By: Andy

There is a growing disconnect in how people talk about Bittensor ($TAO). Crypto audiences see another token, AI audiences see a niche experiment, economists mostly see nothing at all and each group is missing the same thing.

Bittensor is not a speculative asset story: It is not a short-term narrative, not even primarily a crypto story.

It is a shift that has been predicted for nearly a century, which is now technically possible for the first time, and is already unfolding in real-time.

This article was curated, from a masterpiece crafted by Andy ττ, to explain why Bittensor ($TAO) represents a fundamental economic shift, solving the AI “calculation problem” by replacing centralized planning with decentralized market coordination.

The Economic Question That Changed Everything

In 1937, economist Ronald Coase asked a question so simple it had never been asked before: Why do firms exist?

His answer reshaped economic thinking, he noted that firms exist because markets are not free (Meaning they carry transaction and coordination costs. When it is cheaper to organize activity internally than to transact openly, firms replace markets.

But Coase also made the inverse point: When transaction costs fall, markets replace firms.

This single idea explains many of the biggest structural shifts in history:

a. The telegraph collapsed communication costs and enabled national corporations.

b. The internet collapsed information costs and dismantled centralized media, retail, and software monopolies.

c. Open protocols replaced closed systems because coordination became cheap.

Each time, the same pattern repeated. When coordination costs dropped, centralized control lost its advantage.

AI is now at that same inflection point.

Why Centralized AI is Economically Fragile

Modern AI development is dominated by centralized firms. OpenAI, Google, Anthropic, and a handful of others decide what models get built, how compute is allocated, and which use cases receive attention. They set prices, control access, and govern innovation internally.

This structure feels natural today, but economics tells us it is unstable.

In 1920, Ludwig von Mises described the calculation problem. He opined that without real market prices, centralized planners cannot efficiently allocate resources. They simply guess.

In 1945, Friedrich Hayek expanded on this. He noted that knowledge is distributed across millions of actors and no central authority can aggregate it effectively. Only markets can.

This is not ideology; it is an observed reality.

All centralized AI firms face the same problem, like:

a. Which models deserve more compute

b. Which use cases create real value

c. Where capital should be deployed next

Without price signals, these decisions rely on delayed feedback, internal metrics, and executive judgment. That is not optimization, it’s estimation, and it becomes more expensive at scale.

Bittensor Solves the AI Calculation Problem

Bittensor takes a different approach. Instead of central planning, it uses market coordination.

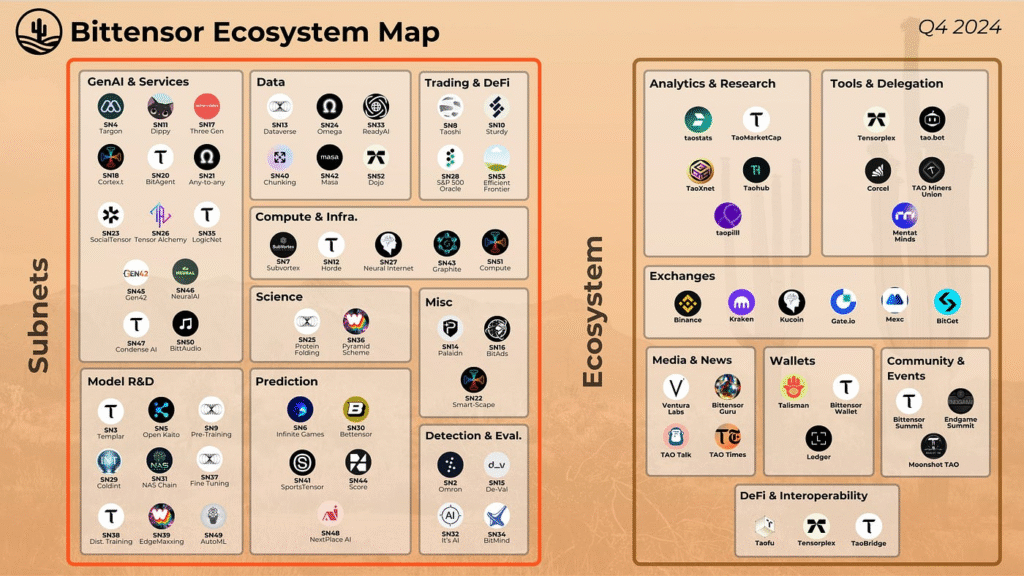

Each subnet represents a specialized AI service. Each has its own token price, market capitalization, and incentive structure. These prices act as real-time signals.

They communicate information that centralized systems cannot access, information like:

a. Which models are valuable

b. Which approaches deserve more resources

c. Which ideas should scale and which should disappear

Capital flows toward productive subnets while underperforming ones lose relevance. This is not theoretical, it is the calculation problem being solved in practice.

Centralized AI firms do not have this feedback loop, Bittensor does.

Why $TAO is Not Just Another Crypto Asset

$TAO is often grouped with other digital assets, but that framing misses its function. Bitcoin is a monetary asset, its value reflects adoption and liquidity cycles. Several DeFi (Decentralized Finance) tokens represent financial infrastructure tied to capital flows but $TAO coordinates a decentralized AI marketplace.

