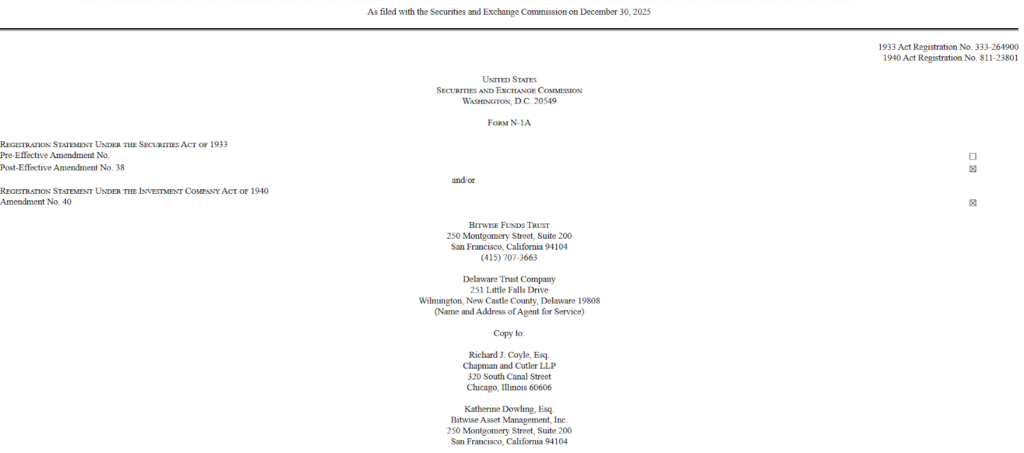

Institutional adoption rarely arrives with announcements or narratives, it arrives through official filings.

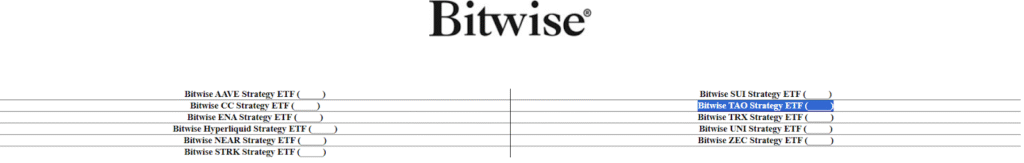

Bitwise submitted applications to the U.S. SEC (Securities and Exchange Commission) to launch 11 single-asset cryptocurrency strategy ETFs (Exchange-Traded Funds). This move reflects a broader effort to widen regulated access to digital assets beyond Bitcoin and Ethereum, while maintaining structures that institutional investors already understand.

Among the proposed products is a strategy ETF tracking Bittensor’s $TAO. Its inclusion places decentralized intelligence alongside some established crypto assets currently seeking regulated exposure.

What Bitwise Filed

The applications were submitted through Form N-1A and outline a family of strategy ETFs that follow a consistent framework across all assets.

Each fund would be able to:

a. Invest up to 60% of assets directly in the underlying token,

b. Allocate at least 40% to ETPs (Exchange-Traded Products) linked to the same asset, and

c. Use derivatives such as futures or swaps to manage exposure.

Unlike spot ETFs, these vehicles combine direct holdings with indirect exposure through regulated products. The structure allows Bitwise to offer targeted access to individual assets while operating within established regulatory boundaries.

Asides Bittensor ($TAO), the proposed lineup covers other key crypto-ecosystems like Aave, Ethena, Sui, Tron, Uniswap, and Zcash.

Why Bittensor is Not Just Another Addition

Bittensor ($TAO) occupies a distinct position within the crypto landscape. Rather than merely supporting payments, governance, or application usage, $TAO secures a decentralized network where machine learning models compete for rewards based on measurable performance.

Here, the capital is allocated to intelligence itself, enforced at the protocol level.

For institutional investors, this distinction matters. $TAO represents exposure to decentralized AI infrastructure rather than application level speculation. Its inclusion in a regulated ETF framework suggests that Bitwise views decentralized intelligence as an emerging asset class rather than a peripheral experiment.

This filing also follows Grayscale’s recent S-1 submission to convert its Bittensor trust into a spot ETP, reinforcing the sense that $TAO is entering a phase of broader institutional evaluation.

Bitwise’s Broader Strategy

Bitwise is not approaching this expansion cautiously. The firm manages more than $15 billion in client assets and operates a wide range of crypto investment products across ETFs, private funds, staking strategies, and managed accounts.

Following the success of spot Bitcoin and Ethereum ETFs, Bitwise has steadily extended regulated access to additional assets, including Solana ($SOL), $XRP, and Dogecoin ($DOGE). The newly filed strategy ETFs go further by offering single asset exposure across multiple crypto sectors under a unified structure.

Placing Bittensor alongside established Layer-1 networks and major DeFi protocols signals that decentralized AI infrastructure is now being evaluated on similar footing.

What a TAO Strategy ETF Enables

If approved, a Bitwise $TAO Strategy ETF would provide institutional investors with regulated exposure to Bittensor without requiring direct custody or interaction with crypto exchanges.

This structure allows for:

a. Allocation through traditional brokerage accounts,

b. Compatibility with advisory and institutional platforms, and

c. Exposure to decentralized AI infrastructure under SEC reporting standards.

For many investors, these vehicles serve as the first practical step toward engaging with new asset categories.

A Wider Shift in Motion

The Bitwise filing arrives during a period of increased ETF activity across crypto markets. Issuers are actively seeking approval for products tied to Solana, XRP, Avalanche, and other major networks.

What differentiates Bittensor is its role. $TAO is not only positioned as a consumer asset or financial application token, it is an infrastructure for decentralized intelligence.

That distinction aligns closely with how Bitcoin and Ethereum first entered institutional portfolios.

Closing Perspective

The approval process remains uncertain, and these filings may evolve. But the direction is clear.

Bitwise did not include Bittensor by default or mistake, it included it because decentralized AI has reached a point where regulated exposure is both feasible and, increasingly, necessary for institutional portfolios.

$TAO is being evaluated not as a trend, but as an infrastructure. That shift tends to happen quietly, starting with paperwork.

Be the first to comment