When a major regional exchange lists a token, the move is rarely about symbolism. It is about access, and access, in crypto markets, is liquidity.

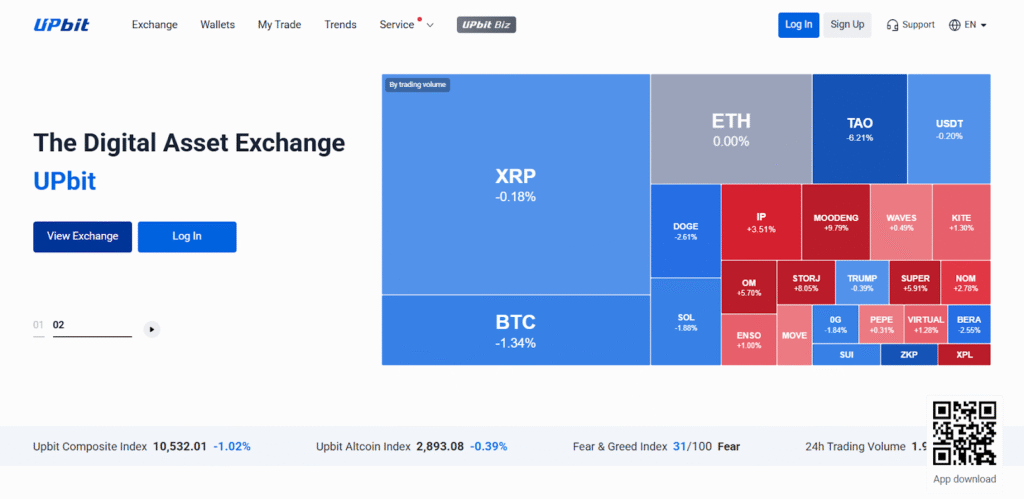

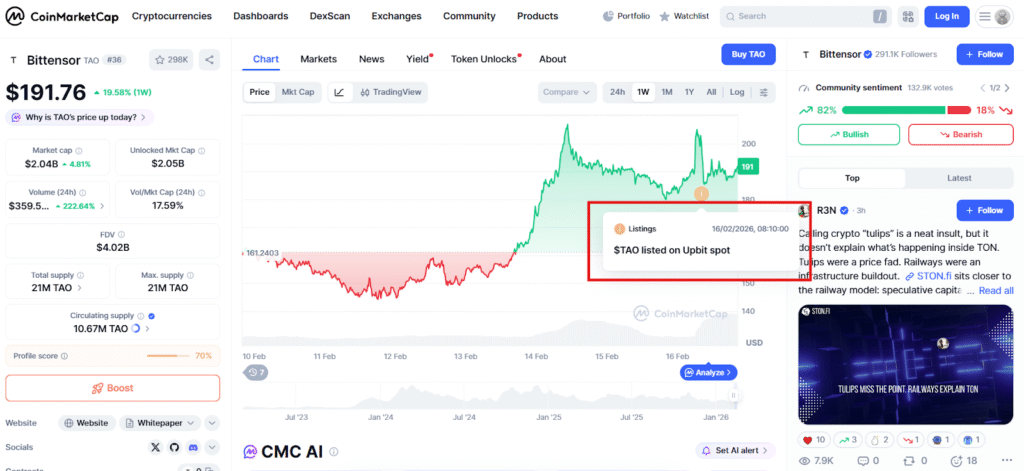

Bittensor’s native token, $TAO, surged nearly 8% within hours after South Korea’s largest cryptocurrency exchange, Upbit, announced new trading pairs. What followed was not just a price spike, it was a textbook liquidity shock that rippled across global venues.

The episode offers a clear look into how modern crypto markets reprice assets when new capital corridors open.

The Catalyst: A New Fiat Gateway

Upbit confirmed it would list $TAO with trading pairs against:

a. $KRW (South Korean Won),

b. $BTC (Bitcoin), and

c. $USD₮ (Tether).

Trading was scheduled for 16:00 KST (Korea Standard Time) on February 16, 2026

The immediate market reaction was decisive. $TAO rose approximately 7.8%, briefly becoming one of the strongest performers among major cryptocurrencies.

Why the speed?