$TAO’s value is linked to productive output like:

a. Real AI services,

b. Real users, and

c. Real revenue.

$TAO is not competing for speculative crypto capital, and it is competing for share of the global AI market.

That distinction is all that matters.

The Market Most People are Ignoring

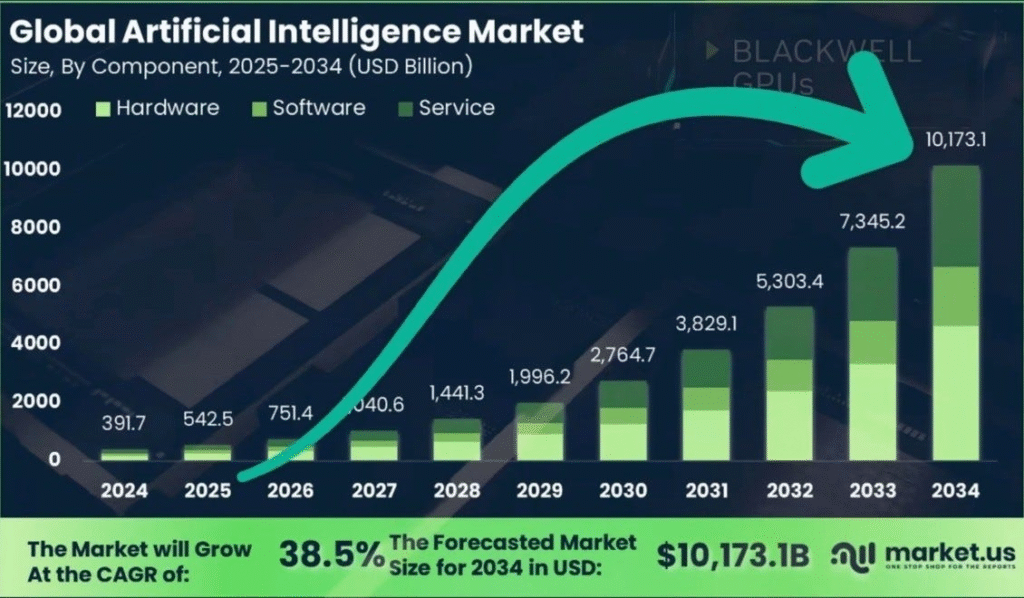

The global AI market in 2025 is already massive:

a. Cloud AI services exceed $100 billion,

b. Enterprise AI software continues to expand rapidly

c. Hardware, inference, and consulting add tens of billions more

By the end of the decade, annual AI revenue is projected to exceed $1 trillion. Bittensor’s current share of this market is tiny and that is precisely the point.

This is not a saturated opportunity and Bittensor is an early infrastructure layer.

Why Decentralized AI Has Structural Advantages

Centralized AI becomes more expensive as it scales. Training costs increase sharply, inference remains costly, and profitability requires pricing power and user lock in.

Decentralized AI distributes these costs:

a. Training is shared across participants,

b. Inference pricing trends toward marginal cost, and

c. Competition drives efficiency.

This advantage is economic, not technological. Distributed cost structures outperform centralized ones over time with history consistently confirming this.

Historical Parallels are Hard to Ignore

The internet followed this exact pattern.

In the early days, walled gardens were expected to win. They were curated, centralized, and easier to manage.

Open protocols looked messy and inefficient, yet, they scaled better, innovated faster, and absorbed demand that closed systems could not.

AI is entering the same phase, centralized AI resembles early closed networks and Bittensor resembles the open protocol layer that eventually replaces them.

Why This is Still Mispriced

Three groups fail to see the full picture. Crypto participants focus on short-term price action, AI practitioners focus narrowly on model performance and economists often ignore crypto entirely as irrelevant noise.

Bittensor sits at the intersection of all three. Until those perspectives converge, mispricing persists.

What The Evidence Already Shows

This is not a future promise. Bittensor already hosts more than 100 live subnets.

Several generate meaningful revenue from real customers, and performance benchmarks show competitive or superior results in specific domains.

This is infrastructure in motion, not just a whitepaper.

The Broader Implication

AI is not just software, it’s intelligence at scale. Who controls intelligence controls innovation, productivity, and strategic power. While centralized control leads to rent extraction and fragility, decentralized markets lead to resilience, efficiency, and broad access.

This is not abstract philosophy: it is how systems behave when coordination costs collapse.

Why Awareness Comes Late

Transformational technologies follow a pattern. First they are ignored, then they are dismissed, then they are debated, finally, they become obvious in hindsight.

Bittensor is still early in that arc. Markets tend to recognize structural shifts slowly, then all at once.

Closing Thoughts

This is not about hype or short-term price action, it is about incentives.

Markets outperform central planning, open systems outperform closed ones, and price signals outperform committees.

Those truths have held for decades, AI coordination costs have now fallen dramatically and, then, the economic consequences are already unfolding.

Bittensor represents that shift in real-time. While most people are not looking for it yet, history suggests they eventually will.

And when they do, the question will not be what happened. It will be who understood it early enough to recognize what was actually being built.

Be the first to comment