A quiet but consequential shift just took place in the Bittensor ecosystem.

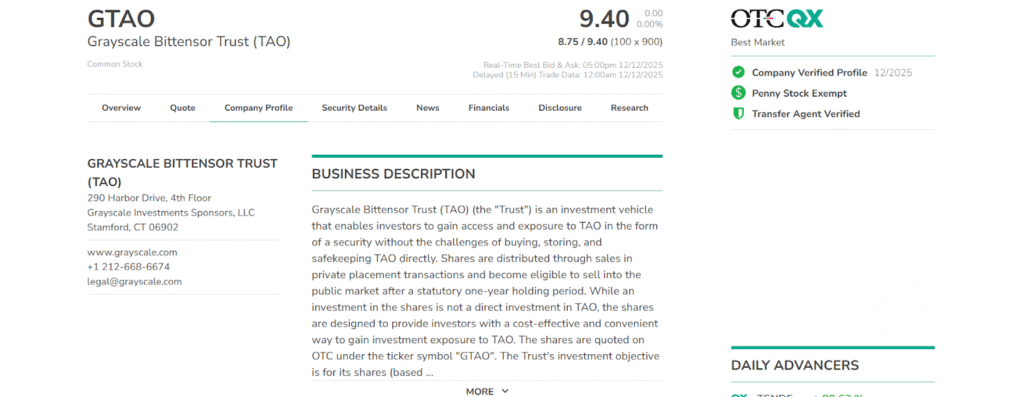

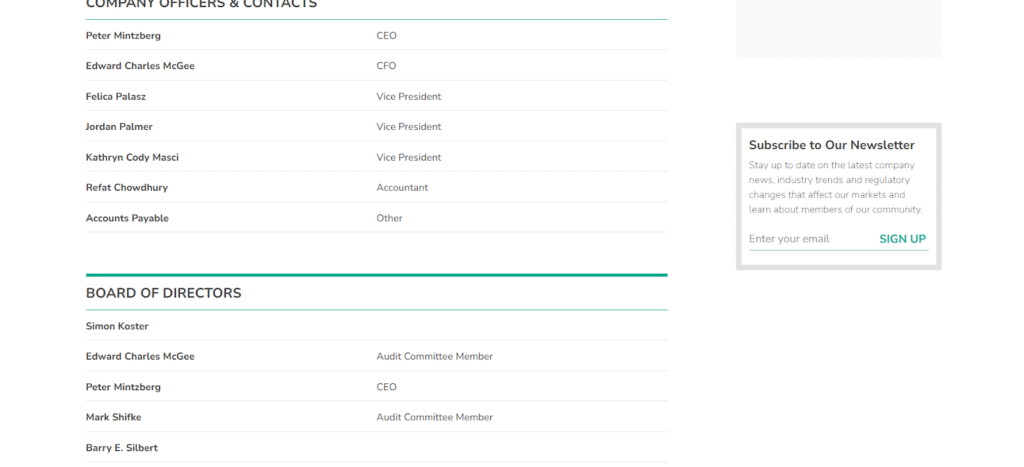

Grayscale’s Bittensor Trust, trading under the ticker $GTAO, has officially gone live on U.S. public markets. At a surface level, this looks like another crypto investment product. In reality, it represents something far more important: a compliant, familiar entry point for traditional capital to gain exposure to $TAO.

This is not about short term price action. It is about access, distribution, and the long-term mechanics of institutional adoption.

What Exactly Went Live

On December 11, Grayscale’s Bittensor Trust ($GTAO) began trading on the OTCQX (Over-The-Counter Quality eXchange) Best Market, the highest-tier of the U.S. over-the-counter market.

This makes it the first-publicly quoted U.S. investment vehicle offering exposure to Bittensor. More importantly, it changes who can now participate.

For the first time, $TAO exposure is available through standard U.S. brokerage accounts, including platforms already trusted by millions of traditional investors.

Why This Changes the Investor Base

Until now, accessing $TAO required crypto-specific infrastructure. Wallets, custody decisions, and exchange risk acted as natural filters that kept many investors on the sidelines.

The trust structure removes those barriers. Investors can now gain exposure through:

a. Standard brokerage accounts such as Fidelity, Schwab, and TD Ameritrade,

b. Retirement vehicles including IRAs and 401(k) accounts, and

c. Advisor managed portfolios that cannot directly hold spot crypto.

This is how long-term capital actually moves. Not through apps or exchanges, but through familiar financial rails.

The Institutional Signal Hidden in Plain Sight

Alongside the launch, Grayscale filed Form 10 for $GTAO, initiating the process toward becoming an SEC (Securities and Exchange Commission) reporting company.

That step introduces:

a. Regular financial disclosures,

b. Annual and quarterly reporting, and

c. Higher transparency standards aligned with public market expectations.

This pathway matters because it mirrors Grayscale’s earlier approach with Bitcoin. The Grayscale Bitcoin Trust ($GBTC) spent years trading on OTC (Over-the-Counter) markets before eventually converting into a spot ETF (Exchange-Traded Fund).

The structure being built today is not accidental, it is preparatory.

Timing That is Hard to Ignore

The launch also coincides with a critical moment for Bittensor itself.

Bittensor’s first halving is scheduled for the same period, introducing a structural reduction in token issuance. At the same time, network dynamics increasingly favor holding rather than automatic selling.

Put simply:

a. New institutional access is opening,

b. Supply growth is tightening, and

c. Long-term holding incentives are strengthening.

This is not a trading setup, it is a structural one.

How Financial Advisors Will See $GTAO

From a professional advisory standpoint, the trust checks several important boxes:

a. Verified company profile,

b. Exempt from penny stock classification,

c. Transfer agent verification, and

d. Listing on OTCQX, the highest OTC tier

These details matter because they determine what advisors are allowed to recommend. For many firms, $GTAO is now a compliant way to discuss Bittensor exposure without navigating the regulatory complexity of direct crypto holdings.

The Scale of Capital Now in Reach

U.S. retirement accounts alone hold over $14 trillion in assets. Historically, nearly all of that capital was structurally excluded from $TAO.

That constraint no longer exists.

Access is no longer technical, it is now administrative. For many investors, exposure now begins with a single conversation with a financial advisor rather than a crypto onboarding process.

This is Infrastructure, Not a One Day Catalyst

The most common mistake markets make is confusing distribution with immediacy.

This development is not designed to move prices overnight. It is designed to enable steady, regulated capital inflows over months and years.

A more realistic progression looks like:

a. Initial discovery by advisors and research desks,

b. Small exploratory allocations,

c. Gradual portfolio inclusion,

d. Broader institutional research coverage, and

e. Potential future product expansion.

This is how institutional adoption actually unfolds.

Closing Thoughts

While much of the crypto market remains focused on short-term price movements, Grayscale has quietly done something far more durable. It has opened a regulated bridge between traditional finance and decentralized AI infrastructure.

That bridge will not matter ‘tomorrow’ but it will matter over the next cycle.

Most participants will only recognize the significance in hindsight, once access (not speculation) becomes the dominant driver of demand. By then, however, positioning will no longer be theoretical.

Be the first to comment