By: Van

As crypto enters a more mature phase, a structural shift is becoming harder to ignore. The market is no longer treating all blockchains as variations of the same investment thesis. Instead, two distinct categories are emerging, each with different economic characteristics, growth profiles, and risk dynamics.

On one side are Layer-1 (L1) blockchains, increasingly viewed as settlement infrastructure. On the other are networks designed to coordinate the production of high-value digital commodities. A recent thesis articulated by vaN ττ frames this divergence as a fundamental bifurcation (division) between utility rails and intelligence factories, with Bittensor ($TAO) positioned firmly in the latter category.

Layer-1s Enter the Utility Phase

For much of the last decade, crypto investing centered on infrastructure. Capital flowed into L1 networks competing to offer faster transactions, lower fees, and greater decentralization. That competition produced clear winners, with Ethereum establishing itself as the dominant settlement layer.

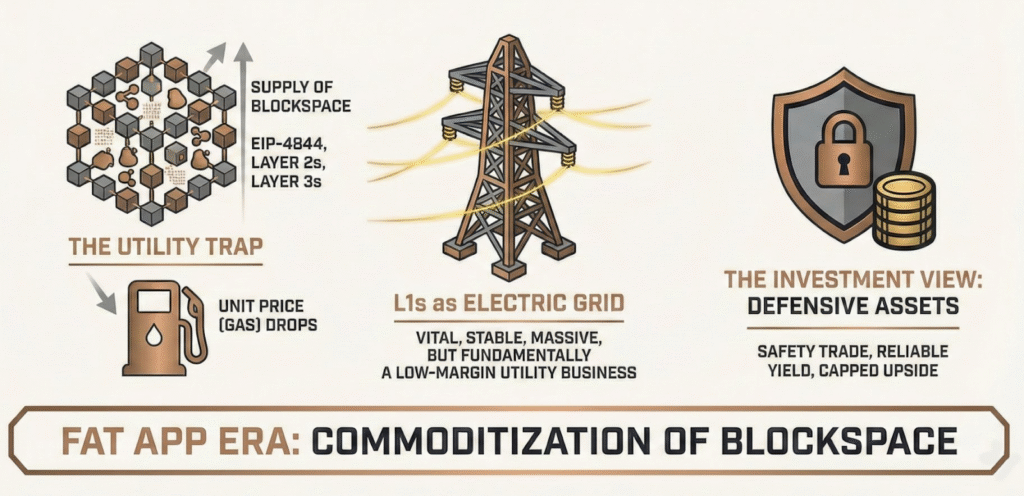

As scaling solutions mature, the economics of L1s are changing. The rapid expansion of Layer-2s (L2s), modular architectures, and data availability upgrades has dramatically increased the supply of blockspace. When supply outpaces demand, pricing power weakens.

This dynamic is pushing major L1s toward a utility-like profile where:

a. Expanding blockspace reduces marginal transaction costs,

b. Fees trend downward as efficiency improves, and

c. Revenue growth becomes linked to volume rather than scarcity.

From an investment standpoint, L1 assets increasingly resemble defensive infrastructure plays. They remain foundational to the ecosystem but offer more predictable, capped upside as optimization replaces experimentation.

The Commoditization of Blockspace

The idea that blockspace is becoming commoditized has gained traction across institutional research. As execution moves off the base layer, L1s function more like global settlement backbones than innovation engines.

This does not diminish their importance, but it reframes their role. Much like electricity grids or payment rails, their value lies in reliability, security, and scale rather than differentiated output.

In this environment, the question for investors shifts from which chain will win to what new systems will be built on top of this infrastructure.

