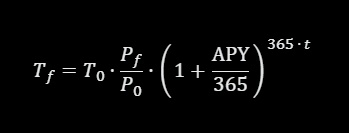

Staking in Bittensor can feel intimidating when subnet “$ALPHA” token prices move up and down. Many people hesitate because they are afraid of “losing $TAO,” especially when $ALPHA prices trend lower. But the truth is that high APYs (Annual Percentage Yields) across Bittensor subnets can generate enough daily yield to offset moderate price declines over time, as long as assets remain staked and yields keep compounding.

On top of that, Bittensor yields compound daily — a major advantage compared to traditional banks, which typically compound interest monthly (or even quarterly). This faster compounding accelerates returns and helps cushion volatility, making long-term staking far more rewarding than it may appear at first glance.

Instead of trying to manually calculate the impact of yield versus price movement, TAO Yield Calculator makes the entire process effortless. Built by τao sτacker, the tool turns complex math rambling into a simple calculator experience.

It shows users how much $TAO stakers can end up with in the future, based on staking duration and APY, without requiring signups, logins, or technical knowledge.

TAO Yield Calculator is designed for one purpose: to help users make confident, long-term decisions about where and how to stake Bittensor assets.

Why TAO Yield Calculator Matters

TAO Yield Calculator removes guesswork. Instead of estimating whether yield will offset a price drop, users see the outcome directly. This tool helps users answer questions like:

a. “Will I gain more $TAO over the next 6 to 12 months even if the subnet price dips?”

b. “How does a high APY compare to price volatility?”

c. “What happens if $ALPHA loses value while they are staked?”

d. “How does a subnet compare to the root over time?”

It also offers several practical advantages.

Key Merits

This automatic yield calculator allows users to seamlessly access yield estimation through an interface that:

a. Requires No Signup or Wallet Connection: Works and delivers results instantly, like a normal calculator does.

b. Powered by Compound Interest: You access realistic growth over time, not simple guesses.

c. Works for every Subnet and Root (Users just fine-tune the inputs to taste).

d. Helps Stress-Test Scenarios: Users can check how their $TAO balance changes even as the future price of $ALPHA changes (explanation below).

With a few inputs, users get a clear forecast of what their final $TAO stock may look like.

How to Use TAO Yield Calculator

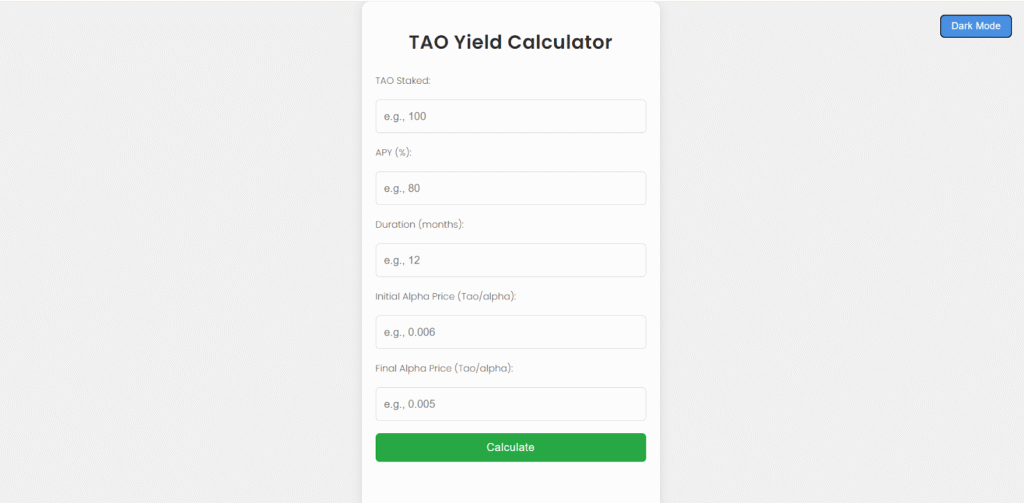

TAO Yield Calculator is very easy to use and does not require any intensive tutorial. Here is a simple step-by-step flow for users

