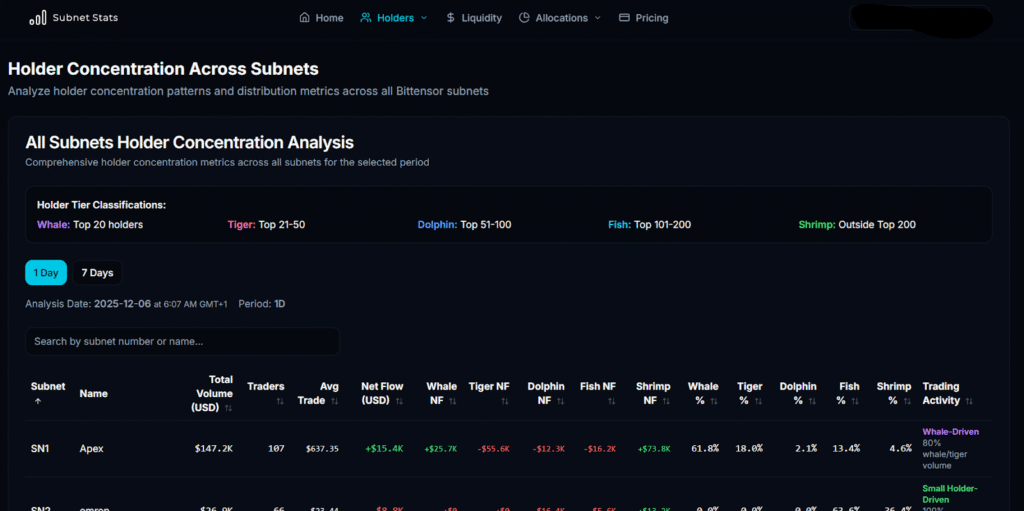

2. Holder Concentration

This analysis point reveals the balance of power inside each subnet. It allows users to study:

a. Concentration levels among top holders

b. Netflows, shown in $TAO terms and USD terms

c. Total trading activity and participation rates

d. Behavioral patterns across specific investor cohorts

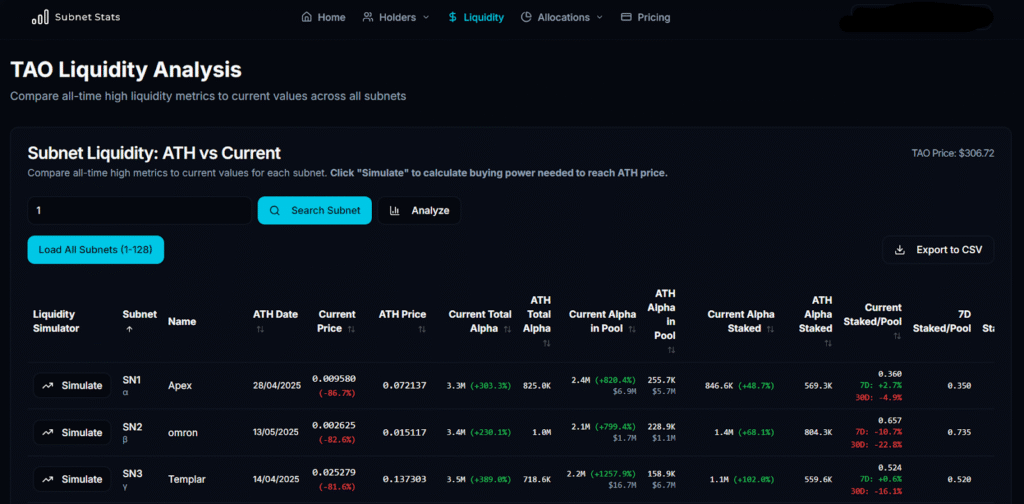

3. Liquidity Analysis

Liquidity determines how safely and profitably a trader can enter or exit a position. SubnetStats provides:

a. A comparison of current liquidity versus ATH (All-Time Highs)

