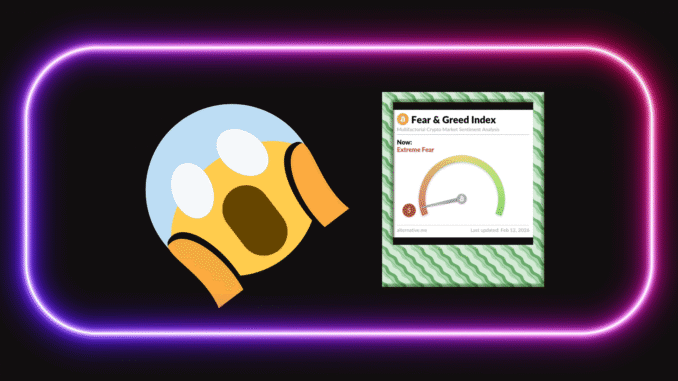

Crypto is no stranger to chaos, but February 12, 2026, delivered one of the darkest sentiment prints in recent history.

The Crypto Fear & Greed Index plunged to 5, matching the extreme panic levels last seen during the March 2020 COVID crash.

It’s the kind of number that doesn’t show up during “healthy pullbacks.” It shows up when the market is bleeding, overleveraged players are wiped out, and confidence evaporates overnight.

But does this signal the end of crypto or the start of the next cycle?

Extreme Fear at 5

The Fear & Greed Index is a strong indicator of market psychology.

A reading of 5 signals maximum panic. This is the moment when most investors stop thinking rationally and start acting emotionally.

Historically, this zone has been where:

- forced liquidations peak

- retail capitulates

- long-term buyers quietly start accumulating

Bitcoin Dragged the Market Into the Abyss

The fear spike is tied directly to Bitcoin’s sharp collapse. Bitcoin is down roughly 52% from its peak of $126,000, trading around the $60,000–$67,000 range currently.

Not only did the drop hurt portfolios, but it also broke confidence, triggering liquidations and sending traders into survival mode.

Yet beneath the panic, there are signs the market is not “dead”. On-chain data shows stablecoin supply sitting near all-time highs, and tokenized treasuries above $10 billion, suggesting a large pool of capital is sidelined and waiting for clearer direction. This looks like some smart chads are keeping dry powder for what’s to come.

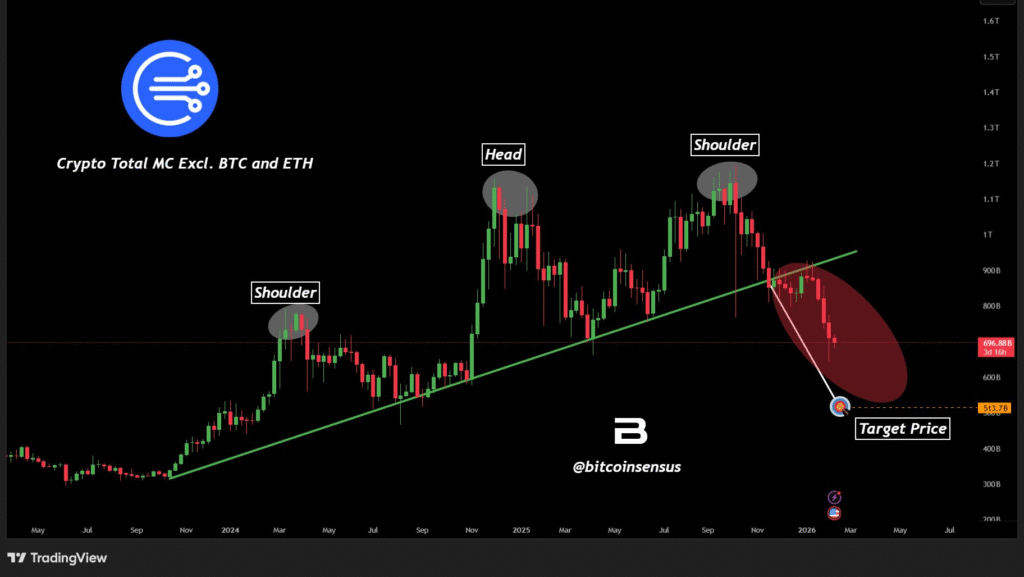

Altcoins Followed BTC Down

The sell-off didn’t stop at Bitcoin.

