As the Bittensor ecosystem matures, its financial layer is beginning to take shape. Subnets are launching, subnet “$ALPHA” tokens are emerging, and liquidity is forming.

But one question remained unanswered: How do you trade conviction on $ALPHA without holding them directly?

MegaTAO provides that answer.

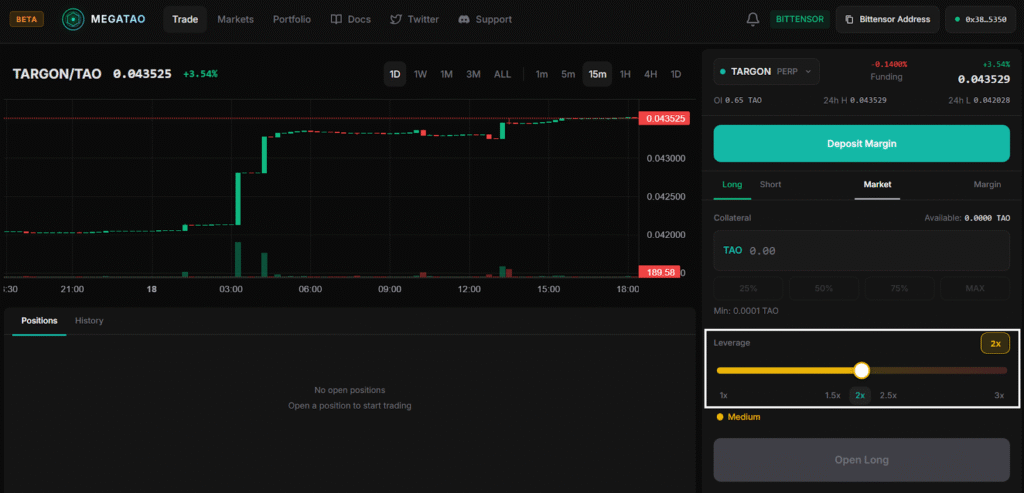

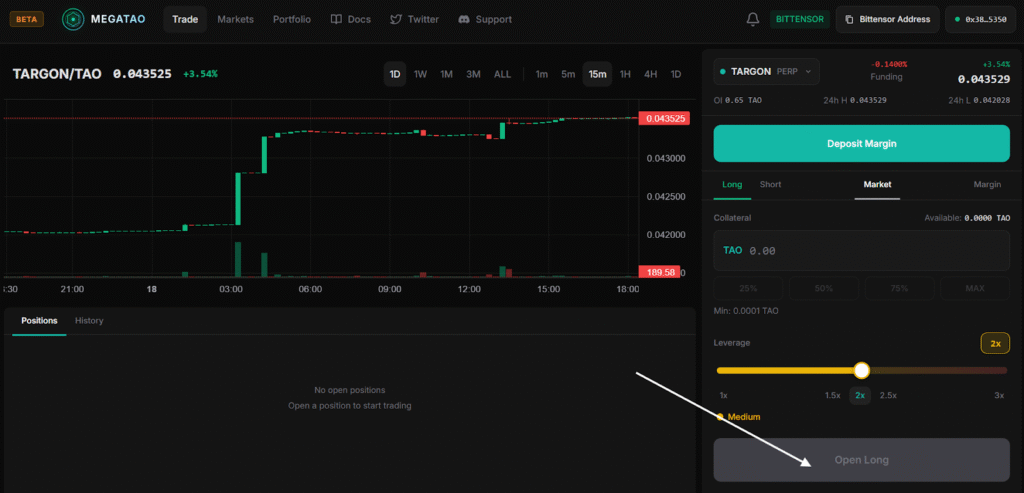

Built on the Bittensor EVM (Bittensor Virtual Machine), MegaTAO is a leveraged perpetual futures platform designed specifically for $ALPHA. It allows traders to go long or short using $TAO as collateral, with profits and losses settled entirely in $TAO.

No custody of subnet tokens, no order book friction, no asset juggling. Just synthetic exposure with leverage.

What is MegaTAO?