b. A Uniswap-V2 Simulator for price impact

c. Statistical connections between staking and price action

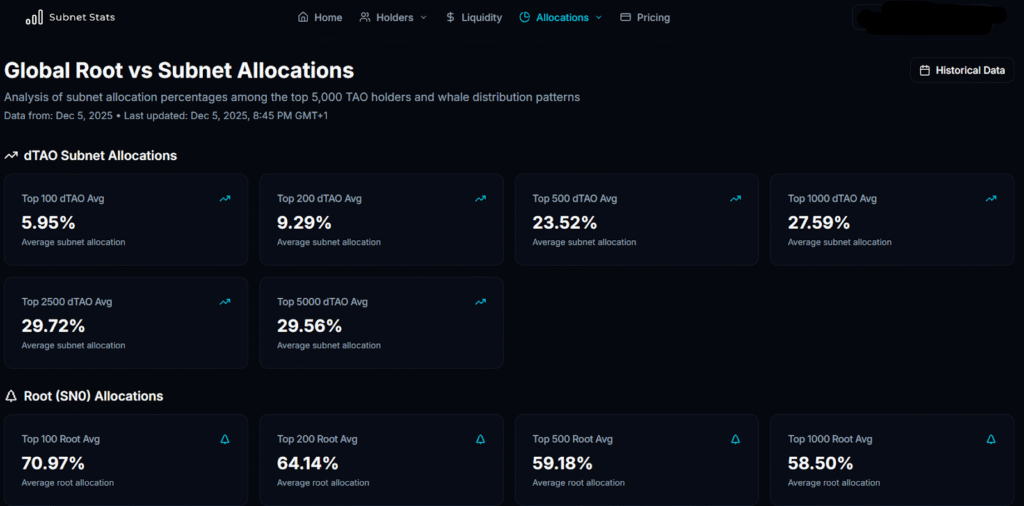

4. Allocation Distribution

This focuses on how major $TAO holders distribute their positions. Users can view:

a. Allocations among the top 100, 500, 1 000, 2 500, and 5 000 holders

b. Subnet concentration by investor type

c. Patterns of diversification or concentrated risk

5. Real-Time Market Alerts

Fast markets require fast alerts, SubnetStats delivers:

a. Immediate whale trade notifications

b. Buy-and-sell flow alerts with price context

c. Early signals when specific wallets begin moving markets

This feature is only available to premium subscribers and alerts are delivered directly to their Telegram in real-time, making SubnetStats practical for traders who want to stay ahead of sudden activity.

Additional Platform Strengths

a. Clean User Experience

The interface is built for readability and decision making. Users can move from high-level snapshots to deeper detail without friction.

b. Network-Wide Coverage

All 128 subnets are tracked in real-time. This provides a complete understanding of how capital circulates across the entire Bittensor economy.

c. Continuous Product Expansion

The team behind SubnetStats plans to introduce more tools, more analytics and more visualizations as dTAO grows. The platform is built to expand in step with the ecosystem.