- Ethereum (ETH) dropped below $2,000, reflecting risk-off sentiment across DeFi.

- Solana (SOL) hovered near $80, as traders questioned how far speculative liquidity can stretch in a bearish macro environment.

- BNB also faced heavy pressure, as overall market activity cooled.

When Bitcoin falls this hard, altcoins rarely survive untouched. They become collateral damage.

X Sentiment: “This Is Where Smart Money Buys”

Interestingly, the mood on X hasn’t been pure despair. If anything, data shows that it’s been the opposite: quiet conviction.

Many traders are framing the Fear & Greed Index at 5 as a classic contrarian setup.

Several posts highlight the same logic:

- extreme fear often clusters near bottoms

- most weak hands have already sold

- risk/reward improves dramatically after capitulation

Spotlight: TAO’s Fundamentals Keep Accelerating

While the market bleeds, Bittensor ($TAO) continues to stand out, not because price is immune, but because the ecosystem momentum hasn’t slowed.

Even in this downturn, Bittensor’s subnet economy keeps expanding, with builders shipping, miners competing, and real workloads running.

For TAO, the price is down, but the network is growing. And that’s usually what creates long-term asymmetric upside.

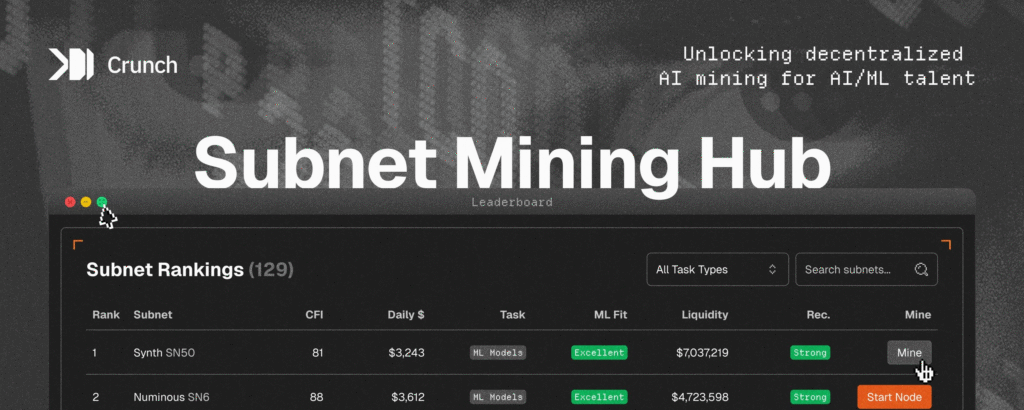

CrunchDAO Opens the Floodgates for New Miners

One of the most important updates is CrunchDAO’s push to onboard real technical talent into Bittensor.

CrunchDAO recently announced efforts to bring subnet mining to its community of:

- 11,000+ ML engineers

- 1,200+ PhDs

That matters because it’s one of the grandest talent onboarding that the ecosystem has experienced.

Crunch is effectively abstracting away the blockchain complexity and allowing researchers to focus on what they do best, which is building models and competing.

That’s exactly what Bittensor needs if it wants to scale into something bigger than a crypto narrative.

