By: @CryptoZPunisher

A Strange Signal from the AI Giants

Mariusz Sobczak (@sobczak_mariusz) shared a troubling observation:

“Here is something interesting that is happening right now at the big AI labs, OpenAI, Anthropic and other labs, their employees have started to sell their shares in massive secondary offerings. If someone is offering shares at $100k what supposedly is a $100 Billion company something is off, this is just odd. Would you cash out at the cusp of a company building an AGI, I don’t think so. I am not sure what all that means but it doesn’t make sense at all, it says that insiders don’t believe that AGI is happening soon and they want to cash out before everyone else finds out. So where is the edge, how can we benefit from it. The real opportunity is building systems around models – the software, infrastructure, and products that turn raw AI capability into something useful, sticky, and revenue generating. Ridges is building exactly that.”

Mariusz Sobczak points out an inconsistency:

- Insiders, supposedly with long-term vision, are selling at premium prices their shares in companies that claim to be on the cusp of AGI.

- If AGI were truly imminent, who would be cashing out today?

This doesn’t just suggest AGI is still far away: it shows that the real value is not in the promise of a single model, but in the systems that turn models into products, applications, and lasting infrastructure.

When Smart Money Connects the Dots

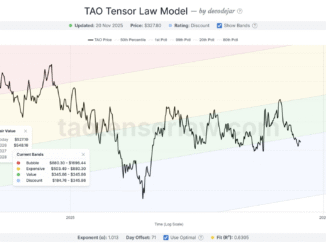

This is exactly what I highlighted in my previous article: smart money doesn’t waste time on short-term price targets for $TAO.

➡️ “$TAO – The Smart Money Is Already Here”

It looks further. It asks which protocols, which architectures, which networks will structure tomorrow’s AI.

Barry Silbert, through DCG and Yuma Group, has already positioned himself around Bittensor. Jason Calacanis, co-founder of Stillcore Capital with Mark Jeffrey and Rob Greer, is on the same track. And surrounding them is the All-In network: Chamath & Jason & David Friedberg & David Sacks.

A network of titans, deeply rooted in tech, finance, and politics. And all of it is gradually converging toward Bittensor.

David Sacks: Open Source and Decentralization

Let’s talk about David Sacks. A member of the “PayPal Mafia” alongside Thiel and Musk, a seasoned VC, he recently shared a sharp view of the AI landscape.

In a tweet from August 9, 2025, he explained that contrary to doomer “takeoff” narratives, models are converging in performance, specializing, and none is running away with the lead. And more importantly:

➡️ “A BEST CASE SCENARIO FOR AI?

- Open source has a major role to play: 80–90% of capabilities for 10–20% of the cost.

- The current competition prevents monopolies, reducing the Orwellian risk of centralized AI.

- Real value will shift to verticalized applications, agents, and the software layers around the models.

In short, David Sacks puts decentralization and open source at the heart of the ideal scenario for AI.

The Bridge to Bittensor

This is where everything comes together. Mariusz Sobczak points out that AGI insiders are cashing out before the hype fades. Sacks emphasizes that the true trajectory lies in decentralization and open source. Silbert, Calacanis, Jeffrey, and others are already channeling capital into Bittensor.

👉 Bittensor is precisely that neutral, decentralized network that allows thousands of models and applications to coexist, specialize, collaborate, and generate value without depending on a single actor.

Conclusion: The Edge Is Already Here

The insiders of the big labs are selling. The AGI-centralized narrative is weakening. But smart money has already found its edge:

- in infrastructure,

- in open source,

- in decentralization.

And all of that carries one name: Bittensor ($TAO).

Centralized AGI can wait. Smart money has already chosen its side.

Be the first to comment