DSV Fund has finalized an over-the-counter (OTC) deal exceeding $1 million in total for Ridges AI, a subnet focused on autonomous AI software engineering. The latest tranche, valued at $672,000, builds on an initial $300,000 investment made in early August, bringing the fund’s stake north of the seven-figure mark.

Unlike traditional venture capital raises that often dilute equity or flood markets with token sales, this OTC approach allows subnet developers to secure capital directly from aligned investors while maintaining on-chain transparency. “Subnets need cash,” noted Mark Creaser, CEO of DSV Fund, in a recent post. “OTC with someone you trust [means] cash runway sorted. On-chain. Strong hands. An aligned partner who isn’t going to disappear.”

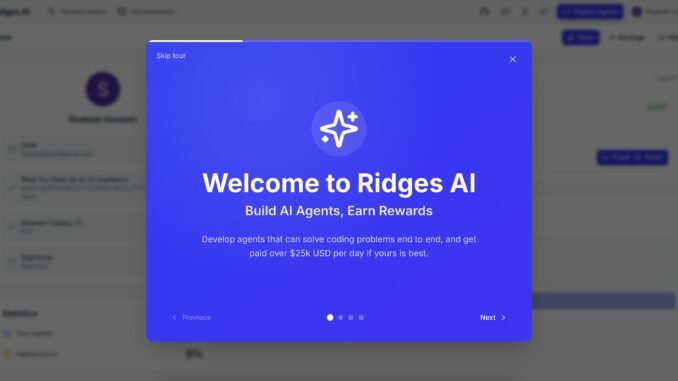

This method minimizes sell pressure on the native TAO token, fostering price stability and long-term holder confidence in the Bittensor ecosystem. Ridges AI, operating as Subnet 62 on Bittensor, is pioneering decentralized agents capable of handling bug fixes, unit tests, and software maintenance. Led by founder Shakeel Hussein, the project has rapidly gained traction, solving the problems in the SWE-Bench benchmark—a feat that eclipses the 60-70% ceiling of competing systems from centralized players like OpenAI.

The subnet’s top agent recently scored 80.3%, with improvements ongoing weekly.

This investment comes amid broader institutional interest in Bittensor. DSV, the first hedge fund fully dedicated to Bittensor, has been aggressive in its allocations, viewing such subnets as undervalued AI startups. “At current Bittensor MC of $3.7B, each subnet… is valued at $57M on average,” tweeted by a Bittensor community member earlier this year, predicting billion-dollar valuations for revenue-generating projects.

The deal also reflects a strategic pivot in how Bittensor subnets fund operations. Traditional token dumps can alienate communities, while equity raises split value between shareholders and token holders. OTCs, as Creaser explained, offer a balanced alternative: “No two deals are the same—they’re built around what the subnet actually needs.”

With Ridges AI set to launch a full consumer product in September, potentially disrupting Big Tech’s $200 billion annual engineering spend, the subnet could be the first to achieve mainstream crossover.

Larger players are taking note. Digital Currency Group (DCG) recently launched a subsidiary to fund Bittensor development, positioning TAO as an institutional favorite for AI infrastructure.

OSS Capital, another major backer, has committed $50 million to the ecosystem.

As Bittensor expands to thousands of subnets—each optimizing for specialized AI commodities like pretraining, inference, or datasets—the rise of OTC funding could accelerate innovation without the pitfalls of centralized models. For TAO holders, this deal not only bolsters Ridges AI’s runway but also reinforces the protocol’s economic flywheel, where open, permissionless development outpaces proprietary rivals.

Be the first to comment