Key Takeaways

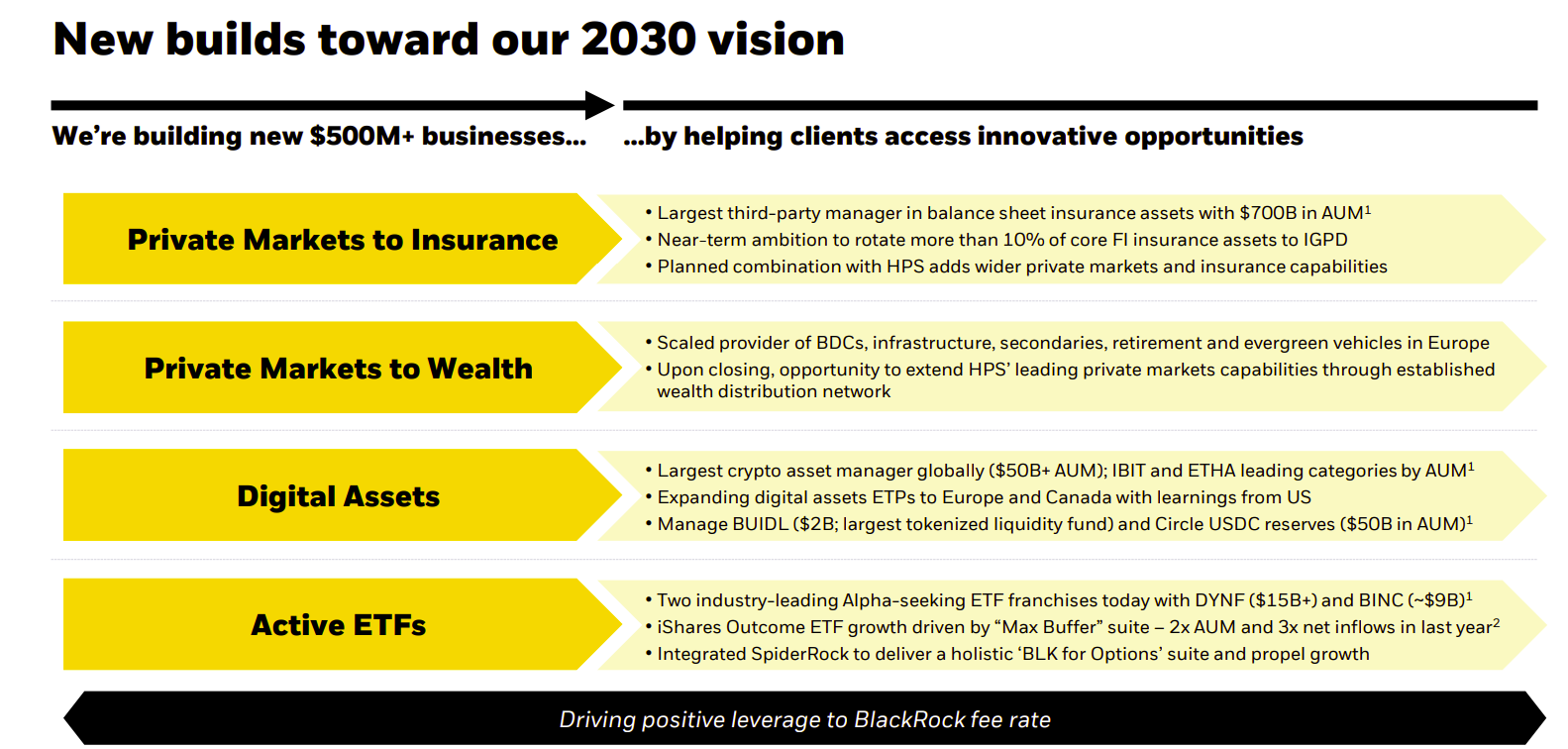

BlackRock plans to become the world’s largest crypto asset manager by 2030.

BlackRock’s digital asset offerings include Bitcoin and Ethereum ETFs leading in their categories.

Share this article

BlackRock is aiming to become the world’s dominant crypto asset manager by 2030, targeting at least $50 billion in assets under management (AUM) through its digital asset offerings, according to a Thursday presentation on its website.

