When crypto moves from narrative to infrastructure, it stops showing up in tweets and starts showing up in filings.

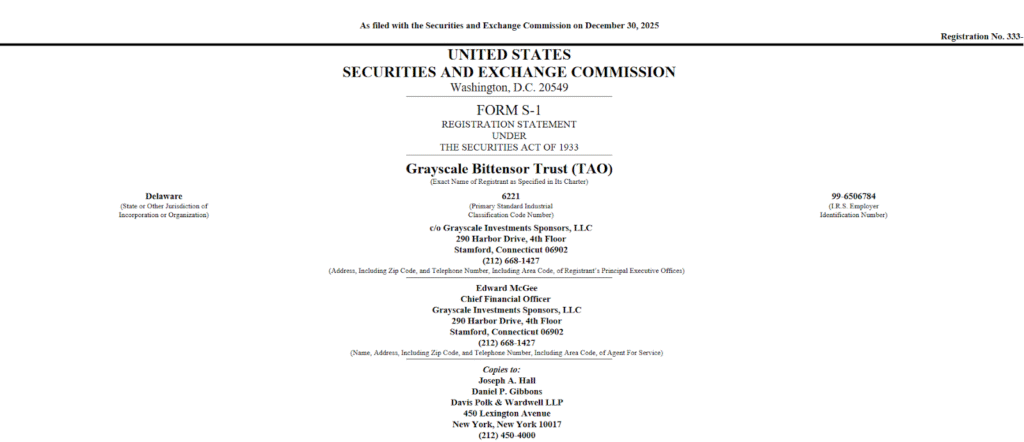

On December 30, 2025, Grayscale Investments submitted an initial Form S-1 registration statement to the U.S. SEC (Securities and Exchange Commission) for $GTAO (Grayscale Bittensor Trust).

The filing marks the next formal step in Grayscale’s plan to convert the trust into an ETP (Exchange-Traded Product), which would make it the first U.S. listed ETP offering direct exposure to Bittensor’s native token, $TAO.

For market participants watching institutional adoption, this is the kind of milestone that matters.

Why This Filing Matters

An S-1 filing is not for sheer marketing, it is a regulatory declaration of intent.

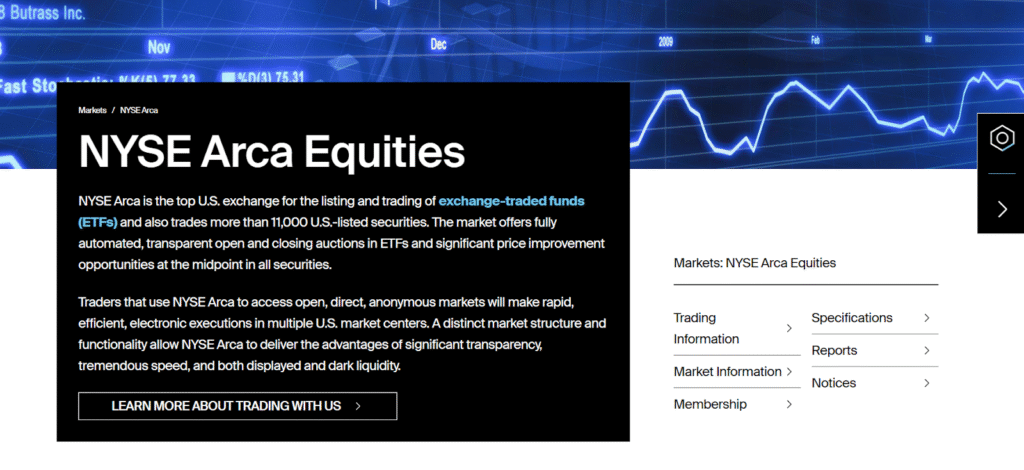

By filing Form S-1, Grayscale is signaling that Bittensor has reached a level of maturity where regulated, exchange listed exposure is not only possible but actively being pursued. If approved, $GTAO would trade on NYSE Arca and provide investors with a compliant, transparent vehicle for accessing $TAO without direct custody.

More importantly, this places Bittensor on a very short list: $TAO would become the first single-asset crypto outside other major assets to follow Grayscale’s full trust to ETP conversion path in the United States.