Bittensor’s Alternative Model

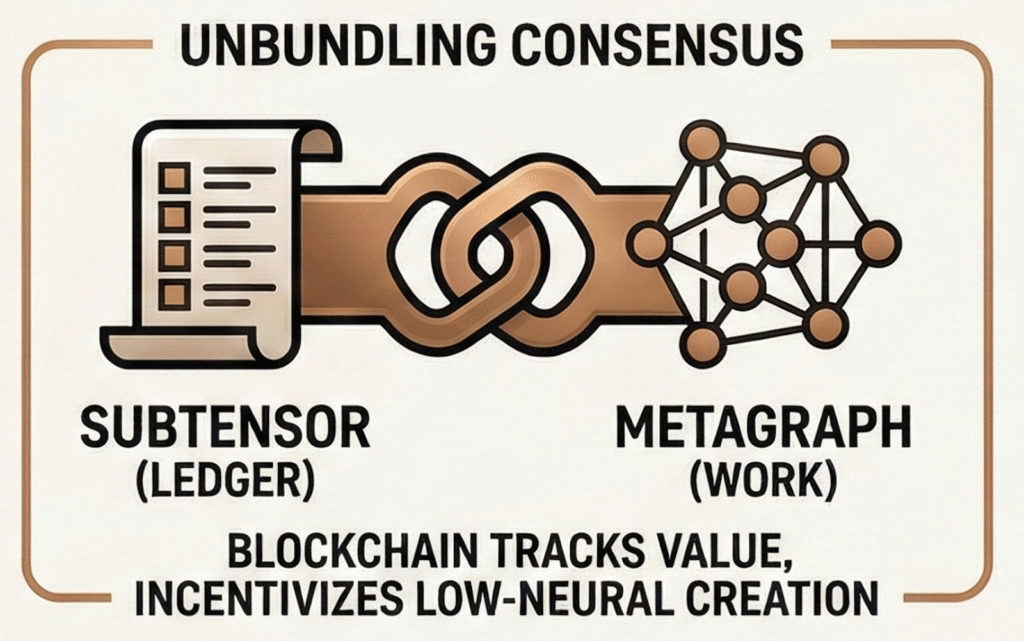

Bittensor approaches the problem from a different angle. Rather than monetizing access to blockspace, it uses blockchain incentives to coordinate the creation of machine intelligence.

The network separates the ledger layer from the work being performed. Participants contribute intelligence, models, or optimization strategies within specialized subnets, and in return, they are rewarded based on the quality of their output, not their access to capital or hardware alone.

This model aligns Bittensor’s economics with production rather than rent. Its value accrues from what the network generates, not from the fees it charges.

Why Intelligence Networks are Structurally Different

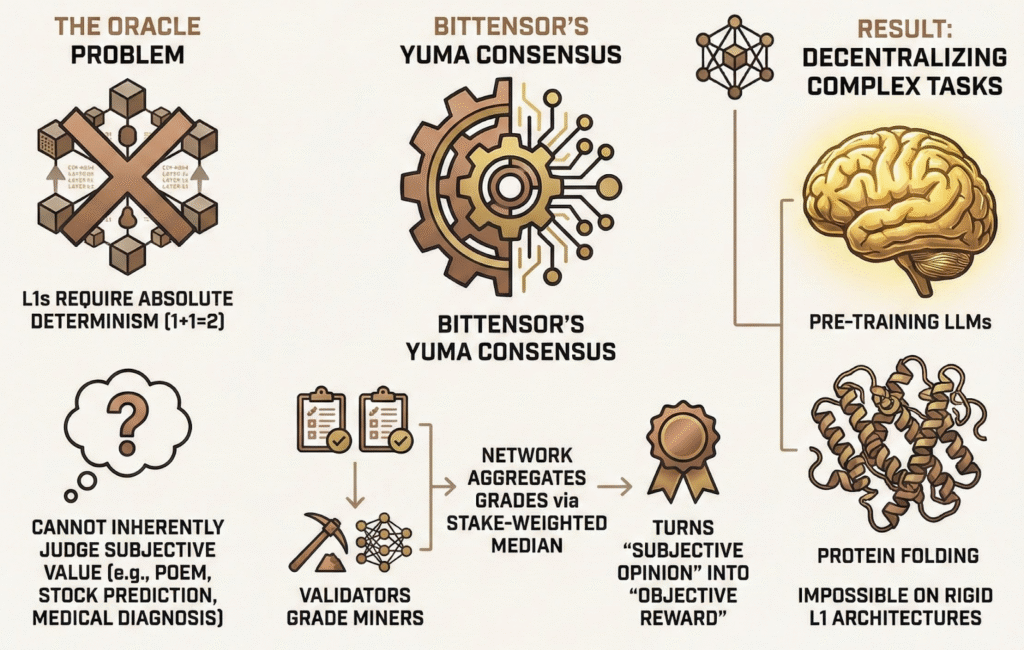

Unlike blockspace, demand for intelligence does not face a natural ceiling. Improvements in AI quality, efficiency, and specialization remain relevant across nearly every industry. Better models translate directly into economic value.

Traditional blockchains struggle to coordinate this type of work because they rely on deterministic outcomes. Subjective outputs cannot be validated through simple state transitions.

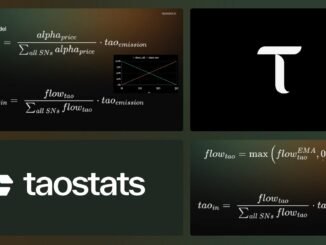

Bittensor addresses this limitation through its consensus mechanism, which allows decentralized participants to evaluate and score qualitative outputs. By aggregating these evaluations, the network transforms subjective assessments into objective economic signals.

This capability enables decentralized coordination of work that standard L1 architectures cannot reliably support.