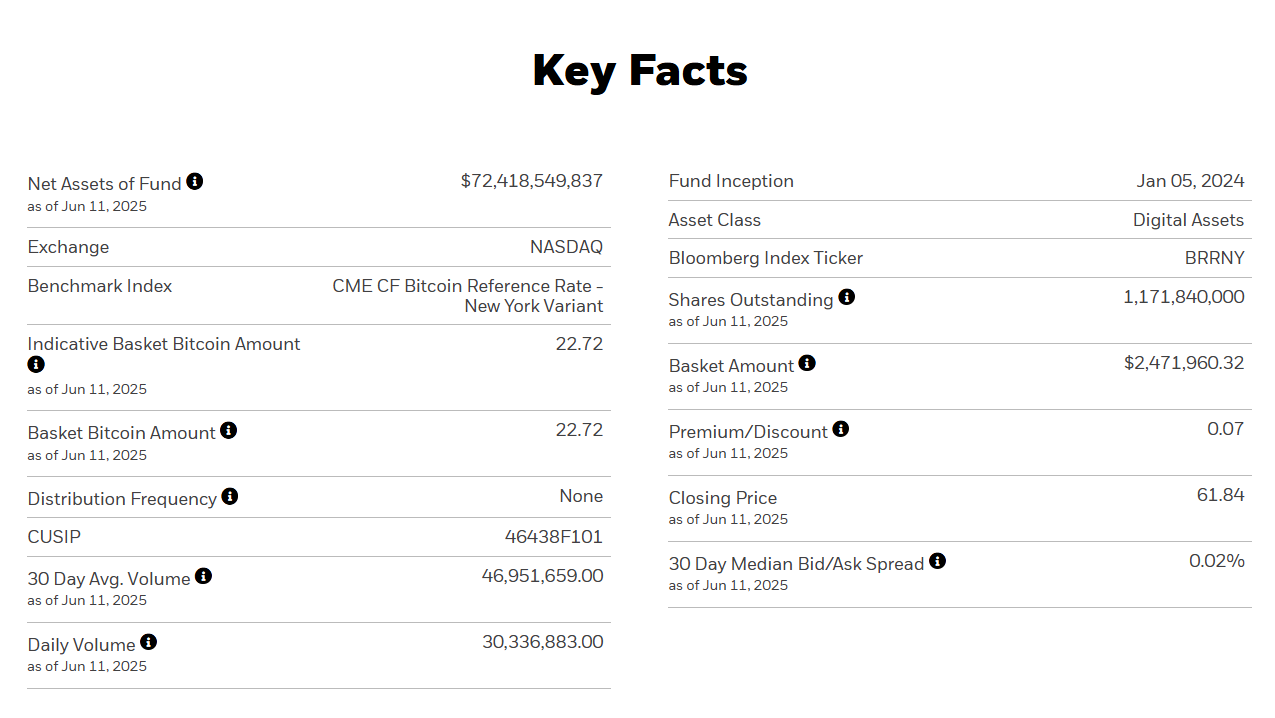

For its flagship crypto ETFs, the iShares Bitcoin Trust (IBIT) and iShares Ethereum Trust (ETHA), BlackRock’s goal is to lead their respective categories by AUM.

IBIT has already secured the top spot among spot Bitcoin ETFs, managing over $73 billion in assets as of June 11. ETHA also leads the spot Ethereum ETF group, with a $4.3 billion market cap, ahead of Grayscale’s ETHE.

On global expansion, the asset management giant targets to expand its digital asset exchange-traded products (ETPs) beyond the US into Europe and Canada.

Following its successful launch of IBIT in the US last year, BlackRock rolled out its first Bitcoin ETP in Europe in March 2025. The fund trades under the ticker IB1T on major European exchanges, including Xetra, Euronext Paris, and Euronext Amsterdam.

The fund is BlackRock’s first crypto-linked ETP outside North America. In addition to this, BlackRock offers the iShares Bitcoin ETF on Cboe Canada.

In the tokenization space, BlackRock’s BUIDL fund remains central to the firm’s long-term digital asset strategy

According to rwa.xyz, BUIDL leads the tokenized US Treasury market with approximately $3 billion in assets as of June 11.

Share this article

Be the first to comment