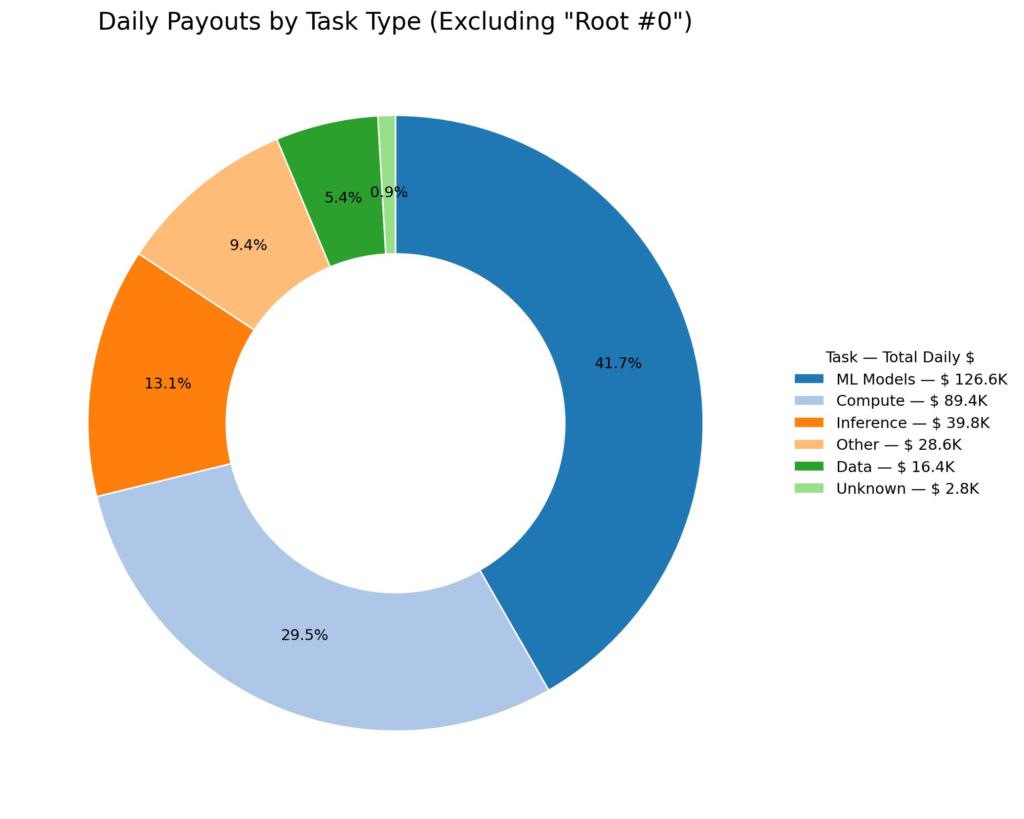

“$100M Per Year Up for Grabs”: Silbert Signals Institutional Attention

CrunchDAO’s dashboard also estimates that Bittensor miners are earning roughly:

$304,000 per day ≈ $111 million annually (at current TAO prices)

That number caught the attention of Barry Silbert (DCG founder), who amplified the idea that Bittensor represents:

“$100 million/year up for grabs for anybody that wants to contribute and compete.”

Silbert has also publicly positioned TAO alongside major assets like BTC and ZEC. In a recent interview he did in the front of multiple Bitcoin OGs, Barry said: “I think a Zcash $ZEC can go up 500x. I think a Bittensor $TAO can go up 500x. And so our (DCG) portfolio is allocated accordingly.”

The Real Takeaway: This Isn’t the End, It’s a Reset

A Fear & Greed reading of 5 feels apocalyptic in the moment, but historically, these are the moments that define cycles.

Bitcoin and altcoins are bleeding. Sentiment is crushed. But the market is also showing familiar patterns:

- capitulation

- liquidity building on the sidelines

- builders continuing to ship

- smart money shifting into accumulation mode

Crypto doesn’t end in panic; it gets rebuilt in panic. And projects with real traction (like Bittensor) tend to use these periods to widen the gap between themselves and everything else.

This isn’t the endgame. It’s the reset.

Be the first to comment