In the next phase of web3, interoperability will define which ecosystems thrive and which remain siloed. For Bittensor ($TAO), the emergence of a multi-chain liquidity protocol marks a critical step forward—expanding beyond its native chain to seamlessly interact with networks like Solana. By enabling wrapped tokens and secure cross-chain transfers, VoidAI (Subnet 106 on Bittensor) is not just bridging blockchains but laying the groundwork for a more fluid, interconnected ecosystem where liquidity, scalability, and AI-powered applications converge.

Why Bridge $TAO?

Bridging $TAO and its alpha tokens extends their usability beyond the Bittensor chain. Once wrapped, the token can be traded, pooled, or staked within Solana. This:

a. Increases liquidity and market access.

b. Expands $TAO’s role across decentralized applications.

c. Enables $TAO holders to earn yield through liquidity provision.

Bridging $TAO and Alpha Tokens via VoidAI Bridge

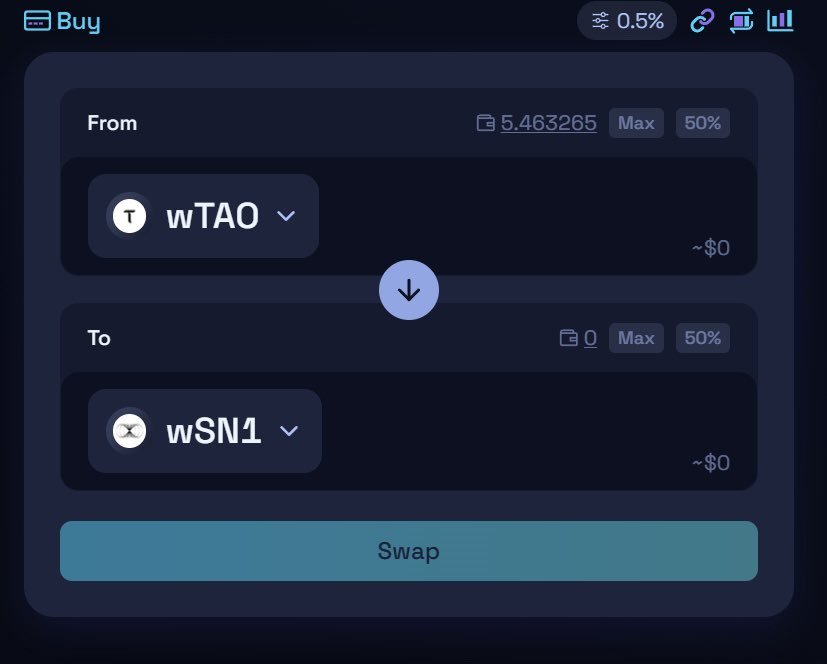

The VoidAI Bridge makes it simple to transfer $TAO or dTAO from the Bittensor network to Solana:

a. Connect wallets — Bittensor and Phantom (Solana).

b. Select bridge direction ($TAO Bridge or $ALPHA Bridge).

c. Enter the $ALPHA amount.

d. Review bridge and gas fees and confirm the transaction.

e. Receive $wALPHA directly in Phantom.

This streamlined process reduces friction for users while maintaining security at every step.

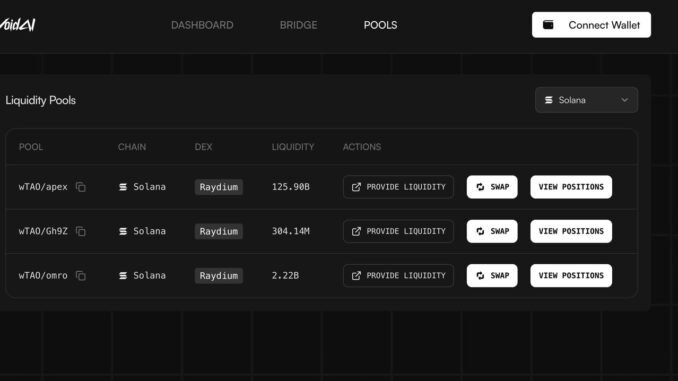

Liquidity Provisioning on Raydium

Once $TAO or $ALPHA has been bridged as $wTAO or $wALPHA, users can deploy liquidity through Solana’s Raydium Protocol. To achieve this,

a. Open Raydium and browse through the liquidity pools.

b. Select a pool (e.g., $wTAO – $wALPHA).

c. Click Add Liquidity.

d. Enter token amounts, review pool shares and confirm the transaction.

e. Monitor liquidity.

This integration brings $TAO/$ALPHA directly into Solana’s DeFi ecosystem, giving holders new ways to earn yield and strengthen liquidity markets.

The Bigger Picture for $TAO and Decentralized AI

By enabling seamless asset movement and liquidity across chains, VoidAI positions $TAO at the center of a multi-chain future. This expansion move to;

a. Enhance $TAO’s role as a utility token for decentralized AI.

b. Bridge fragmented ecosystems into a unified liquidity layer.

c. Encourage broader adoption by making $TAO accessible where users already operate.

With this cross-chain functionality, $TAO transitions from a single-network asset into a multi-chain instrument for decentralized intelligence.

Be the first to comment