For most of the last decade, artificial intelligence has followed a familiar pattern: Bigger labs, bigger budgets and bigger models. A perfect projection of an increasingly centralized race where progress depends on who can spend the most.

But a different idea is quietly gaining traction. “What if AI innovation behaved less like a corporate arms race and more like Bitcoin? An open system, relentlessly competitive, optimized not by permission, but by incentives.

That idea sits at the center of Bittensor, and it was the core theme explored in this episode of the Messari Theses Podcast (watch below), where Chris Davis sat down with Sami Kassab and Seth Bloomberg of Unsupervised Capital.

The conversation moved beyond slogans about decentralization and focused on structure, incentives, and execution.

What followed were clear analyses that support the fact that open competition, when paired with crypto incentives, accelerates innovation in ways even centralized systems cannot.

Bitcoin as the Original Optimization Machine

Sami framed the discussion with a familiar reference, “Bitcoin was a relentless optimization machine,” he said. “It just happened to be optimizing SHA 256 hashes.”

The implication was that Bitcoin proved that when competition is open and rewards are clear, systems improve continuously. There is nothing inherent about that model that limits it to hashing.

Seth expanded on the idea. He noted that “The only real competitive moat in AI today is the rate of innovation, and open systems move faster.”

Bittensor, they argued, applies this same logic to intelligence itself.

Why Bittensor Exists

Chris guided the conversation toward Bittensor’s core design. He noted that instead of proof of work, Bittensor rewards proof of intelligence.

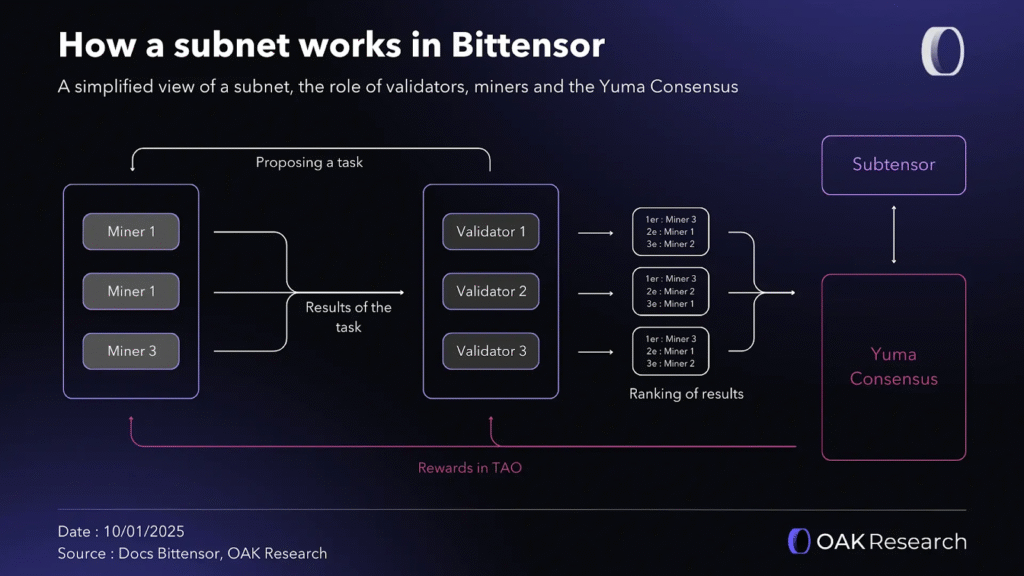

Bittensor is structured as a network of subnets, each operating as an independent market focused on a specific AI task. Performance is evaluated continuously, and rewards flow to those who contribute the most value.

The key components include:

a. Subnets are independent markets focused on tasks such as compute, training, inference, agents, or prediction.

b. Miners are participants who contribute intelligence, models, or compute resources.

c. Validators are evaluators who measure performance and determine reward allocation.

d. $TAO is the incentive layer that aligns participants around quality and improvement.

“There is no static benchmark,” Seth noted. “Everything is tested in real time.”

Templar and the Reality of Decentralized Training

When the discussion turned to model training, Templar became a central example. Seth explained that Templar (Built on Subnet 3) focuses on decentralized pre training.

“They have been running large scale training experiments for over a year,” he said. “Including models in the seventy billion parameter range.”

Sami was quick to clarify the objective, he opined that the goal is not to beat frontier labs today but to refine the system.

Templar’s work centers on solving fundamental challenges such as coordination, communication efficiency, and latency in decentralized environments. These improvements are foundational for future scalability.

“This is not about vanity metrics,” Sami added. “It is about building a system that works when scale arrives.”

Why the Timing Finally Works

The speakers agreed that decentralized AI struggled in earlier cycles because the market was not ready. That has changed.

Sami outlined several structural shifts:

a. Open-source models are now competitive with closed systems,

b. Users are increasingly willing to switch tools based on performance, and

c. Massive data center expansion is creating idle compute supply.

He also added that for the first time, decentralized networks actually have a product people want. Seth added that RL (Reinforcement Learning) has become increasingly important.

“RL fits naturally into distributed environments,” he said. “And crypto is very good at coordinating specialists.”

Subnets Behave Like Startups

Chris pointed out that Bittensor changes how AI companies are formed. He pointed out that subnets function like startups but with global participation.

Instead of hiring centralized teams, subnets rely on miners to perform research and development. This creates a powerful economic discipline.

Sami explained the pressure clearly, “if the token underperforms, miners leave, and if miners leave, the product collapses.”

This dynamic forces subnets to pursue real users, real revenue, and real product market fit.

Where Revenue is Emerging Today

Seth highlighted compute focused subnets as early leaders noting that compute and inference subnets are already generating meaningful revenue.

These subnets (like Targon, Lium and Chutes) provide GPU access and inference services directly to customers. Others, such as Templar, are building long-term infrastructure rather than immediate commercial products.

Sami acknowledged the uncertainty, adding that “We do not know which sector breaks out, that is the nature of venture.”

Looking Ahead to 2026

As the conversation closed, the speakers shared measured expectations. Sami believes decentralized AI will attract stronger founders as results become harder to ignore. He noted that “crypto has always struggled to attract top-tier talent, but that is starting to change.”

Seth pointed to two emerging themes:

a. AI agents returning with real utility, and

b. Growing demand for privacy and ownership in creative workflows.

Chris brought the discussion back to fundamentals. “Narratives come and go,” he said, “Revenue is what proves the model.”

Let the Market Decide

While Bittensor does not promise shortcuts or guarantees, it offers a system where intelligence competes openly and improvement is rewarded continuously. As Sami summarized, “Open competition accelerates innovation.”

In a world where intelligence is becoming the most valuable resource, the future may not belong to the biggest models. It may belong to the best incentives.

In the end, the thesis is simple, “let the market decide.”

Be the first to comment