⚠️ Note: This article was repurposed from The Kobeissi Letter’s tweet.

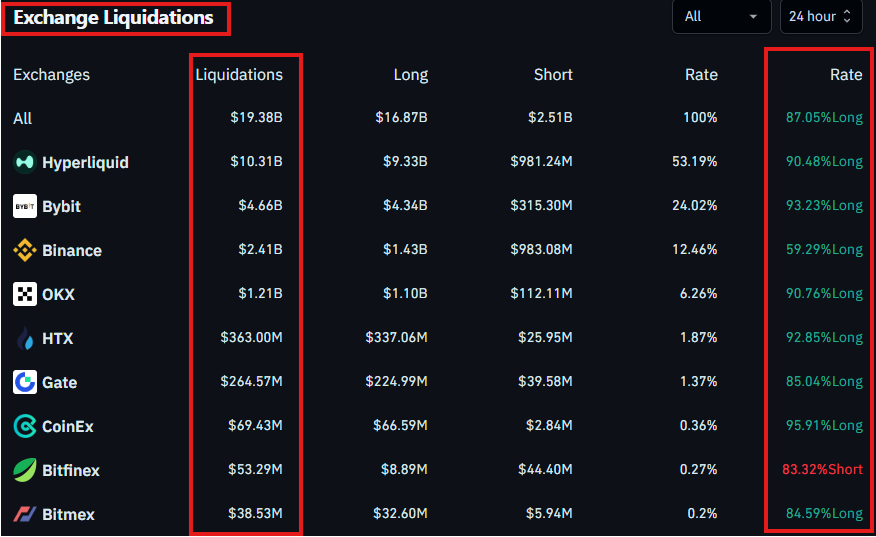

It’s official — crypto just witnessed the largest liquidation event in history, with 1.6 million traders liquidated in a single day.

Over $19 billion worth of leveraged crypto positions were wiped out within 24 hours — nine times the previous record.

Putting It Into Perspective

The liquidation event that occurred in the last 24 hours was approximately $17 billion larger than the February 2025 crash.

It was more than 19 times larger than the March 2020 crash and the FTX collapse.

Simply put, nothing like this has ever happened before.

Bitcoin’s $380 Billion Swing

Amid the liquidations, Bitcoin recorded a $20,000 daily candlestick, marking a $380 billion swing in its market cap within a single day.

That’s more than the total market cap of all but 25 public companies in the world. Once again, this scale of volatility is unprecedented.

Timeline of the Crash

To understand what caused this, here’s a breakdown of how it unfolded:

- 9:50 AM ET: Crypto began to sell off.

- 10:57 AM ET: Trump posted about new tariffs on China.

- 4:30 PM ET: A large “whale” opened major short positions in crypto.

- 4:50 PM ET: Trump officially announced a 100% tariff on China.

By 5:20 PM ET, just 30 minutes after Trump’s announcement, $19.5 billion in liquidations had occurred.

The whale closed its shorts soon after, securing $192 million in profit.

The Main Culprit: Excessive Leverage

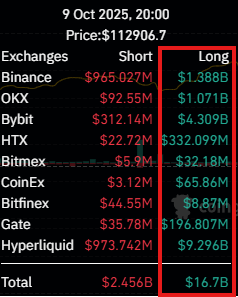

The data points to a market overloaded with long leverage.

A total of $16.7 billion in longs were liquidated compared to $2.5 billion in shorts — a 6.7:1 ratio.

Every major exchange except Bitfinex saw the majority of liquidations on the long side — most with 90%+ long exposure.

On Hyperliquid alone, over $10.3 billion in long positions were wiped out, the same exchange used by the whale.

The Shock Effect and Market Sentiment

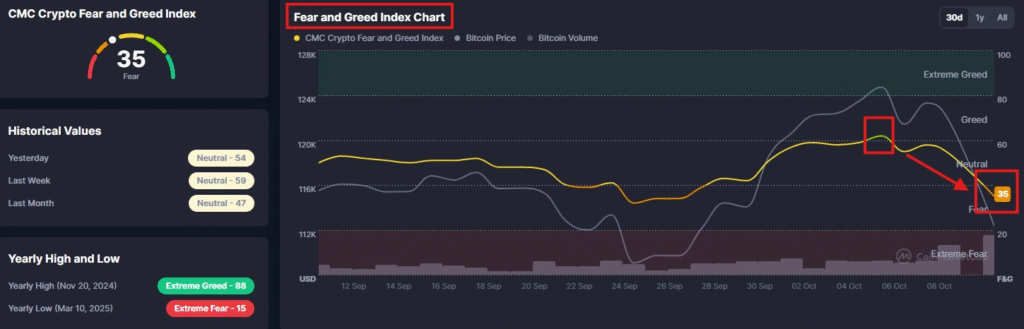

The crash followed a historic market rally from the April 2025 lows.

Greed readings had exceeded 60 on the Fear & Greed Index just days before the event — signaling an overheated market.

When Trump’s tariff post hit, sentiment flipped instantly.

A wave of panic selling cascaded across exchanges, amplified by thin weekend liquidity.

The Liquidity Trap

Trump’s announcement came 50 minutes after U.S. markets closed on Friday, a notoriously low-liquidity period for crypto.

As seen in past events, Friday and Sunday nights often see sharp crypto moves due to low order book depth.

This thin liquidity magnified the shock, triggering a domino effect of forced liquidations across exchanges.

What Happens Next?

While the crash was dramatic, analysts believe it was largely technical, not fundamental.

A correction was long overdue following the extended bullish run since April.

A future trade deal between the U.S. and China could ease macro pressure, and structurally, crypto remains strong.

The recent spike in volatility also opens new opportunities for traders and investors positioned for short-term rebounds.

Final Thoughts

Yesterday’s drop was a stark reminder of how fragile — yet profitable — markets have become.

Between 9:30 AM ET and 5:20 PM ET, the crypto market erased $800 billion in total capitalization.

Remaining objective and disciplined amid volatility will be key going forward.

Stay tuned for real-time analysis from @KobeissiLetter as this story continues to develop.

.

Be the first to comment