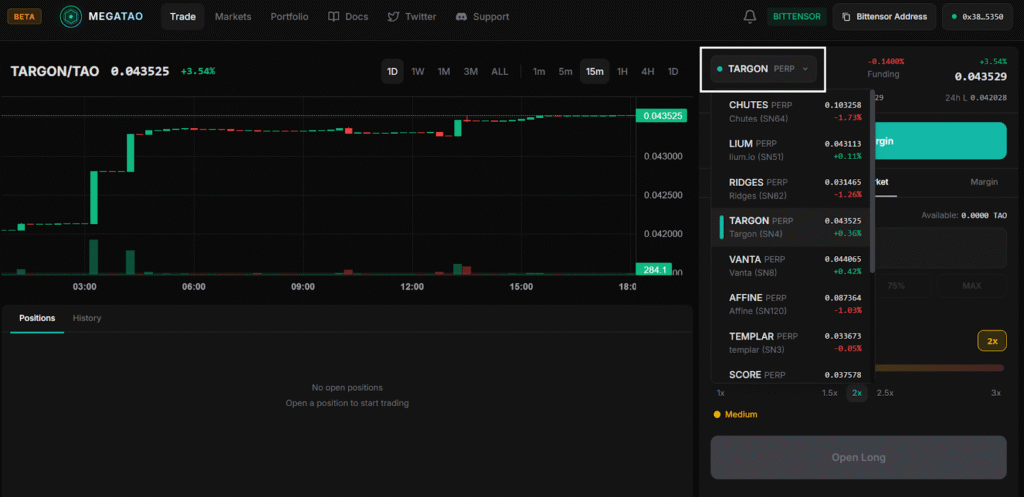

MegaTAO is a decentralized perpetual futures platform for $ALPHA (Bittensor subnet tokens).

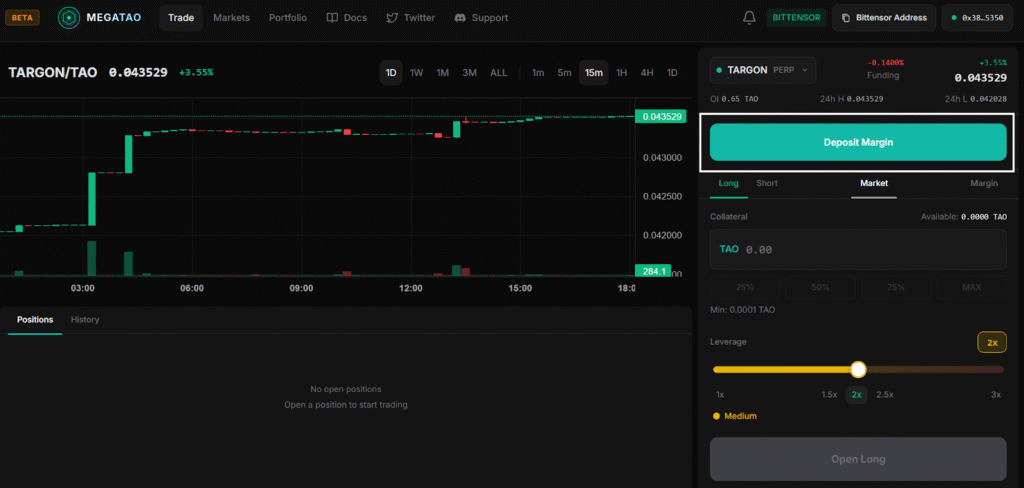

The core model is simple:

a. Deposit $TAO as margin,

b. Select an $ALPHA,

c. Choose position (either to long or short),

d. Apply leverage (1x–3x),

e. Settle P&L (profit and loss) in $TAO.

Everything is synthetic, and users never hold the underlying $ALPHA.

How MegaTAO Works

MegaTAO removes traditional exchange complexity. There is no order matching, no counterparty dependency, and no token transfers

The flow:

a. Deposit $TAO,

b. Select asset (preferred subnet tokens),

c. Select desired direction (long or short),

d. Choose leverage, and

e. Execute instantly.

The system calculates exposure synthetically and adjusts margin balances in real-time. This design prioritizes simplicity and capital efficiency.

