Subnet tokens on Bittensor have long been powerful but inaccessible. To acquire them, users traditionally needed to stake $TAO through chain-native tools, which required technical know-how and a tolerance for friction. This high barrier meant that only a small group of insiders could meaningfully participate.

Void AI, built right Subnet 106, changes the equation. By wrapping subnet tokens and deploying them onto familiar ecosystems like Solana and Ethereum, Void AI makes these assets accessible through the same wallets, decentralized exchanges (DEXs), and dashboards that DeFi users already know. In short, it removes complexity and opens the door for subnet tokens to flow into the wider crypto economy.

Hash Rate’s Episode 135 featured Subnet 106 founder Hansel Melo, who explained how Void AI is opening access to Bittensor and setting the stage for $TAO integration into the broader Web3 economy.

Why Wrapped Tokens Matter

The core breakthrough of Void AI is the wrapped-token system. Instead of subnet tokens being siloed inside the Bittensor ecosystem, they are mirrored as ERC-20s on Ethereum or SPL tokens on Solana. This enables:

a. Plug-and-play DeFi integration: Wrapped subnet tokens can interact with existing liquidity pools, lending markets, and staking platforms.

b. User familiarity: Traders can access subnet assets directly through Phantom, MetaMask, or even centralized exchange apps once integrated.

c. Visibility and volume: By being present on networks with billions in daily trading activity, subnet tokens gain natural exposure and demand.

The result is a bridge between the specialized world of decentralized intelligence and the global liquidity of DeFi.

Fixing Liquidity Pool Inefficiency

Liquidity has always been a sticking point for subnet tokens. Native pools on Bittensor mostly rely on V2-style models, which spread capital thinly across wide ranges. This makes trading inefficient—large orders create high slippage, while most of the liquidity sits idle.

Void AI introduces concentrated liquidity pools (Uniswap V3 style), where liquidity providers (LPs) can:

a. Focus their capital in active price bands.

b. Reduce slippage for traders, improving execution.

c. Earn better rewards for providing strategically placed liquidity.

To make this sustainable, Subnet 106 emissions now flow directly to LPs. That means users aren’t forced to choose between staking rewards or liquidity rewards—they can earn both, reducing the opportunity cost and drawing deeper participation.

Subnet 106’s Status

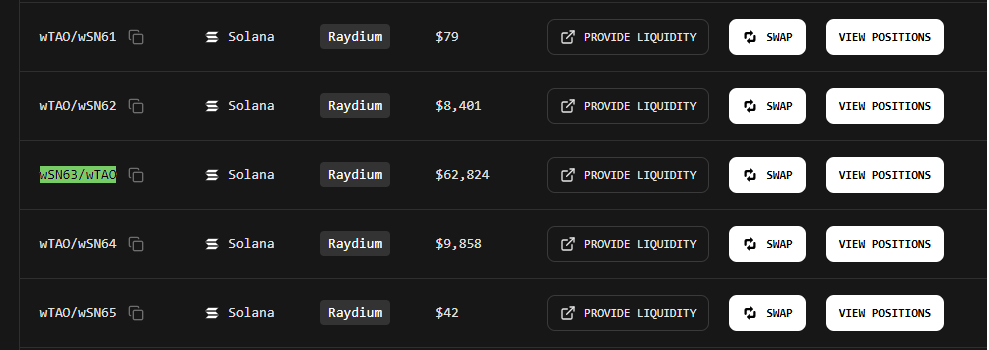

Although still early, Void AI’s wrapped-token initiative is already showing traction:

a. Around $200K worth of $TAO and subnet tokens has been bridged to Solana.

b. Liquidity pools are live for several subnets, with Subnet 63 already attracting huge.

c. Daily liquidity is rising as miners and subnet operators compete for emissions through concentrated liquidity ranges.

It’s not yet at the scale of Bittensor’s native pools, but the trajectory is clear: liquidity is steadily migrating where incentives are aligned.

The Growth Roadmap

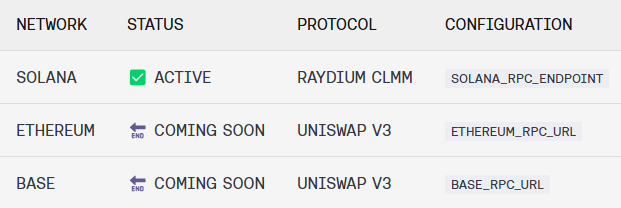

Void AI’s vision stretches far beyond the initial Solana launch. Several key milestones are lined up:

a. Ethereum and Base Deployments (Q4 2025): Unlocking larger markets with deeper liquidity and easy access via MetaMask and Coinbase Wallet.

b. Governance Dashboard (Q1 2026): Token holders will decide which subnets and which chains receive wrapped-token support, prioritizing those with real economic activity.

c. Aligned Rewards: Emissions are structured to mirror $TAO performance—subnets that prove valuable within Bittensor also receive stronger cross-chain support.

This roadmap ensures Void AI doesn’t just create bridges, but builds a framework for sustainable liquidity growth across ecosystems.

Simplifying User Experience

One of the strongest features of Void AI’s approach is accessibility. For the first time, subnet tokens can be acquired and traded in the same way as any other DeFi asset.

a. Wallet integration: Users can trade subnet tokens directly through Phantom or MetaMask, without learning new tools.

b. DEX accessibility: Liquidity on Radium, Uniswap, and eventually Base brings subnet tokens to where crypto’s existing user base already trades.

