Investing88 (deployed on TAO’s Subnet 88) is redefining how decentralized finance meets professional portfolio management.

By leveraging a network of both human and artificial intelligence, it enables miners to develop sophisticated staking strategies designed to optimize returns within the $TAO/$ALPHA ecosystem.

Since its inception, the subnet has been steadily carving a niche in algorithmic portfolio management, bridging crypto markets with principles drawn from traditional finance.

How Subnet 88 Works

Subnet 88 operates as a decentralized laboratory for investment strategies. Miners create, submit, and refine staking strategies through a simple mechanism: placing strategy scripts into the subnet.

Once submitted, strategies are automatically scored and reflected on Investing88 with daily updates after midnight (UTC timing).

Key operational rules for this protocol include:

a. Strategy Updates: Miners can “rebalance” strategies at any time and updated timestamps trigger automatic resubmission,

b. Allocation Changes: Adjusting subnet allocations may incur slippage costs,

c. Multiple Miners per Machine: A single machine can run multiple miners, each with unique strategies,

d. Novelty Incentive: Strategies that closely resemble existing submissions may see reduced scores, and

e. New Miner Immunity: Newly registered miners enjoy a three-day immunity period.

This system ensures fairness while incentivizing innovation and diverse approaches.

The Scoring Framework

Investing88 uses a sophisticated scoring algorithm that evaluates strategies on multiple dimensions. Such as:

a. Return: Absolute and relative gains,

b. Volatility: The stability of returns,

c. Drawdown: Maximum potential losses,

d. Slippage: Costs associated with reallocations, and

e. Timeframe: Alignment with investment horizons.

The algorithm recognizes that investors have varying styles, risk tolerances, and capital availability. By focusing on long-term portfolio optimization rather than short-term trades, the subnet encourages strategies designed to consistently outperform the market while mitigating beta exposure.

For miners new to portfolio theory, Investing88 integrates foundational finance concepts like:

a. Modern Portfolio Theory (MPT) for balancing risk and return across multiple assets, and

b. Capital Asset Pricing Model (CAPM) for estimating expected returns relative to risk.

Additionally, it also has a standalone tool that allows miners to backtest strategies against historical market data, refining performance before live deployment.

The 88 Quant Fund: Real-World Application

The first fully algo-driven hedge fund on Bittensor, 88 Quant Fund, exemplifies the subnet’s practical potential.

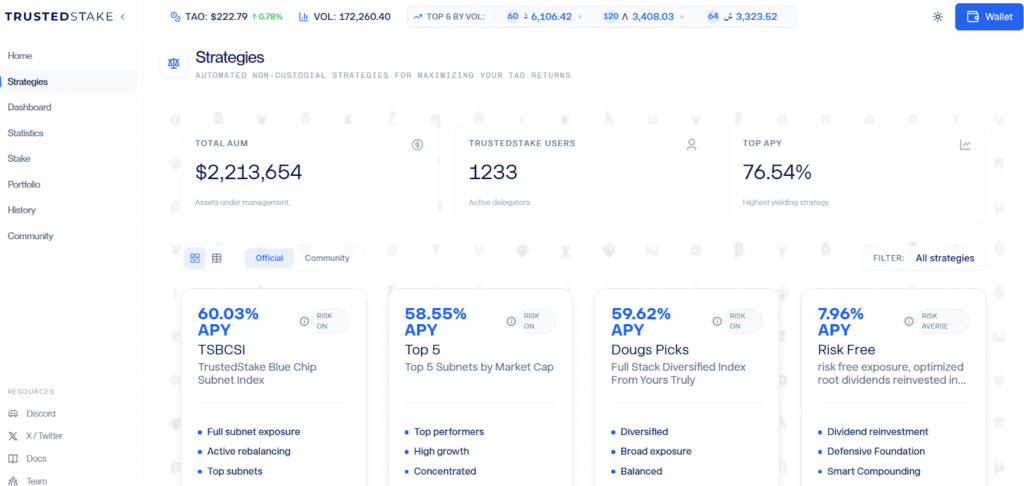

Powered by miner-generated strategies and executed through TrustedStake’s AUM (Assets Under Management) app, the fund operates with a focus on:

a. Dynamic Allocations: Continuous adjustments to maximize alpha,

b. Automated Execution: Fast, fully automated strategy responses,

c. Risk Management: Low drawdowns with high-performance targets,

d. Proprietary Ensemble Model: Aggregates miner outputs for diversified portfolios,

e. Rigorous Backtesting: Strategies tested and refined over months, and

f. Continuous Model Training: Ensures performance adapts to evolving markets.

Early Performance and Metrics

Since going live, the fund has focused on validating execution quality and risk control under real market conditions. The early data provides a first look at how the strategy performs in practice, not just in theory. It has shown that:

a. Launch Timeline: Strategy inception on December 30, 2025, with live trading beginning December 12, 2025,

b. Initial Capital Base: 1,100 $TAO in starting AUM,

c. Initial Performance: 12.95% return achieved within the first 17 trading days

d. Risk Profile: Maximum observed drawdown limited to 3.63% during this period

Based on early execution, capital efficiency, and modeled risk constraints, the strategy outlines clear expectations for scale and return potential as deployment expands with:

a. Target Drawdown: Maintained below 5% through dynamic position sizing,

b. Projected Compound Returns: Estimated 300% to 500% APR under active market conditions,

c. Near-Term Scale: Targeting 10,000 $TAO in AUM by the end of 2026, and

d. Long-Term Vision: Path toward $50 million in AUM by the end of 2028.

For the revenue model and incentive alignment, the fund’s economics are structured to align manager performance with capital growth while supporting long-term treasury expansion:

a. Management and Performance Fees: 2% baseline AUM fee plus a 20% performance (profit) share, and

b. Treasury Expansion: Ongoing growth driven by trading profits and systematic reinvestment.

This combination of strategy, automation, and real-time performance monitoring positions 88 Quant Fund as a pioneering example of decentralized, AI-enhanced portfolio management.

Looking Ahead: Scaling Across Markets

Investing88 is more than a crypto experiment. Its principles (dynamic allocation, low-covariance diversification, and data-driven portfolio management) are designed to extend to traditional markets, with the goal of extracting alpha while minimizing risk.

By leveraging Bittensor’s decentralized network of miners and validators, the subnet creates a feedback loop: strategies are continuously tested, refined, and scaled, producing actionable insights for both crypto-native and broader financial investors.

As 88 Quant Fund matures, it’s poised to demonstrate how decentralized AI and human intelligence can converge to deliver optimized portfolio management at a scale previously unseen in crypto or traditional finance.

Conclusion

Investing88 is redefining how investment strategy and decentralized intelligence interact. Through a carefully designed infrastructure, miners and validators contribute to an evolving ecosystem where strategies are continuously tested, scored, and improved. With robust early performance, ambitious growth projections, and a clear roadmap for both crypto and traditional markets, Investing88 exemplifies the potential of combining AI, decentralized networks, and financial innovation to generate consistent alpha while managing risk.

The future of investing may well be decentralized, automated, and intelligence-driven, and Subnet 88 is already leading the way.

Be the first to comment