What is Grayscale Bittensor Trust ($GTAO)

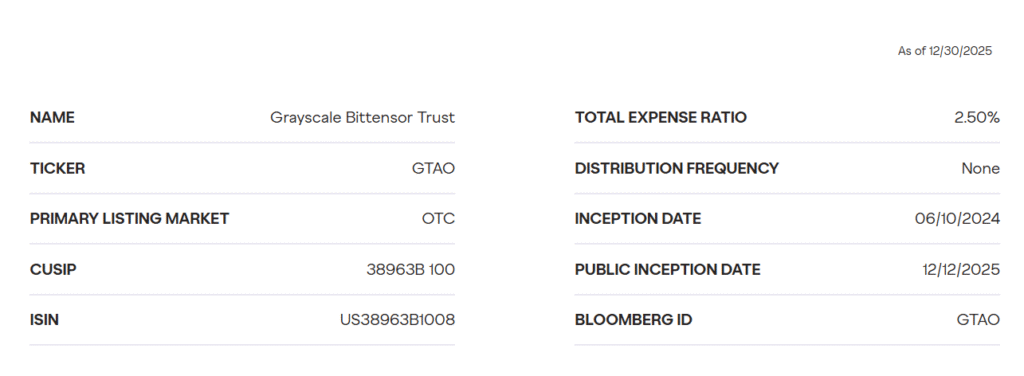

The Grayscale Bittensor Trust is a Delaware statutory trust designed to hold $TAO as its sole underlying asset. Shares represent fractional beneficial ownership in the trust and are intended to track the value of $TAO held, net of expenses.

Key characteristics include:

a. The trust commenced operations in June 2024 and has been operating for months,

b. $TAO is held with institutional custodians including Coinbase Custody,

c. Net asset value is based on $TAO per share,

d. Shares are currently quoted on OTCQX under the symbol $GTAO, and

e. Upon effectiveness, shares are intended to list on NYSE Arca.

While the trust structure does not provide direct ownership of $TAO, it is designed to deliver cost-efficient exposure through a regulated security.

From Trust to ETP: The Grayscale Playbook

This is not Grayscale’s first time walking this road, they have followed a similar progression with other assets like Bitcoin’s $BTC and Ethereum’s $ETH.

Bitcoin Trust ($GBTC) launched privately in 2013 before converting into a spot Bitcoin ETF in January 2024, also, Ethereum Trust ($ETHE) followed the same pattern, converting into a spot Ethereum ETF in mid 2024.

In both cases, the sequence was consistent:

a. Launch a private trust,

b. Build operating history and assets under management,

c. File for conversion via S-1,

d. Obtain regulatory approval,

e. List on a national exchange, and

f. Unlock broad institutional participation.

The filing for $GTAO suggests Bittensor is now entering that same institutional pipeline.

What This Opens Up for $TAO

If approved, a U.S. listed TAO ETP would materially change who can access Bittensor exposure. Many capital allocators are restricted from holding digital assets directly.

Regulated exchange traded products remove that barrier, and s opens access to a range of individuals like:

a. Registered investment advisors,

b. Pension funds,

c. Endowments and foundations,

d. Family offices,

e. Corporate treasuries, and

f. Funds with compliance based mandate constraints.

These institutions collectively manage trillions in assets. For them, paperwork is not friction. It is permission and security.

Liquidity, Price Discovery, and Market Structure

Historically, the launch of regulated ETPs has led to deeper liquidity, tighter spreads, and improved price discovery. Beyond capital flows, ETPs also tend to reshape market structure by:

a. Expanding participation across traditional broker platforms,

b. Increasing daily trading volume,

c. Improving transparency through standardized reporting, and

d. Encouraging additional product competition.

Grayscale’s filing also sets the stage for other asset managers to evaluate similar offerings. Competition in this context is not dilution, it is crude validation.

What This Says About Bittensor

The most important signal here is not price speculation, it is classification. Grayscale is not treating $TAO as an application token or a niche experiment, it is positioning Bittensor’s $TAO alongside crypto infrastructure assets that underpin entire ecosystems.

Covering major assets in blockchain and now Bittensor, this sequence reflects how institutional finance categorizes importance, not popularity.

Looking Ahead

The S-1 filing is subject to SEC review and is not yet effective; Approval is not guaranteed, and timelines remain uncertain.

But, it is clear that when serious capital prepares to move, it leaves a paper trail first.

Grayscale has now placed Bittensor squarely inside the U.S. regulatory process. For a decentralized AI network built on open competition and real economic output, that may prove to be one of the most consequential validations yet.

Markets react to narratives, institutions respond to filings and this one speaks loudly.

Be the first to comment