Contributor: airbender.btc

The real estate industry has a data problem despite being the largest asset class on Earth (worth over $300 trillion). The data infrastructure of the industry is fragmented and outdated. The property intelligence is locked behind APIs, private databases, and under costly enterprises.

Realtors, lenders, and analysts rely on providers like MLS, Zillow, or CoreLogic, each maintaining isolated datasets. This architecture makes innovation in proptech quite difficult.

Since AI models cannot access the open, verifiable, real-time data they need, developers face prohibitive costs and restrictive licensing. The result: a trillion-dollar industry that still moves at analog speed compared to other industries tapping into the AI boom.

RESI (Real Estate Smart Intelligence), a decentralized real-estate data and valuation network built on Bittensor, solves these problems. Instead of relying on centralized APIs or data vendors, Resi Labs transforms the process of real-estate intelligence into a verifiable, peer-coordinated subnet where independent miners and validators gather, store, and infer property data.

Each data point (tax assessments, home valuations, etc.) is collected, verified, and refined across a distributed ecosystem, producing an open, AI-ready real-estate database that anyone can build on.

Even better, the architecture is interesting. RESI architecture is a three-layer architecture: a data collection layer, a storage and transformation layer, and a competitive inference layer.

- Data Collection Layer

150 miners continuously scrape public, MLS, and county property data.

Validators require > 95 % completeness and > 90 % cross-miner agreement.

Multiple miners collect from identical sources, ensuring accuracy. - Storage & Transformation Layer

50 miners clean, normalize, and geocode property data.

Data is stored using Reed–Solomon encoding and Merkle verification, achieving a loss probability of less than 10⁻⁹.

Each record is transformed once, ensuring consistency and traceability. - Competitive Inference Layer

46 inference miners train competing ML models (Random Forests, Gradient Boosting, and Neural Nets) to generate valuations.

Validators select the most robust median result within 10 % variance; the most accurate models earn the majority of rewards.

Together, these layers form an autonomous, self-verifying pipeline: from raw property data → normalized intelligence → real-time valuations, all coordinated through validator consensus.

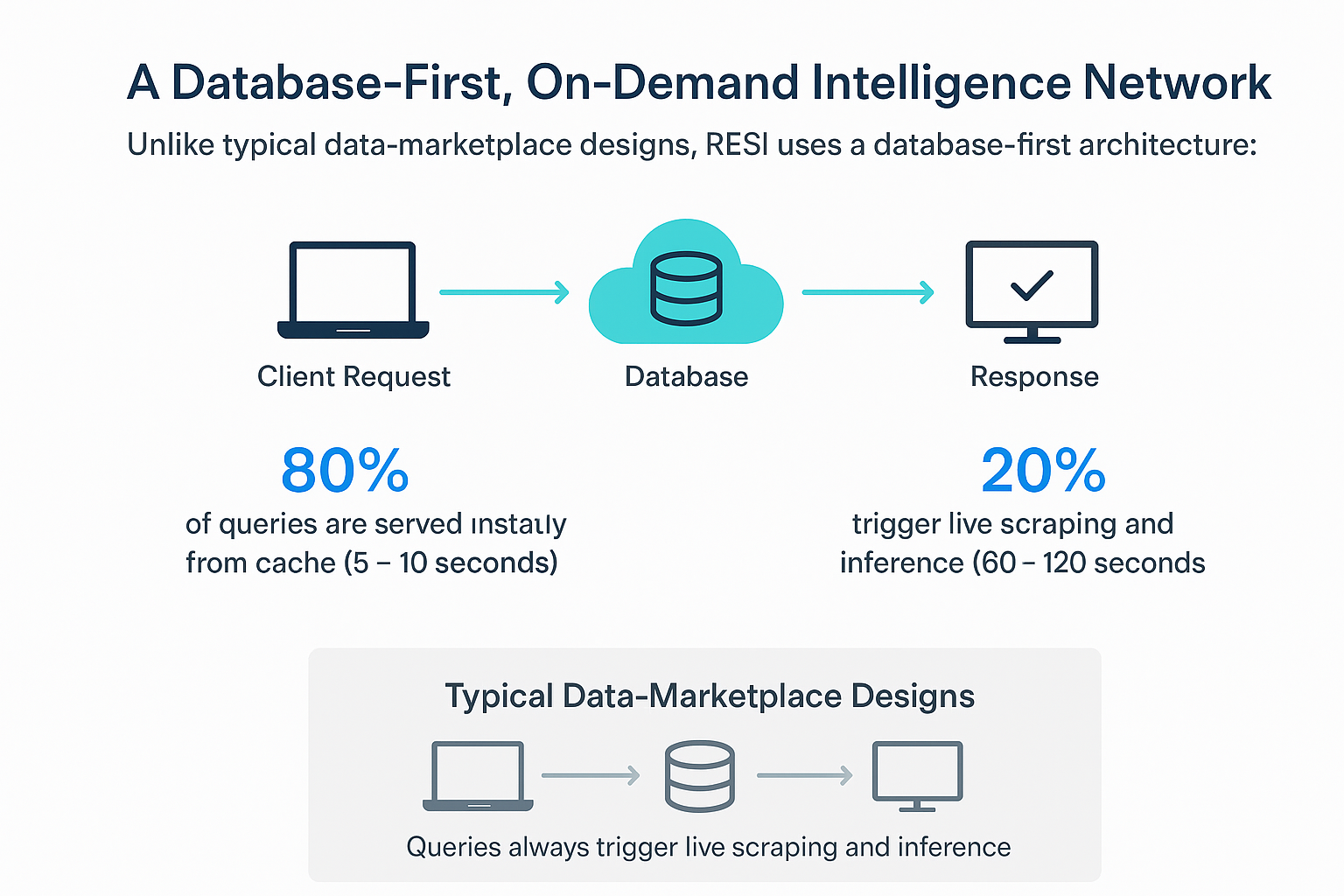

Unlike typical data-marketplace designs, RESI uses a database-first architecture that allows users to get near-instant answers for most requests:

- 80 % of queries are served instantly from cache (5 – 10 seconds).

- 20 % trigger live scraping and inference (60 – 120 seconds).

Economic Model

- Users pay in fiat ($50 – $1,000).

- Payments convert to Alpha tokens (DTAO model) used for subnet queries.

- Tokens flow to miners & validators across the three layers.

RESI is secure

Cross-miner redundancy: multiple miners do identical tasks; > 90 % agreement needed.

Reed–Solomon + Merkle Proofs: 18 nines (10⁻¹⁸) data-loss probability.

Anti-collusion: random miner assignment makes cheating riskier than honest work.

Governance: early stage is centralized for agility; later transitions to Alpha stake-weighted voting on parameters (burn rate, thresholds, etc.).

Updated Roadmap Note

Resi Labs has indicated that the roadmap now focuses on bringing data collection and storage in-house, allowing all external miner efforts to specialize in competitive agent creation.

The first agent competition will center on appraisal agents, where validators benchmark property price predictions against randomly selected sold properties and reward the models with the lowest average delta between predicted and actual sale prices.

By fusing open data, AI, and crypto incentives, RESI builds what legacy PropTech players cannot:

Real-time, verifiable data feeds.

Transparent pricing and provenance.

And a permissionless developer ecosystem.

Concluding Thoughts

Subnet 46 (RESI) is basically pioneering the new generation of real estate infrastructure. A distributed intelligence layer for the world’s largest asset class, powered by miners, validated by consensus, and governed by the market itself.

Be the first to comment