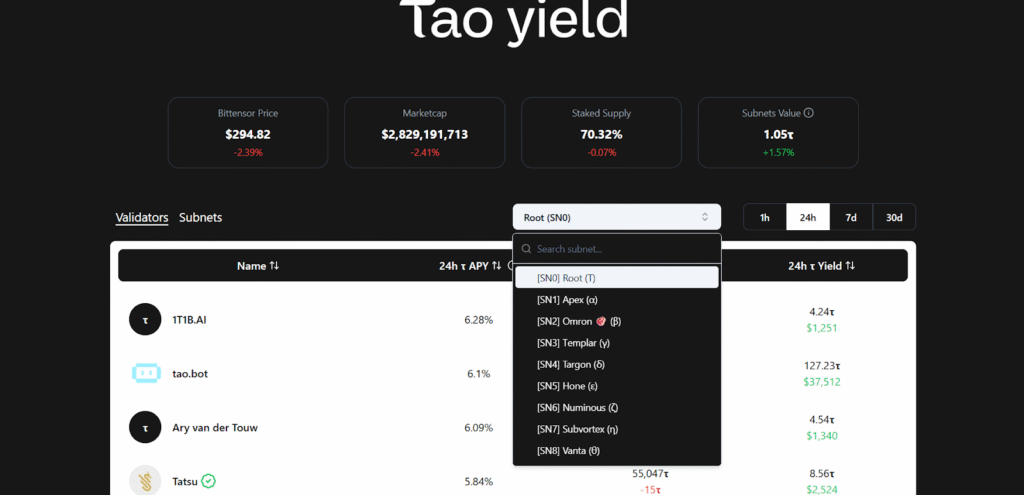

Step 1: Scout for prospective validators on tools like Tao Yield or TaoStats. Users are expected to note the APY%, the proposed entry and exit value of the asset, as well as the duration they intend to stake for.

Step 2: Visit TAO Yield Calculator

Step 3: Input the figures.

