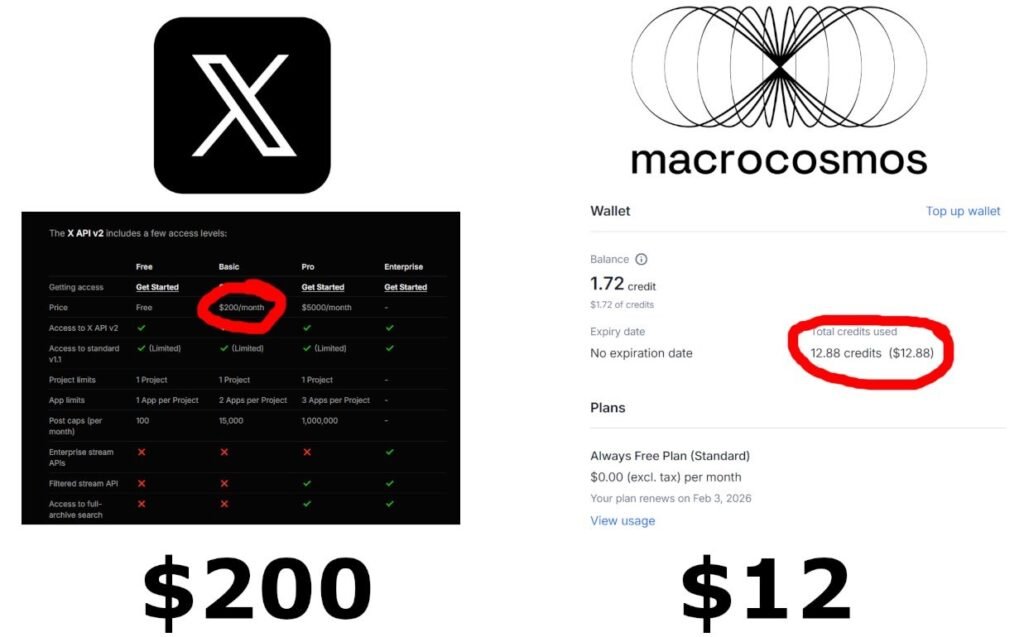

A Bittensor community member just proved something important about decentralized networks. They needed Twitter data for a dashboard tracking subnet activity. Using X’s Basic API would cost $200 per month. Using Bittensor’s Subnet 13, they spent $12.88 for the entire month.

That’s 94% cheaper for the same data.

TAOTemplar posted screenshots on January 10, 2026, showing the exact costs. On one side, X’s pricing page with the $200 Basic plan circled. On the other side, their Macrocosmos wallet showing $12.88 in credits used. The data powers a public dashboard on taoflute.com that tracks which Bittensor subnets are active on Twitter.

Why Centralized Data Is So Expensive

To understand why this matters, you need to understand how centralized platforms treat data access.

Twitter charges $200 monthly for their Basic API tier. What do you get? Access to search recent posts, capped at 15,000 posts per month. No full archive search. No enterprise streaming. Rate limits that can block you if you hit them. And X can change the rules, raise prices, or cut you off whenever they want.

Need more? The Pro tier costs $5,000 monthly. Enterprise pricing starts even higher. These aren’t small side businesses charging these rates. These are the baseline costs for accessing data that users create and post publicly.

The logic behind these prices is simple. X controls access. They own the platform where the data lives. They can charge whatever they want because they’re the only option. You either pay or you don’t get access. It’s a monopoly extracting maximum value from anyone who needs the data.

For small developers, researchers, or projects like Bittensor tracking tools, these costs are prohibitive. Spend $200 monthly just to check if subnets have posted recently? That’s not sustainable for community projects or individual developers.

How Subnet 13 Works Differently

Bittensor’s Subnet 13, called Data Universe and built by Macrocosmos, operates on completely different principles.