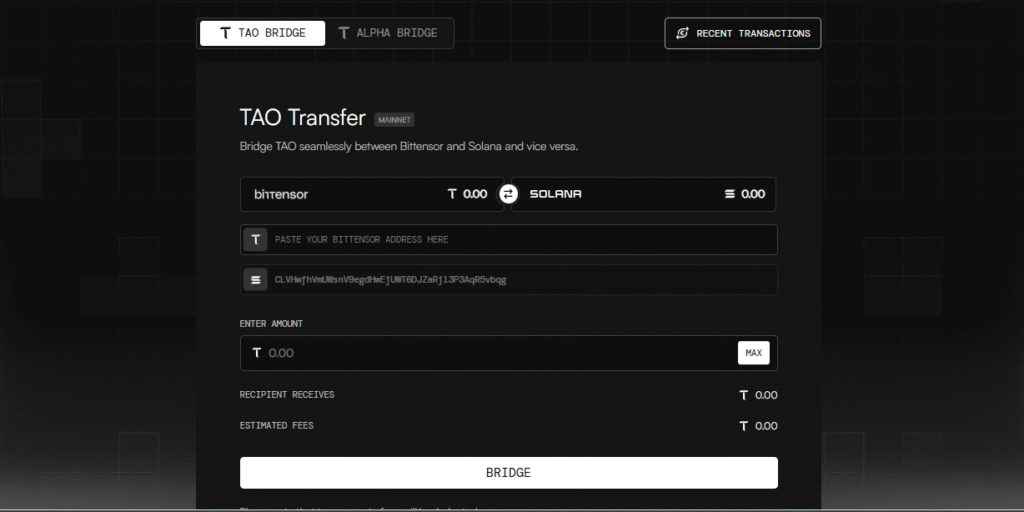

c. Seamless bridging: Assets can move between Bittensor and Solana/Ethereum with only a few clicks.

This shift lowers the barrier for mainstream users and allows subnet tokens to tap into the established DeFi user base, rather than relying on a niche community of TAO stakers.

The Security Challenge of Bridges

Of course, accessibility means nothing without security. Historically, bridges have been one of crypto’s weakest points, with over $2.8 billion lost in hacks. From Wormhole to Ronin to Poly Network, the lesson has been clear: without a strong security model, bridges can become systemic risks.

Void AI recognizes this and is aligning with the most credible standard available, Chainlink’s Cross-Chain Interoperability Protocol (CCIP).

Chainlink’s Role in Securing the Bridge

Chainlink has built its reputation by securing price oracles—the lifeblood of DeFi lending platforms. The same principles now apply to cross-chain transfers:

a. Decentralized verification: Every bridge transaction is validated by a decentralized oracle network.

b. Staked incentives: Oracle nodes stake ChainLink’s token —$LINK, giving them skin in the game. Malicious behavior risks real financial loss.

c. Battle-tested methods: Chainlink’s feeds have secured billions in DeFi value without major exploit, making them a proven model for reliability.

By adopting CCIP, Void AI ensures its bridge inherits these protections, reducing systemic risk while maintaining composability.

Transitioning to CCIP

With liquidity flowing, the next challenge is security. Void AI’s bridge strategy takes a phased path toward adopting Chainlink’s CCIP, ensuring today’s usability while ensuring resilience in the future:

a. The current Solana bridge runs on audited contracts.

b. The Ethereum bridge would be CCIP-ready, upon launch.

c. Over time, all bridges will transition to CCIP, making every subnet token transfer governed by decentralized verification and staked incentives.

This phased approach balances immediate utility with long-term resilience.

Current Performance and Future Prospects

Already, liquidity pools on Solana are seeing competitive activity, with LPs dynamically adjusting their positions to capture rewards. As liquidity incentives mature and Ethereum/Base support goes live, subnet tokens will have the potential to appear directly in apps like Coinbase Wallet and Kraken, further expanding their reach.

Longer-term, Void AI envisions subnet tokens as first-class DeFi assets, not just niche staking instruments. With liquidity, security, and accessibility aligned, subnet tokens could become part of the everyday trading flow across multiple chains.

Conclusion

Void AI is more than a bridge—it is an infrastructure layer that makes Bittensor’s subnet economy accessible to the broader world. By combining wrapped tokens, efficient liquidity pools, and Chainlink-secured cross-chain transfers, Void AI lays the groundwork for subnets to thrive in global DeFi.

The result is a win-win:

a. For users: Simple access to subnet tokens without technical hurdles.

b. For LPs: Sustainable rewards with concentrated liquidity incentives.

c. For the ecosystem: A secure, scalable foundation that connects decentralized intelligence to the wider financial system.

In the end, Void AI is not just solving a technical challenge—it is creating a new on-ramp infrastructure for decentralized intelligence to flow into the global crypto economy.

Useful Resources

Access Subnet 106’s ecosystem via official sources:

Website: https://voidai.com/

X (Formerly Twitter): https://x.com/v0idai

Telegram: https://t.me/v0idai

Discord: https://discord.com/invite/Qu8gGDJETB

Docs: https://voidai-docs.vercel.appGitHub: https://github.com/v0idai

Be the first to comment