A new wave of “human miners” is quietly entering the Bittensor ecosystem, and it’s coming from a place most crypto-native builders rarely reach: the global machine learning talent pool. In a recent Hash Rate interview (watch below), Jean Herelle, founder of Crunch, explained how his company has built a bridge between high-level data scientists and decentralized AI networks like Bittensor. Crunch now has access to over 11,000 machine learning engineers and 1,200 PhDs, and is actively onboarding them into subnet mining.

Bittensor has capital flow and decentralization figured out, but onboarding is still too complex for outsiders. Crunch is positioning itself as the interface layer that makes it easy for talented ML contributors to participate without needing to understand wallets, staking, mining slots, or the messy coordination layer that scares off non-crypto natives.

Crunch Started as a “Subnet Before Subnets”

Crunch didn’t begin inside crypto. It started four years ago as an experiment in talent aggregation. Jean’s background was originally in building AI models for the insurance industry, but after exiting that business, he and his partner moved into an even harder arena: algorithmic trading.

Competing against quant giants like Citadel, Millennium, and Two Sigma quickly exposed a harsh truth. In financial markets, even tiny data edges are already exploited. To win, you need more than internal talent. You need the smartest minds available globally.

In 2020, Jean noticed Numerai, a project that paid data scientists to contribute predictive models. That inspired him to run a similar incentive structure. Crunch started posting crypto bounties online, and the response was immediate. Within months, hundreds (then thousands) of contributors began submitting models.

Jean realized something subnet owners on Bittensor now understand deeply: if incentives are strong and competition is structured properly, external intelligence can outperform anything you can build internally. At that point, Crunch shifted from “building models” to “finding brains.”

From Hedge Funds to Harvard: Crunch Becomes Institutional

As Crunch scaled its contributor base into the thousands, institutional interest followed. Jean described how major organizations began approaching them, including sovereign wealth fund research labs in the UAE running large quant operations.

By 2023 and 2024, Crunch was supplying algorithms and model contributions to elite institutions, including Harvard, MIT, and the Broad Institute.

Crunch became extremely strong at one thing: aggregating talent. But it still lacked something Bittensor does well: credible decentralization and incentive transparency.

Why Crunch Chose Bittensor

Jean’s explanation for joining Bittensor: Crunch solved the talent side, but Bittensor solved the trust and capital side.

Bittensor doesn’t require participants to trust a centralized entity to judge performance or distribute rewards. The architecture makes rewards deterministic and transparent. That is exactly what Crunch didn’t have.

Crunch had built the “crowd,” but Bittensor had built the “machine.” So instead of reinventing decentralization, Crunch decided to plug into an ecosystem where the rules were already enforced by the network itself.

Subnets as a New Kind of Customer

One of the most interesting ideas from the interview was Jean’s framing of subnets as “decentralized customers.” Crunch has traditionally served institutional clients, but now sees the possibility that certain subnets may grow into massive entities capable of paying for top-tier intelligence.

Unlike institutions that pay fixed contracts, Bittensor pays miners directly based on performance. That changes the entire incentive model. It creates a system where intelligence becomes liquid, measurable, and competitive by default.

Jean believes this is where the future is heading: a world where intelligence is not just valuable, but priced in real time.

The Mining Problem: Bittensor Is Still Too Hard

Mark Jeffrey, the interviewer, highlighted a core issue: even with tools like OpenClaw for “vibe mining,” mining Bittensor is still painful.

He described running multiple infrastructure instances to mine Vidaio (Subnet 85), dealing with constant deregistration, port mismatches, crashes, and validator rejections. Even experienced participants struggle.

Now imagine a brilliant PhD researcher who has never touched crypto. They won’t tolerate that learning curve.

This is exactly the problem Crunch is solving. It’s not that Bittensor lacks talent. It’s that Bittensor lacks a clean onboarding pipeline for talent.

Crunch’s Solution: A Human Device Driver for Mining

Crunch has launched a mining dashboard and hub designed to simplify the entire process. Instead of forcing contributors to learn the mechanics of Bittensor, Crunch abstracts the coordination layer away.

Jean explained that their platform lets users mine without even creating a wallet manually. Crunch automatically generates a wallet using Privy, handles setup, and provides a unified interface across different subnets.

The user only needs to focus on what they’re good at: building models.

That’s why Mark called Crunch a “device driver for smart humans.” It’s a layer that allows machine learning engineers to plug into Bittensor without needing to understand the messy backend.

