For more than three years, artificial intelligence has dominated tech headlines. Since the launch of ChatGPT in late 2022, investors have searched relentlessly for the crypto equivalent of OpenAI or Google’s AI division.

The challenge is simple. There is no ChatGPT token, no Gemini coin, and no single, obvious way to invest directly in the infrastructure powering the AI boom.

That gap has pushed investors toward a crowded field of so-called AI cryptocurrencies, many of which struggle to differentiate themselves beyond narrative appeal. Yet within that noise, a small number of projects have begun to stand apart.

One of them is Bittensor.

The AI Coin Landscape is Smaller Than it Looks

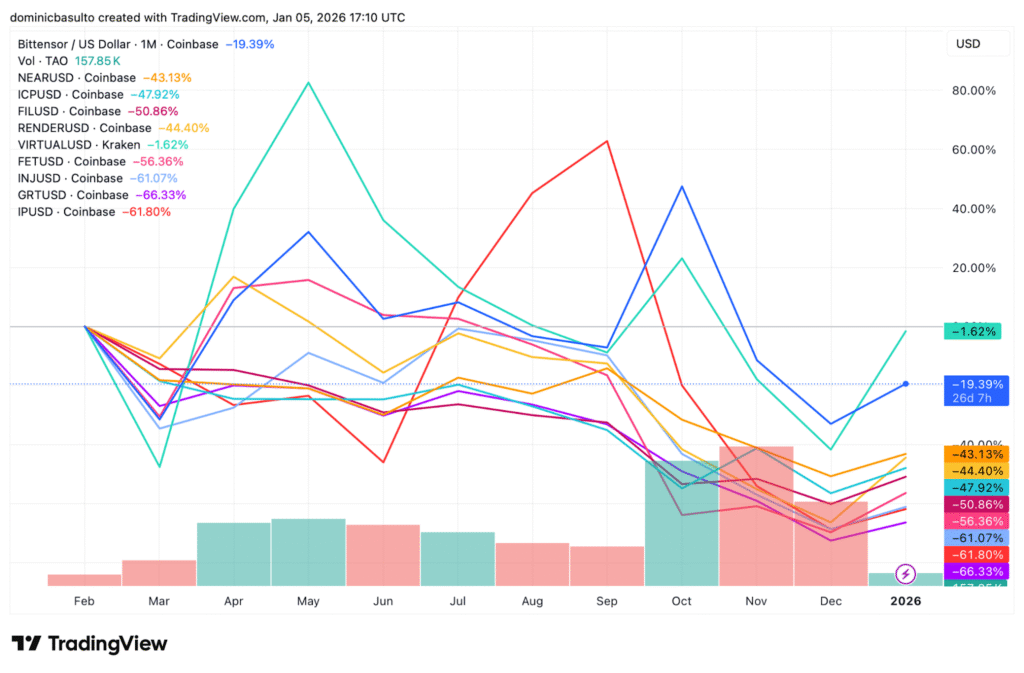

A glance at the performance of leading AI tokens over the past year paints a sobering picture. Most have underperformed sharply, with drawdowns exceeding 40%.

Against that backdrop, two projects have shown relative resilience:

a. Bittensor ($TAO)

b. Virtuals Protocol ($VIRTUAL)

While neither has been immune to volatility, both have held up meaningfully better than the broader AI token cohort. Bittensor, in particular, stands out not only for performance, but for accessibility, liquidity, and ecosystem depth.

What is Bittensor?

