Most AIs give you answers. They say yes or no, up or down, as if the world is that straightforward. But the world is not black and white. It’s a world of maybes, mights, and what-ifs.

Synthdata (subnet 50) is a Bittensor network AI project that understands this. Instead of pretending it knows the future, it calculates how likely different futures are. That makes it one of the most intelligent subnets in the ecosystem.

What Is Synthdata?

Synthdata is an AI software that’s designed to forecast possibilities, not inevitabilities. It doesn’t say, “Bitcoin will hit $125K.” It says:

60% chance it stays between $121K and $124K

25% chance it goes below $121K

15% chance it goes above $124K

This type of forecast is called a probabilistic distribution. It’s just like the weather. You don’t want someone to tell you, “It will rain.” You want, “There’s a 70% chance of rain.” That’s what enables you to prepare. Synthdata gives traders and builders that kind of preparation, but for financial decision-making.

Why Probability Is Smarter Than Prediction

To predict once is to guess. Anyone can guess. However, to give a range of potential outcomes with percentages? That is strategy. That’s what mathematicians, scientists, and smart investors do.

By thinking in probabilities, Synthdata teaches more informed decision-making. It shows you that while you can’t control the future, you can prepare for it. You can hedge risks, set objectives, and decide when to enter or exit a market based on probability, not luck.

Who Uses Synthdata?

Synthdata (Subnet 50) is designed for a set of users who need reliable probabilistic forecasting data — no guessing. According to the whitepaper, target users are:

Miners/Modelers: AI creators and quant teams who build probabilistic forecast models to compete in Synth. These are the folks creating the price distributions.

Validators: Participants who score and rank the accuracy of miners’ predictions using metrics like CRPS (Continuous Ranked Probability Score).

AI Agents & Developers: DeFi or independent agents that use synthetic distributions instead of explicit price data to make decisions.

Quantitative Analysts & Strategists: Individuals or organizations that need higher-quality data feeds for risk models, trading plans, or simulation, especially when real data is missing or skewed.

DeFi Protocols & Infrastructure Builders: Projects that would likely leverage Synth’s synthetic data for prediction layers, model training, or use as an oracle alternative.

What Scenarios Is Synthdata Most Well-Suited For?

Synthdata is best suited for scenarios where uncertainty is high, data is partial, or risk is a concern. Some key use cases:

- Volatile Markets & Black Swans: Historical records will crumble under disaster scenarios. Synth generates distributions that are better in tail risk and rare occurrences.

- Limited Real Data or Gaps: While market segments or time periods lack sufficient history, synthetic data fills in the gaps without leaning models towards overfitting.

- DeFi Agent Training & Simulation: Agents (bots or autonomous systems) can learn from more abundant scenario space, not just individual trajectories. It allows agents to reason over multiple potential futures.

- Risk Management & Position Sizing: Instead of asking “Will the price go up?”, you ask “What is the chance that it stays within this band?” That helps size capital and put stops more smartly.

- Mixing Signals & Models: You can pipe Synth outputs into bigger systems: overlap with on-chain info, sentiment, volume, to increase prediction accuracy.

- Protocol Design & Incentive Structures: DeFi systems or prediction systems that need precise forecasts in order to price derivatives, design oracles, or insure risk can rely on Synth’s information to power their logic.

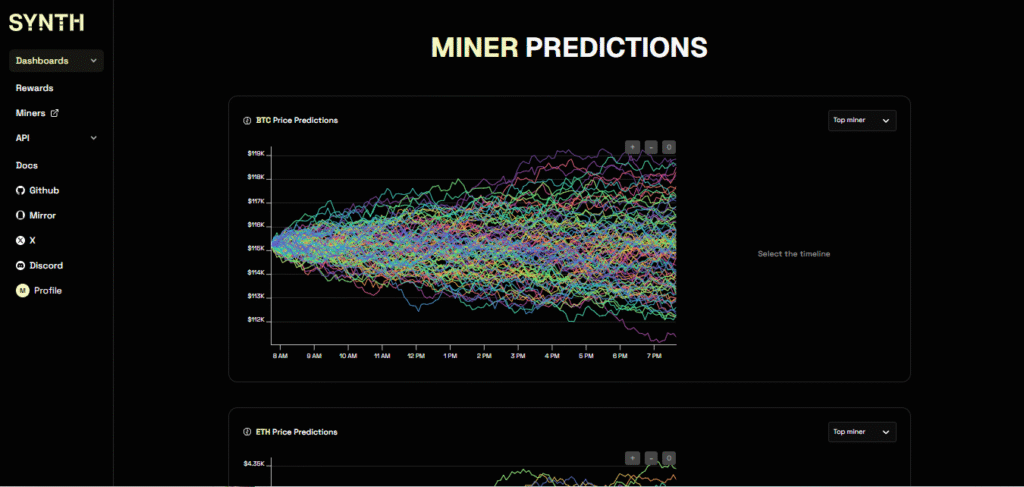

How to use Synthdata

- Go to Synthdata and log in:

- You can immediately start looking at predictions.

Why Bittensor Needs Systems Like Synthdata

Bittensor is building an economy of intelligence, a mesh of AI models competing to provide value. The majority of models produce answers. But a network this powerful also needs models that tune uncertainty. That’s what Synthdata provides: clarity in the chaos.

Instead of “What would be the price?” it’s asking, “What would be the possible price?” It’s turning information into strategy. That’s a move towards maturity, not just for AI, but for AI-based financial systems.

Be the first to comment