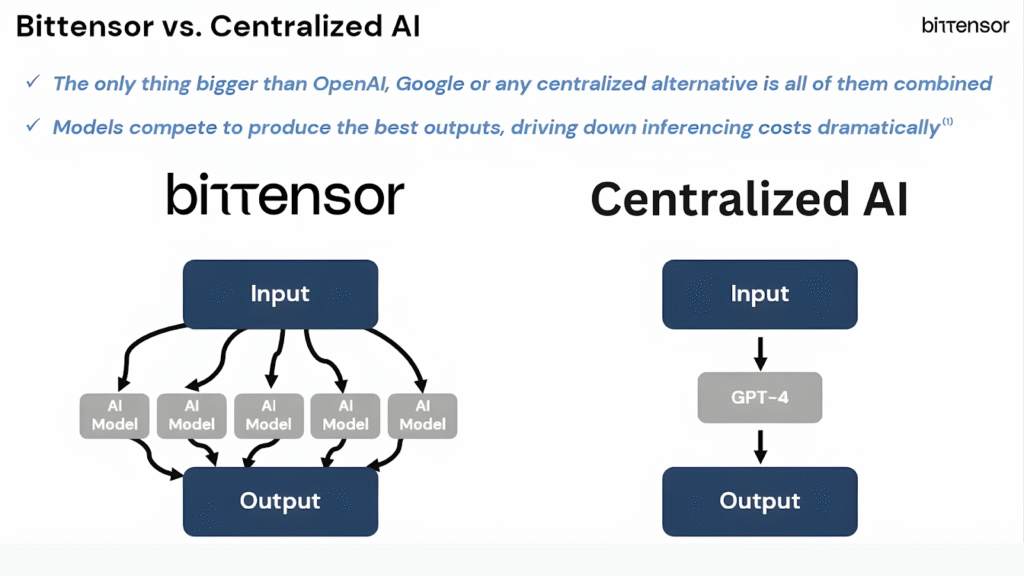

Instead of one company controlling access, thousands of independent miners around the world scrape data from Twitter, Reddit, YouTube, and other platforms. They don’t ask permission from the platforms, they just collect publicly available information the way anyone with a browser could.

These miners compete to provide the best data. Validators on the network check quality, freshness, and relevance. Good miners earn TAO token rewards. Bad miners earn nothing and drop out. The system naturally selects for quality without needing a central authority deciding what’s acceptable.

When someone wants data, they request it through tools like Gravity, Macrocosmos’s API. Miners who have that data or can quickly get it respond. The requester pays a small amount based on what they actually use. No monthly minimums. No arbitrary caps. Just pay for the data you consume.

The costs are dramatically lower because there’s no massive company overhead. No executives taking salaries. No shareholders demanding dividends. No expensive offices in San Francisco. Just miners running computers, getting paid fairly for the data they provide.

Why Quality Doesn’t Suffer

You might think cheaper means worse quality. It doesn’t, because of how the incentive system works and how it ensures competition drives quality up.

Miners get scored by validators on data freshness (recent tweets count more than old ones), accuracy (wrong data gets penalized), and completeness (missing information drops your score). Miners with consistently high scores earn more rewards. Miners with low scores earn nothing.

This creates constant competition to provide better data. Unlike X’s API where you get whatever X decides to give you at whatever quality level they maintain, Subnet 13 miners actively compete to be better than each other. If one miner is slow or unreliable, validators route requests to better miners. The bad ones drop out naturally.

The network has already scraped over 55 billion posts across platforms. That’s not a small test. It’s an enterprise-scale operation happening through decentralized coordination.

What This Proves

TAOTemplar’s use case is perfect for showing how this works in practice. They needed to track whether Bittensor subnets are active on Twitter. Each subnet lists their Twitter handle in their GitHub repository. The dashboard pulls recent activity from those handles to show which subnets are posting regularly.

Using X’s API, this would require searching for posts from multiple accounts, checking activity timestamps, and updating regularly. With the 15,000 post cap on the Basic tier and the way API calls count against limits, you’d easily burn through that monthly allowance. Cost: $200 minimum.

Using Subnet 13, miners handle the scraping. The data flows into the dashboard through Macrocosmos’s infrastructure. TAOTemplar pays only for the actual data used. Total cost for the month: $12.88.

Same functionality. Same reliability. For a fraction of the price.

This pattern repeats across Bittensor. Chutes offers AI compute for 95% less than AWS. Ridges provides coding assistance that beats Anthropic’s Claude on benchmarks for a fraction of the cost. Remove the centralized middleman extracting profit, distribute work to competing providers, and costs plummet while quality stays high or improves.

What Happens Next

As more people discover these cost differences, adoption naturally follows. Why pay $200 when $12 does the same job? The centralized platforms will either need to drop prices dramatically or accept that decentralized alternatives will eat their market share. They’ve built business models on monopoly pricing. When the monopoly breaks, the business models break too.

For developers, researchers, and small businesses, this opens up projects that weren’t economically viable before. Study social media trends, analyze information spread, track public discourse, all possible on limited budgets.

For Bittensor, cases like this validate the entire thesis. Decentralized AI infrastructure isn’t just possible, it’s cheaper and increasingly just as good or better than centralized alternatives. Each subnet that proves this attracts more users, more miners, more validators, and more value to the TAO token.The data monopolies are breaking. What replaces them isn’t another monopoly—it’s thousands of independent miners competing to provide better service at lower costs. That’s not just cheaper. It’s better for everyone except the companies that used to control access.

Be the first to comment