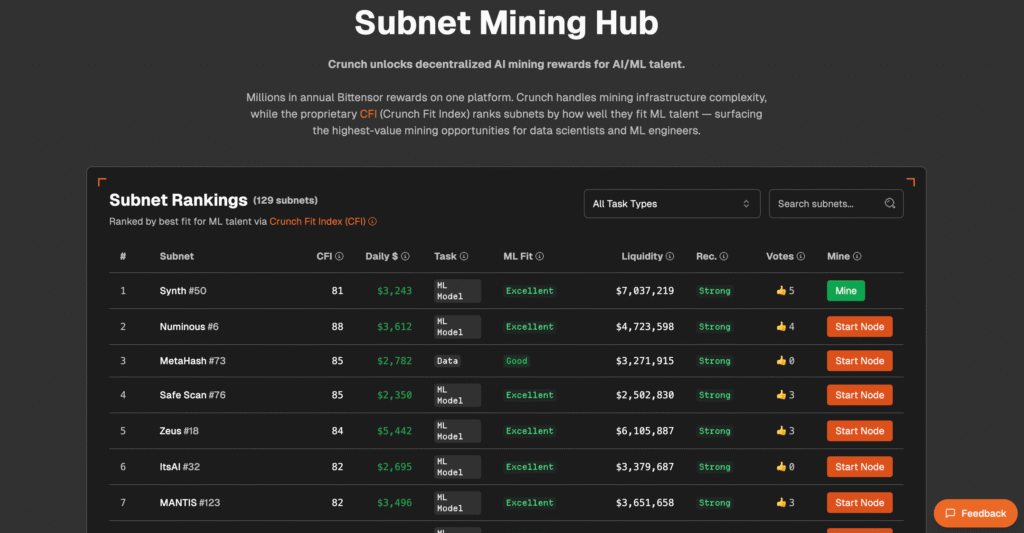

The Crunch Fit Score: Ranking Subnets by Human Mining Potential

Crunch also introduced a scoring system that helps contributors decide where they should mine. It includes factors like ML relevance, reward potential, and whether the subnet fits the skillset of human data scientists.

Jean made it clear this is not a judgment of subnet quality. It’s purely a “fit index” that answers one question: is this subnet a good target for Crunch’s talent pool?

The dashboard also estimates daily reward distribution in dollar terms, giving miners a clearer picture of where incentives are strongest.

How Crunch Pays Contributors Today

Right now, Crunch pays in USDC. Contributors get a wallet automatically created for them, and can withdraw whenever they want.

But Jean admitted this is only an early-stage solution. The long-term goal is more complex: keeping alignment between contributors and the networks they improve.

If Crunch simply converts all rewards into stablecoins, contributors lose exposure to subnet token upside. And many of these contributors aren’t crypto traders who will manually rebuy tokens.

Jean emphasized that alignment is critical. The future version of Crunch must support distributing subnet tokens directly, so contributors benefit from the long-term growth of the networks they help build.

Claude Skills: Mining From WhatsApp

An exciting announcement made during the interview was Crunch’s release of Claude Skills. This allows contributors to interact with Crunch using command-line tools, and eventually even through WhatsApp.

Jean described a future workflow where a data scientist can casually message Claude: “I want to mine Synth. Fetch the rules. Explain scoring. Suggest an approach. Code a model. Run tests. Submit.”

That changes everything. It removes the biggest bottleneck in machine learning work: the manual loop of debugging training runs, checking errors, restarting jobs, and losing hours to simple failures.

Jean believes this is how human productivity scales. Not by replacing humans, but by putting them in an “Iron Man suit” where machines do the repetitive work and humans provide the key insight.

The Bigger Question: What Is the Price of Intelligence?

Jean argued that humanity is entering a new era where intelligence becomes measurable and liquid. In the old world, intelligence was illiquid—you hired people, trained them, and hoped they produced value.

In Bittensor-style markets, intelligence is ranked, rewarded, and priced in real time. That means you can see clearly what is “noise” below benchmark and what is “signal” above benchmark.

And once signal becomes visible, it becomes monetizable.

Jean believes the most important question of the next decade is this: what is the price of the next unit of intelligence above benchmark? Whoever answers that will shape the future economy.

Vibe Mining and the Risk of Converging Into “Bitcoin Mode”

Mark also shared his personal vision: a self-sustaining AI miner that pays for its own compute in TAO, mines subnets automatically, converts rewards, and expands itself into a self-running profit engine.

Jean agreed this will likely happen, but warned about where it leads. If mining becomes fully automated and no human input is involved, the ecosystem may converge into a pure compute arms race. At that point, the winner is whoever has the most GPUs and the cheapest energy.

In other words: it becomes Bitcoin again.

Jean’s position was clear: without human input, the system collapses into pure power competition. With human input, it stays dynamic and innovation-driven.

Why Crunch Matters for the Entire Bittensor Ecosystem

The biggest takeaway from the interview is that Crunch is not just building another tool. It is building the missing onboarding layer for Bittensor.

Bittensor has always claimed it can attract the world’s best minds, but the reality is that most of those minds don’t touch crypto. Crunch is changing that by making mining accessible, structured, and familiar to ML professionals.

If it works, it could unlock a completely new growth phase for Bittensor: not just more capital, but a massive inflow of global intelligence.

And that may be the real moat.

Be the first to comment