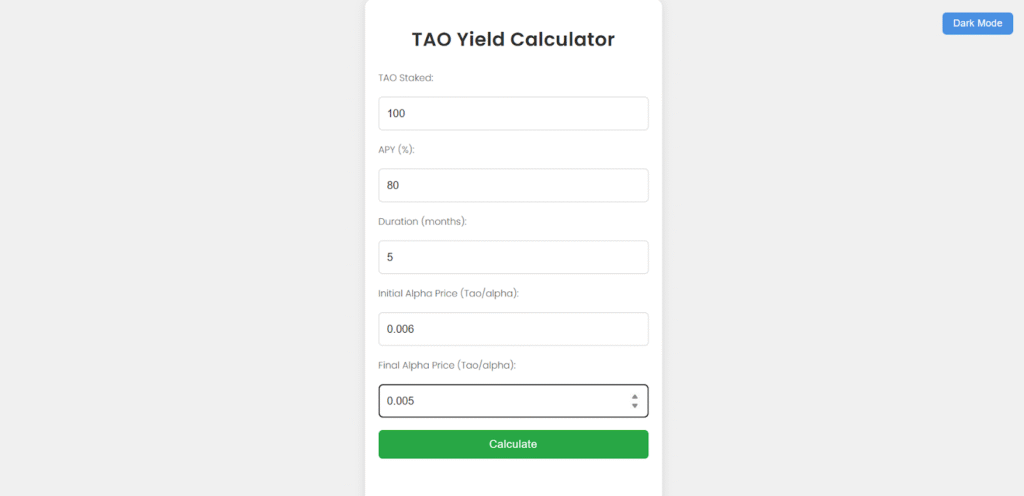

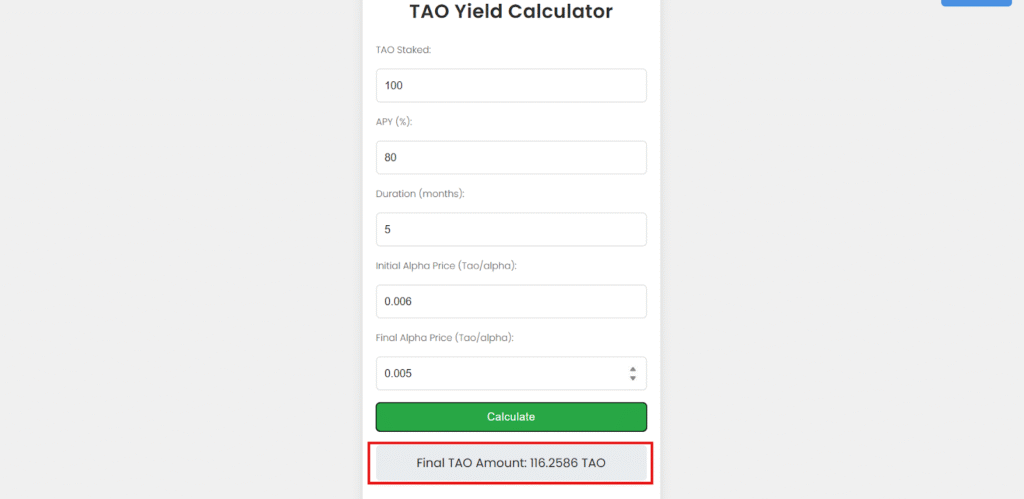

Let’s see the result when we chose to stake 100 $TAO in a validator with 80% APY for a period of 5 months, an initial $TAO/$ALPHA value of 0.006 and final $TAO/$ALPHA value of 0.005.

Users can also input dummy figures for the initial and final values to simulate the effect of price movement on Bittensor.

Step 4: Hit the “Calculate” button. The final $TAO totals appear instantly. No need for spreadsheets, formulas, or manual compounding.

Calculating Root

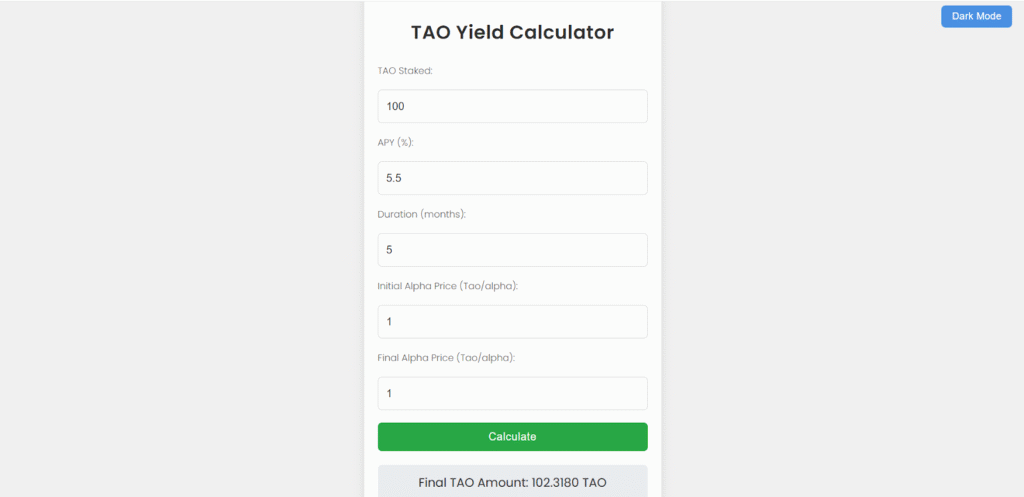

One of the most common questions is whether the calculator works for Root. Yes, it does.

To compute for Root staking, users are to set both initial and final prices to 1. The result would be the simple compounded $TAO that would be earned by staking directly to Root.

Conclusion

TAO Yield Calculator turns staking decisions into clear, data-driven choices. Instead of guessing how yield interacts with price volatility, users can model scenarios instantly and understand exactly how their $TAO balance grows over time.

With high APYs on many subnets and simple compounding working in users’ favor, staking can remain attractive even during price dips.

Before staking, users should check validator APYs on credible platforms, plug their numbers into TAO Yield Calculator, and let the platform guide a calm, long-term strategy.

Be the first to comment