Crypto trading is evolving fast, but Vanta Network (Subnet 08 on Bittensor) is building something different: a decentralized proprietary trading ecosystem where the best traders rise, weak traders get eliminated, and risk adjusted performance decides who gets paid.

It blends on-chain incentives with real trading skill, opening a path for individuals to access massive trading capacity without needing millions in capital.

Let us explore how Vanta works from the perspective of a single miner, how payouts are earned, how elimination works, and why this subnet is becoming one of the most competitive arenas on Bittensor.

Setting Up as an Individual Miner

Individual miners operate by running their own server and staking Subnet 08’s $ALPHA token into the system.

The setup is lightweight, its basic requirement is:

a. A CPU-based VPS is enough (cost is usually under $10 per month)

b. No complex infrastructure or GPU-power needed

Once online, the miner decides how much capacity they want to trade with. This is where the staking mechanism matters.

Staking $ALPHA to Unlock Trading Capacity

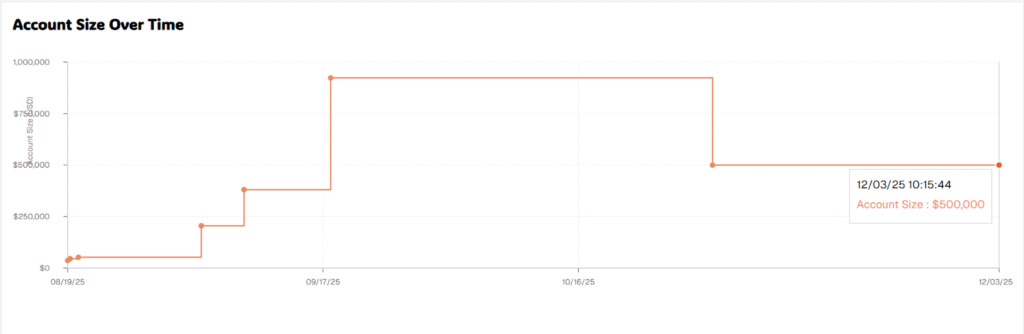

Capacity works like decentralized prop firm leverage. For example, if a miner deposits 1,000 $ALPHA, Vanta grants $500k trading capacity, calculated at $500 per $ALPHA

This capacity is not withdrawable capital. It is the size of the account the miner trades with inside the Vanta system.

They choose their strategies and place trades directly:

a. Long or short crypto

b. FOREX pairs

c. Equities by month end

Validators track every order in real-time.

How Vanta Judges Performance

Vanta does not simply look at raw PnL (Profit and Loss). It evaluates risk-adjusted performance, which rewards consistent, controlled trading rather than lucky moonshots.

Validators continuously measure:

a. Profit consistency

b. Drawdowns

c. Leverage behaviour

d. Position sizing

e. Volatility exposure

This creates a level playing field where smarter trading beats reckless trading.

The Challenge: 60 to 90 Days of Evaluation

Every miner must pass a probation phase before earning payouts, the challenge window lasts 60 to 90 days. During this time, the network gathers enough data to understand the miner’s performance profile.

At the end of the challenge:

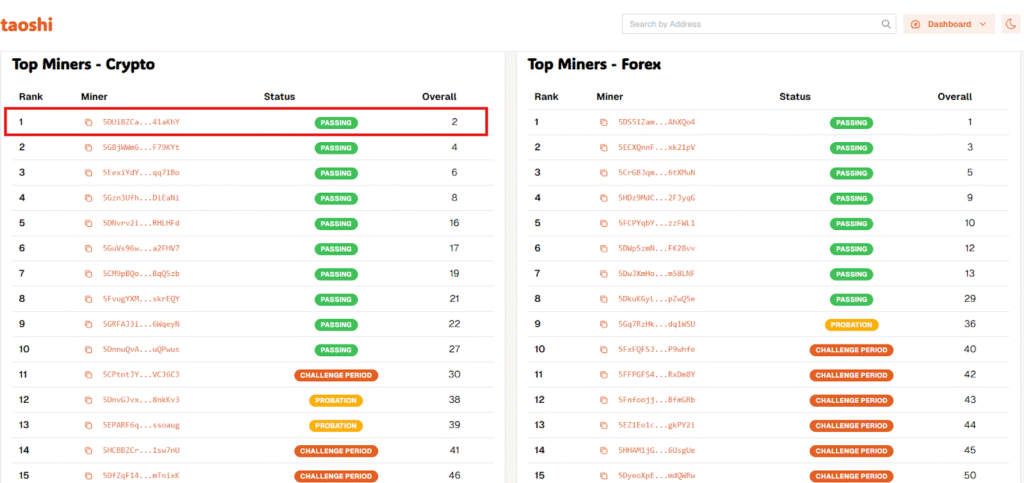

a. Finishing inside the top 25 in your asset class qualifies miners for payouts.

b. Finishing outside the top 25, miner’s staked $ALPHA is collected and burned.

It is high stakes by design keeping the network competitive and removes weak or reckless traders early.

Staying in the Top 25

Passing the challenge is only the beginning. To remain active, a miner must:

a. Stay within the top 25 of their category

b. Maintain strong risk adjusted metrics

c. Avoid deep drawdowns

If a miner falls below the threshold and remains there:

a. They are eliminated

b. A portion of their alpha is burned

c. The burned amount is proportional to their drawdown (max. 10%)

Eliminations are transparent and visible on the dashboard.

How Payouts Work for Successful Miners

Miners who survive the challenge and stay competitive receive monthly payouts.

Payouts scale with:

a. The trader’s net profit

b. Their risk adjusted scores

c. How far above threshold their performance is

If risk metrics fall, payouts get reduced but if risk metrics stay strong, miners receive full rewards.

Example:

The current top crypto miner, khy:

a. Trades a $500,000 account

b. Is up more than 4% this month

c. Earns over $20,000 in payouts

Their metrics exceed every risk threshold, so they receive the full reward.

Burning Mechanism and Long-Term Expectations

Any $ALPHA not paid out is burned. Right now, burns are sizable because most individual miners fail, but Vanta expects this to change soon.

When entity miners arrive:

a. Tens of thousands of traders enter the system

b. More traders produce profits

c. Burn levels fall

d. Registration fees increase inflows

e. Network margins increase

The model resembles traditional proprietary firms, where:

a. 93% to 95% of traders fail

b. 1 in 1000 trade like elite performers

c. Margins are historically 60% to 80%

Vanta captures this dynamic on-chain.

Lifting the Ceiling: Capacity Increasing to $2.5 Million

As the network gains stability, miner capacity is rising.

Miners who demonstrate exceptional performance will see:

a. Automatic capacity increases

b. Scaling up to $2.5 Million

c. Bigger profit share potential

d. Stronger influence on network models for Glitch

Entity miners will allow traders to start with less than $1,000 and scale into multi-million dollar accounts if they prove themselves.

Conclusion

Vanta Network turns trading skill into an on-chain competitive sport. Individual miners stake $ALPHA, trade with leveraged capacity, survive a challenge period, and earn payouts based on risk-adjusted returns. Traders who fall behind are eliminated, and their $ALPHA is burned to strengthen the network.

For strong traders, Vanta offers a path to scale from small deposits to large accounts. For the network, it creates a merit-based environment where only consistent, disciplined performers remain.

Be the first to comment