How to Explore SubnetStats

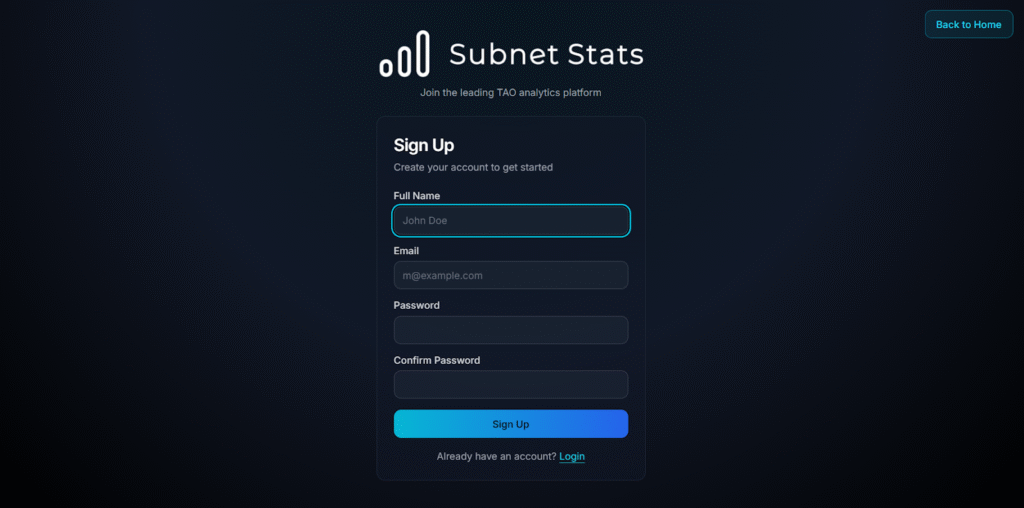

SubnetStats is an easy to access web application, with simple signup and login procedure.

To get started on SubnetStats, users should:

a. Visit SubnetStats and input necessary details (signup takes an average of 30 seconds)

b. Users access the dashboard and navigate based on the metrics they wish to analyze.

c. To access the suite of features on SubnetStats, users can also opt-in for the subscription package.

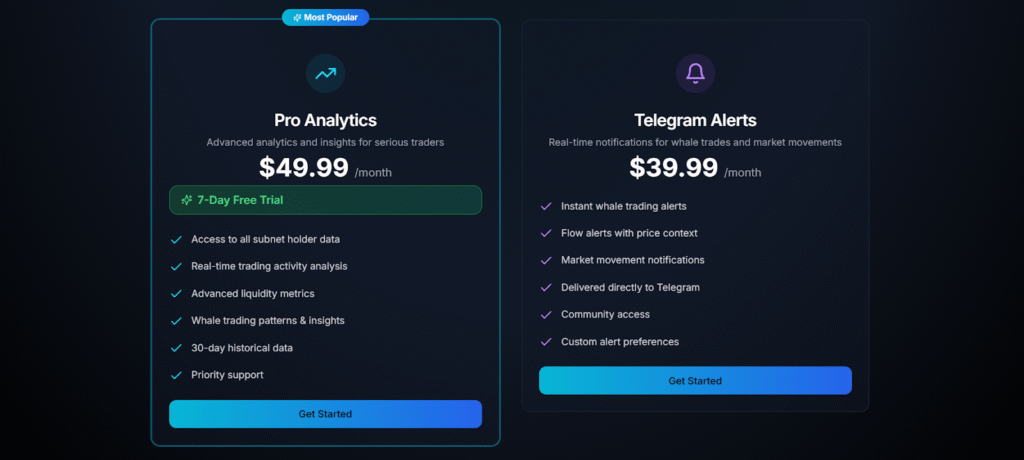

There are two main subscription plans on SubnetStats, they are:

1. Pro Analytics ($49.99 Per Month with a 7-Day Free trial)

This plan gives users a complete toolkit for in-depth analysis. With this, users receive:

a. Full-holder level datasets

b. Detailed position tracking

c. Advanced liquidity and netflow metrics

d. Whale insights and behavioral patterns

e. 30-day historical datasets

f. Priority customer support

2. Telegram Alerts ($39.99 Per Month)

This gives users a direct line to market moving events. Directly in their Telegram inbox, subscribers receive:

a. Immediate whale activity alerts

b. Flow alerts with clear price interpretation

c. Major trading movement notifications

d. Community access and customizable alert settings

How SubnetStats Changes Subnet Investing

By combining holder intelligence, liquidity analysis, allocation tracking and real-time alerts, SubnetStats turns an emerging market into something legible. Traders on the ecosystem can now gain a competitive advantage, investors gain transparency while researchers gain a ready-made structure.

Most importantly, users are able to make decisions based on data rather than noise (not even guesswork!).

Conclusion

SubnetStats arrives at a moment when the subnet market is expanding, competition is increasing and capital is becoming more sophisticated. By providing the deepest and most organized intelligence available, it positions itself as a foundational tool for anyone who wants to navigate the Bittensor economy with confidence.

For the broader ecosystem, this is a significant step toward transparency, maturity and informed participation.

Be the first to comment