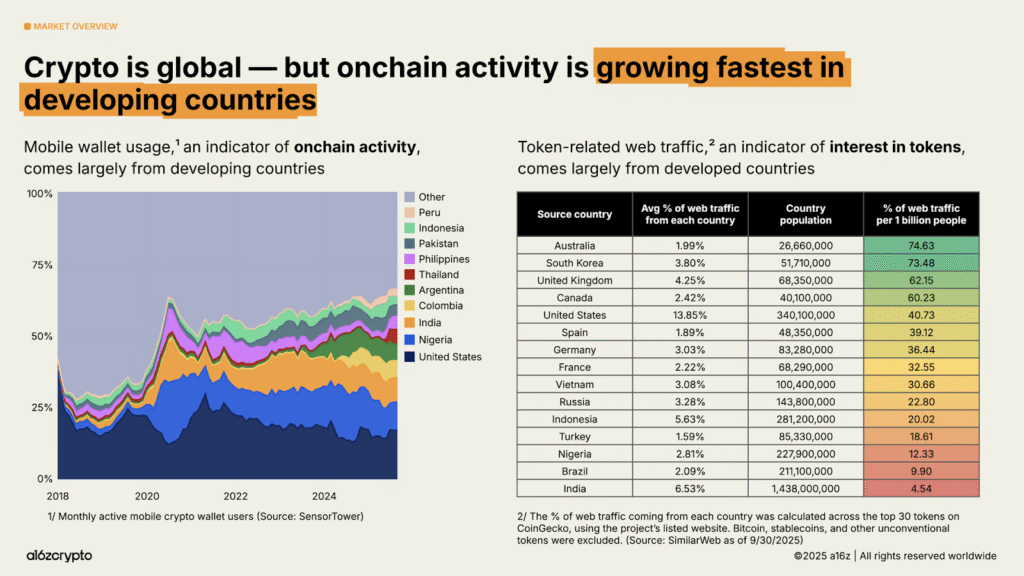

Because $KRW pairs matter. South Korea remains one of the most active retail crypto markets in the world, and Upbit commands dominant local market share.

When a token gains direct Korean Won access, three structural forces activate simultaneously:

a. New Fiat On-Ramp Access: Local traders no longer need cross-exchange routing or stablecoin bridges.

b. Media Amplification: Regional coverage increases visibility beyond crypto-native channels.

c. Anticipatory Positioning: Traders front-run expected inflows before trading even begins.

This compresses latent demand into a narrow time window. This pattern $TAO’s moved towards precisely.

The Liquidity Transmission Mechanism

The rally did not remain isolated to one venue. Shortly after the listing announcement, volume and volatility increased on major global exchanges, including Binance and Coinbase.

This is where market structure becomes important.

When a token lists on a new exchange:

a. If it trades at a premium on the newly listed venue,

b. Arbitrageurs buy on cheaper exchanges,

c. They sell into higher-priced markets,

d. Price spreads tighten, and

e. Volume spikes across all venues.

In $TAO’s case, the initial demand impulse on Upbit triggered a synchronized repricing elsewhere. Arbitrage activity ensured global price convergence, while momentum traders amplified the move once $TAO surfaced on top-gainer dashboards.

What began as a regional announcement became a multi-exchange repricing event within minutes.

This is modern crypto liquidity in action.

Why $TAO Was Positioned to Respond

Exchange listings do not produce equal outcomes for all assets.

Some tokens spike briefly and retrace. Others absorb new demand more effectively because the narrative environment is already supportive.

Bittensor sits at the intersection of two powerful themes:

1. AI Infrastructure Exposure

Bittensor is widely framed as a decentralized coordination layer for artificial intelligence models. With AI remaining a dominant macro and crypto narrative, tokens perceived as “infrastructure” rather than “application layer” tend to attract structural interest.

That positioning increases sensitivity to positive catalysts.

2. Decentralization Signaling

Ongoing ecosystem discussions around governance evolution and deeper decentralization reinforce Bittensor’s alignment with crypto’s foundational ethos: reducing central points of control.

Narratives do not create liquidity events on their own, but they determine how aggressively markets respond when catalysts appear.

In $TAO’s case, the groundwork was already laid.

A Clean Market Sequence

The repricing followed a logical chain:

a. Upbit listing announcement,

b. Immediate demand shock,

c. Cross-exchange arbitrage activation,

d. Elevated global volume,

e. Momentum participation, and

f. Short-term volatility expansion.

The primary driver was the listing, the amplification came from market structure.

What This Event Reveals

$TAO’s 8% surge highlights three enduring truths about crypto markets:

a. Exchange access remains a powerful catalyst,

b. Regional liquidity corridors can drive global repricing, and

c. Narrative alignment determines magnitude of response.

In interconnected markets, price discovery does not remain local. A liquidity expansion in Seoul can cascade through New York and Singapore within minutes.

That dynamic was on full display here.

Final Perspective: Listings Are About Flow, Not Hype

It is tempting to interpret exchange listings as validation events. But structurally, they are flow events.

They alter:

a. Who can access the asset,

b. How easily capital can rotate into it, and

c. How quickly prices can adjust.

$TAO’s rally was not simply enthusiasm, it was the market reacting to an expanded liquidity surface.

Whether the move sustains will depend on broader conditions and continued ecosystem development. But as a case study in how modern crypto markets process new access, the signal was clear.

When access expands, equilibrium resets. And sometimes, that reset happens in hours (or even minutes!), not weeks.

Be the first to comment