Faster Evolution Through Market Selection

Another point of divergence lies in how these systems evolve. L1 upgrades are deliberately slow, requiring extensive coordination to avoid destabilizing core infrastructure.

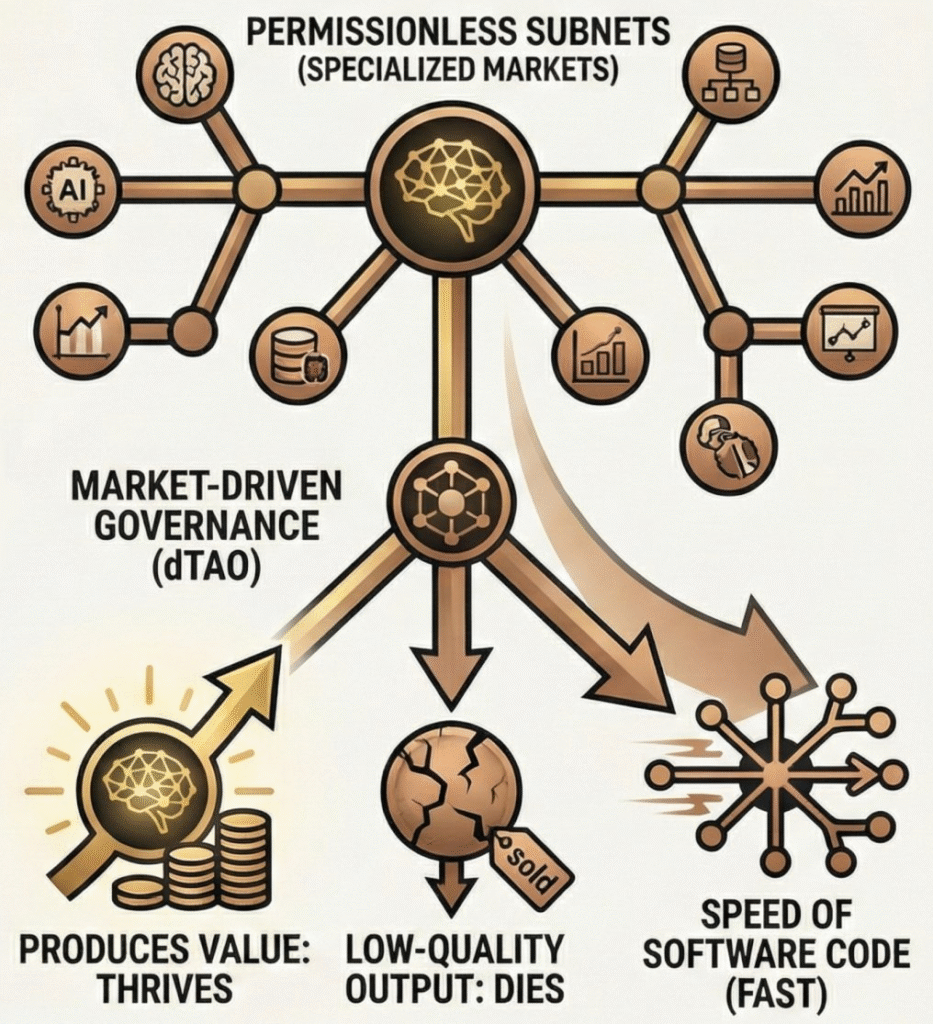

Bittensor’s ecosystem operates under different constraints. Subnets are permissionless, and capital allocation is market driven through dynamic TAO (dTAO). Over time, poorly performing subnets lose relevance, while those producing valuable outputs attract attention and resources.

This structure introduces a faster evolutionary cycle:

a. Specialized subnets compete for relevance and emissions,

b. Market signals determine survival rather than governance committees, and

c. Innovation occurs through continuous experimentation.

The result is an ecosystem that evolves at the pace of software markets rather than protocol politics.

Two Roles, Two Investment Profiles

The broader implication is that crypto assets are no longer competing within a single category.

L1s,such as Ethereum, increasingly function as settlement infrastructure. Their returns are tied to adoption, stability, and transaction throughput.

Bittensor represents a different bet. Its valuation is linked to the decentralized production of intelligence and the economic value of the outputs generated by its network.

Both roles can coexist, but they serve different purposes and appeal to different risk profiles.

Conclusion

Crypto’s next phase appears less about building new rails and more about what those rails enable. As infrastructure matures, attention is shifting toward networks that can coordinate high-value production at scale.

This emerging split between settlement layers and intelligence networks helps explain why assets like Bittensor are increasingly discussed outside the traditional L1 framework. Rather than competing to move transactions, these systems aim to produce outcomes.

As the market continues to mature, understanding this distinction may become essential for evaluating where long-term value is being created.

Be the first to comment