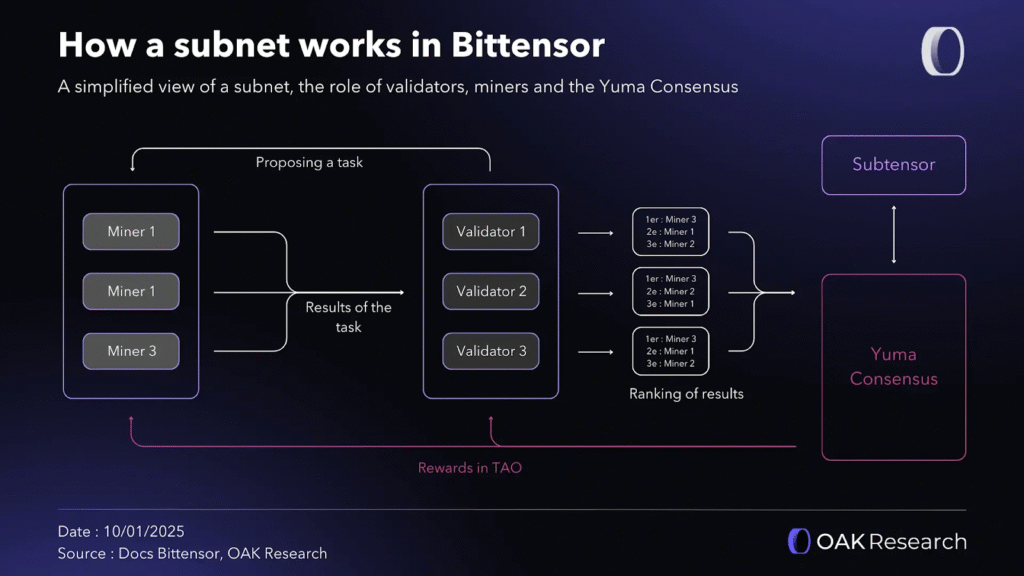

Bittensor is a decentralized, open-source network designed to coordinate, reward, and validate machine intelligence.

Instead of hosting a single AI model, Bittensor operates as a network of independent subnets. Each subnet focuses on a specific function, such as inference, training, data generation, or compute. Contributors are rewarded-based on the usefulness of the intelligence or resources they provide.

It’s on this mechanism that Bittensor turned AI development into a competitive, market-driven process.

Key characteristics include:

a. A decentralized architecture with no central model owner,

b. Permissionless participation for builders, miners, and researchers,

c. Incentives aligned around useful work rather than hype, and

d. A fixed maximum supply of 21 million $TAO coins.

That final point often draws comparisons to Bitcoin. Scarcity alone does not guarantee success, but it does shape long-term supply dynamics in a way many AI tokens ignore.

Why Bittensor Fits the AI Investment Thesis

The bull case for Bittensor is not about chasing the latest AI trend but about infrastructure. As demand for AI accelerates, three structural pressures continue to grow:

a. Centralization of compute and model access,

b. Rising costs for training and inference, and

c. Limited pathways for open, permissionless innovation.

Bittensor positions itself as an alternative to closed AI ecosystems. By remaining decentralized and open source, it allows experimentation that may not fit within the constraints of large corporations.

This openness has already attracted global participation. Researchers and builders from multiple regions, including China, are actively developing on Bittensor subnets. That geographic diversity matters in a world where AI progress is no longer confined to Silicon Valley.

If breakthroughs emerge from outside traditional AI power centers, platforms like Bittensor are structurally positioned to benefit.

Institutional Interest is Beginning to Form

The second major catalyst often cited by investors is institutional access. Earlier this year, reports surfaced around a planned Bittensor ETF (Exchange Traded Fund) from Grayscale. While regulatory approval is never guaranteed, the signal itself is notable.

An ETF would:

a. Lower the barrier to entry for traditional investors,

b. Enable exposure through standard brokerage accounts, and

c. Increase visibility among institutions and advisors.

More importantly, it would place Bittensor within a familiar financial wrapper, making it easier for cautious capital to engage with AI crypto infrastructure without managing wallets or private keys.

Even modest inflows could have an outsized impact given $TAO’s limited supply.

Can Bittensor Really Be a Long-Term Outlier?

No single cryptocurrency can guarantee life-changing returns, that framing often obscures more than it explains.

What can be said is this: Bittensor combines several traits rarely found together in AI tokens:

a. A real, working network with live economic activity,

b. A modular design that allows many AI use cases to coexist,

c. Scarcity that enforces discipline on supply growth, and

d. Early signs of institutional attention.

If AI continues to expand as a foundational technology, infrastructure layers that enable open participation may become increasingly valuable. Bittensor is one of the few projects explicitly designed around that premise.

Whether it ultimately delivers outsized returns will depend on execution, adoption, and the pace of AI innovation itself. But as far as AI-focused cryptocurrencies go, Bittensor is no longer just a speculative idea. It is an ecosystem worth watching closely.

Final Thoughts

The search for the definitive AI crypto often leads investors toward noise, not substance. Bittensor stands out not because it promises easy gains, but because it tackles a real coordination problem at the heart of AI development.

In a market full of tokens chasing attention, Bittensor is building infrastructure.

And in crypto, infrastructure is often where the longest lasting value is created.

Be the first to comment