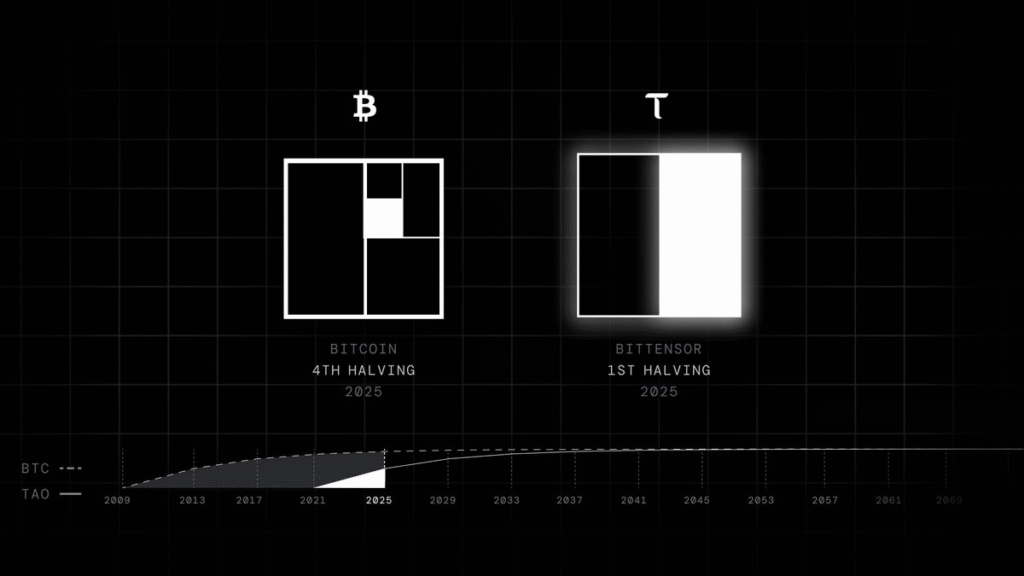

Bittensor is entering a defining moment. On December 14, the decentralized AI network will undergo its first-ever halving, a milestone that reduces the issuance of its native token, $TAO, and reshapes incentives across the ecosystem. For investors, the event revives hopes of a price recovery.

For builders and miners, it signals a tougher environment where only productive subnets are likely to survive.

This is not simply a supply adjustment. It is a stress test for the entire Bittensor economy.

What the Halving Actually Changes

Like Bitcoin, Bittensor is designed with a capped supply. However, the mechanism differs in one important way.

Instead of halving based on block height, Bittensor’s issuance reduction is triggered by total supply milestones. Once the network distributes half of its maximum supply, emissions are automatically reduced.

Key facts at a glance:

a. Maximum Supply: 21 million $TAO

b. Halving Threshold: 10.5 million $TAO issued

c. Daily Emissions Nose-Dive: From 7,200 $TAO to 3,600 $TAO

At the current issuance rate, that threshold is expected to be reached in the early hours of December 14.

Why Investors Are Paying Attention

$TAO has struggled over the past year, falling roughly 47% amid a broader period of weakness across crypto markets. The halving introduces a structural change that many investors believe could alter that trajectory over time.

Lower inflation means fewer new tokens entering circulation each day. If demand remains stable or grows, this creates a more favorable environment for long term price appreciation.

As Arrash Yasavolian, founder of Taoshi, puts it, supply contraction tends to benefit networks where real usage continues to expand. History shows that halving-based systems often perform better over longer horizons, though the impact is rarely immediate.

Still, expectations remain tempered by macro-realities. Trade tensions, delayed interest rate cuts, and broader market uncertainty continue to weigh on risk assets, including crypto.

A Reckoning for Subnets

Beyond price, the halving will have a direct and immediate impact on Bittensor’s subnet economy. Subnets are the backbone of the network, enabling participants to contribute compute and intelligence to decentralized AI applications. These contributors earn $TAO emissions in return.

Once rewards are cut in half, not every subnet will remain viable. Industry observers expect capital and attention to concentrate around subnets that generate real usage and revenue, while weaker projects struggle to survive.

In practical terms, this likely means:

a. Capital flowing toward high-performing, revenue-generating subnets,

b. Reduced emissions for experimental or inactive projects, and

c. Increased pressure on teams to demonstrate real economic value.

Some have described this process as the starvation of so-called “zombie subnets”, projects that exist but fail to contribute meaningfully to the network but earn emissions nevertheless.

Miners Face Tighter Economics

The halving also affects miners directly. Just as Bitcoin miners faced margin pressure after the 2024 block reward reduction, Bittensor miners will need to adapt to lower emissions.

This may lead to short-term consolidation, with resources shifting toward the most-efficient and performant operators.

Expected outcomes include:

a. Tighter margins across the network,

b. Temporary volatility in participation, and

c. Greater emphasis on efficiency and output quality

Over time, this tends to result in a leaner and more competitive network.

A Stronger Network, If It Holds

Halvings are rarely comfortable moments. They introduce friction, force hard decisions, and expose weaknesses that were previously masked by generous emissions.

For Bittensor, proponents argue this discomfort is necessary. Reduced inflation, more selective rewards, and better capital allocation could ultimately lead to a healthier ecosystem, one where incentives are aligned with real value creation rather than speculative participation.

As Yasavolian notes, the long-term effect is not simply fewer tokens, but a more efficient network where resources flow toward subnets that actually matter.

Closing Thoughts

Bittensor’s first halving is more than a symbolic milestone; it is a transition from early growth to economic discipline.

The coming months will reveal which subnets can survive reduced rewards, which miners can adapt, and whether demand for $TAO is strong enough to absorb a tighter supply.

If the network holds, the halving may be remembered as the moment Bittensor matured. If it doesn’t, the cracks will become visible quickly.

Either way, the experiment is about to enter its most revealing phase.

Be the first to comment