The Leverage Framework

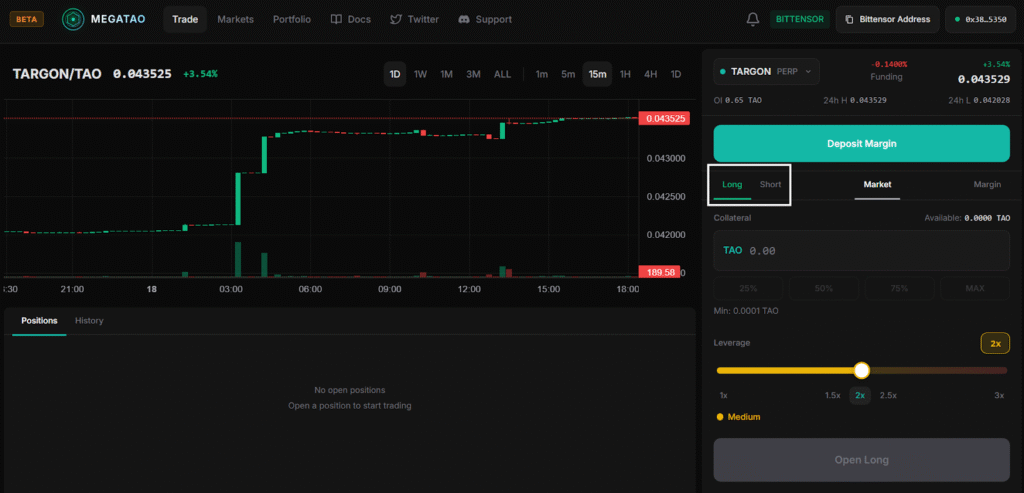

Leverage multiplies exposure relative to the deposited margin.

| Leverage | $100 Deposit Controls | Liquidation Threshold |

| 1x | $100 | 100% move |

| 2x | $200 | 50% adverse move |

| 3x | $300 | ~33% adverse move |

At 3x leverage, a 10% price move results in a 30% impact on margin. Leverage is powerful, it is also unforgiving.

For most users, 1x–2x is a more sustainable range.

Margin Ratio and Liquidation Mechanics

Position health is determined by margin ratio. Here are the margin levels:

a. Healthy: Above 35%,

b. Caution: 25–35%,

c. Danger: 20–25%, and

d. Liquidation: Below 20%.

If the margin ratio drops below 20%, the position closes automatically, a 5% penalty is applied to the remaining margin, and the remaining $TAO returned.

Example:

A 3x long entered at $100 would face liquidation around $67. Users can actively manage positions by adding or removing margin at any time.

Order Types and Trade Control

MegaTAO supports advanced order functionality:

a. Market orders for immediate execution,

b. Limit orders for precise entries,

c. Stop orders for downside protection,

d. Take profit automation, and

e. Trailing stops for trend strategies.

This provides strategic flexibility comparable to centralized exchanges while remaining on-chain.

Fee Structure Overview

Transparency is central to the protocol. The trading fees are structured thus:

a. 0.1% on open, and

b. 0.1% on close.

On additional costs:

a. Funding (variable),

b. 5% liquidation penalty (if triggered),

c. Gas fees (EVM-based), and

d. No deposit or withdrawal fees.

Example:

On a $10,000 round-trip trade:

a. Trading fees: ~$20

b. Funding: depends on duration

c. Gas: ~0.03 $TAO

Costs scale with position size and holding time.

Risk Management Framework

Leverage is a tool, discipline is protection. Recommended guidelines are as follows:

a. Keep margin ratio above 35%,

b. Use stop-losses consistently,

c. Risk no more than 1–5% of capital per trade,

d. Avoid maximum leverage early, and

e. Maintain an emergency $TAO reserve.

Active monitoring is essential during volatile conditions.

Why MegaTAO Matters

As Bittensor evolves, its financial primitives are expanding.

MegaTAO introduces:

a. Synthetic $ALPHA exposure,

b. Capital-efficient leverage,

c. On-chain derivatives native to the ecosystem, and

d. $TAO-settled trading without asset fragmentation.

In most blockchain ecosystems, derivatives accelerate liquidity, price discovery, and capital rotation. MegaTAO represents the early construction of that layer within Bittensor.

Final Thoughts

Every maturing network builds three layers: Infrastructure, applications, and markets.

Bittensor already has a rapidly expanding subnet layer, and MegaTAO is helping shape the market layer.

It gives traders a way to express conviction on $ALPHA without holding them, amplifying both opportunity and risk.

Used responsibly, leverage can be a precision instrument, and used recklessly, it becomes a liquidation engine.

Trade with clarity.

NFA Alert: Leveraged trading carries significant risk, and users can lose their full deposit. Prospective traders should only trade with funds they are prepared to lose entirely.

Official Links

For real-time updates on MegaTAO and the ecosystem, follow through on the official channels via:

a. Website: https://www.megatao.com/,

b. Docs: https://docs.megatao.com/,

c. X (Formerly Twitter): https://x.com/mega_tao,

d. GitHub: https://github.com/alpha-futures, and

e. Discord: https://discord.gg/KQYpAaY2dv.

Be the first to comment