When Mark Jeffrey sat down with Seby Rubino of RESI (Real Estate Super Intelligence) on the 138th episode of Hash Rate Pod, he didn’t waste time getting to the heart of the idea. “It sounds,” he said, “like you’re building a kind of Chainlink for real estate — a system that knows everything about property data.”

Rubino smiled at that description. It was, he admitted, spot-on. RESI is exactly that — a decentralized oracle designed to verify and deliver real estate data on-chain, bridging two worlds that have rarely met: property and blockchain.

You can also catch up with the Revenue Search appearance of RESI here.

From Realtor to DeFi Builder

Mark wanted to understand how someone moves from selling houses to building AI infrastructure. Rubino’s story goes back to age eighteen, when his parents paid for his real estate classes as a birthday gift. Within months, he became a licensed realtor in New Jersey.

That early start led him to work with an iBuyer firm — companies like OpenDoor that rely heavily on data to buy properties in bulk. There, he learned how predictive analytics could drive multi-million-dollar decisions. When COVID hit, his boss pivoted entirely into Bitcoin, and curiosity got the best of him. “I remember thinking — if crypto can reshape money, could it also reshape property?” he recalls.

Together with a friend, Rubino built software that could predict who might sell their home next. The project worked so well that investors and realtors adopted it, eventually leading to an exit. “It wasn’t a $30 million deal,” he admits, “but it taught us how to build and ship something that solves a real problem.”

The DeFi Connection

Mark pointed out that Rubino’s career path seemed engineered for what he’s doing now — real estate on one hand, decentralized finance on the other.

After the sale, Rubino dived into crypto projects, eventually landing at Alpha Growth, where he helped scale Compound Finance during the height of DeFi summer. Later, he joined Maple Finance, a credit protocol connecting blockchain lending to real-world assets.

“That’s where it clicked,” he said. “Everything was being tokenized — bonds, credit, commodities. But not real estate. Why? Because there’s no reliable on-chain data to prove what anything’s worth.”

The Missing Infrastructure

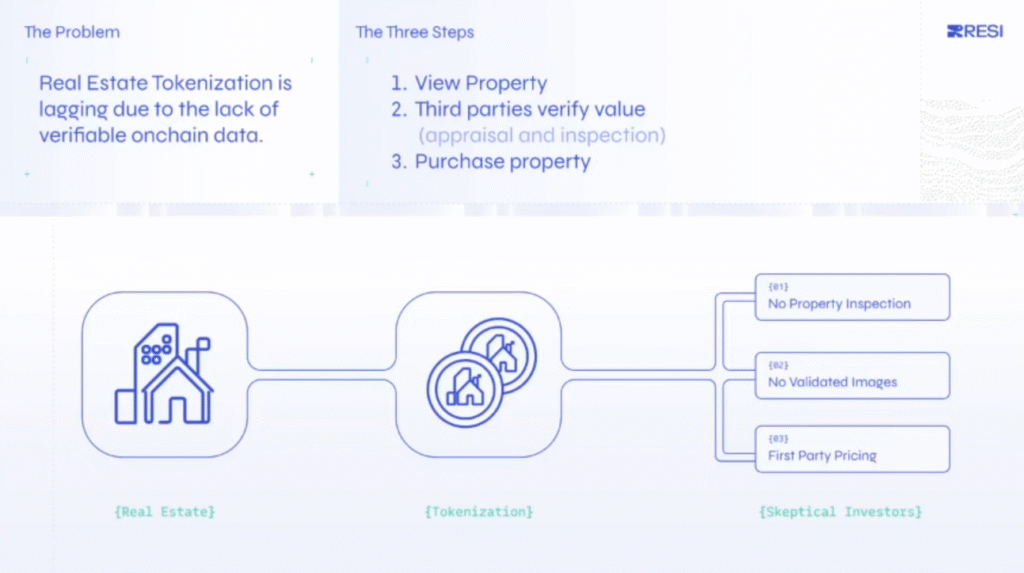

Mark summarized the issue neatly: without verified property data on-chain, no one can build DeFi tools around real estate — loans, insurance, or investments.

Rubino agreed. Tokenized property projects today rely on what he calls ‘trust-me-bro pricing’ — tokenizing a home without verifying what it actually looks like. “You could be buying a share of a house that no longer looks like the pictures,” he explained. “There might be squatters living in it. Or it might’ve been remodeled. No one checks.”

The result? Investors hesitate. Without verifiable inspections, appraisals, or live images, there’s no objective way to value tokenized property. “That’s why real estate lags behind,” he said. “You can’t build finance on uncertainty.”

The Vision Behind RESI

RESI’s solution is simple to describe, though complex to build. It’s an oracle for property data, powered by miners on Bittensor’s Subnet 46.

When a query comes in — say, “What’s the value of 123 Main Street in Nashville?” — a network of miners collects market comps, merges them with inspection reports, and generates an AI-backed appraisal. Validators then check and confirm the data through consensus before it’s stored on-chain.

Mark noted how similar it sounded to Chainlink’s data oracle. Rubino agreed but pointed out the difference: “Chainlink verifies price feeds. We verify physical reality.”

Why It Matters

Real estate represents over $300 trillion in global value, yet remains largely disconnected from blockchain. As Mark put it, “It’s the biggest market not yet brought on-chain.”

RESI is changing that. By making verified property data publicly accessible, it lays the groundwork for:

a. Fractional ownership that’s actually trustworthy

b. On-chain lending and mortgages backed by verified appraisals

c. Decentralized valuation APIs that developers and institutions can use

d. Fair market transparency in an industry long dominated by gatekeepers

“It’s about creating objective truth,” Rubino said. “Once you can trust the data, everything else (lending, investing, ownership) starts to work.”

Looking Ahead

As the discussion wound down, Mark asked about RESI’s roadmap. Rubino explained that Subnet 46 is currently refining its data infrastructure and preparing a whitepaper.

Long term, he envisions a full suite of products — from lending and investment sourcing to professional inspection services — all feeding into the same verified oracle.

In his words, “Subnets are digital commodities — AI infrastructure that powers real-world intelligence. We’re just applying that to the world’s largest asset class.” Mark nodded. “If you can pull that off,” he said, “you’re not just building an oracle. You’re building the foundation for on-chain real estate itself.”

Rubino smiled. “That’s exactly the plan.”

Useful Resources

Official Website: https://resilabs.ai/

X (Formerly Twitter): https://x.com/resilabsai

GitHub: https://github.com/resi-labs-ai/resi

Discord: https://discord.gg/fpDQ6tHEXb

Be the first to comment