The Bittensor Revenue Search show, hosted by Mark Creaser and Siam Kidd, returned for another highly anticipated episode 35 featuring Sam, the founder of Subnet 10 — one of Bittensor’s most practical and fast-growing subnets.

While the episode began with news around subnet acquisitions and transparency in the Bittensor community, it quickly turned into a deep dive into how Swap (Subnet 10) is solving one of Bittensor’s biggest challenges: making it simple for users to seamlessly interact with $TAO and $ALPHA.

The Challenge: Onboarding New Users to Bittensor

For most newcomers, buying and staking on Bittensor can be overwhelming. Setting up a wallet, securing a mnemonic phrase, and bridging $TAO across networks often takes hours — even for crypto-savvy users.

Sam described the issue clearly:

“The first time you bought Alpha tokens was probably pretty challenging. Even experienced crypto users need to download a new wallet, manage a mnemonic, and find a way to get $TAO. It’s a long process — and that’s the problem we wanted to fix.”

Swap’s mission is to streamline that process — to make entering the Bittensor ecosystem as easy as a single click.

The Solution: Seamless Cross-Chain Swaps

Subnet 10’s Swap protocol enables users to purchase $ALPHA (Subnet tokens) directly from familiar wallets like MetaMask, without needing to set up a separate Bittensor wallet.

Here’s how it works:

1. Users select the token they want to swap (e.g., $ETH) and the token (e.g., $ALPHA) they want to receive.

2. In the backend, the $ETH is swapped to $USDC, which is bridged to Bittensor EVM using Hyperlane.

3. $USDC is then swapped for $TAO via Swap’s liquidity pool.

4. Finally, that $TAO is staked for $ALPHA automatically — all from within MetaMask.

As Sam explained:

“What’s really beautiful about this process is that it doesn’t require a new wallet or $TAO for gas. Everything happens in one transaction, controlled from your MetaMask.”

By tapping into the Bittensor liquidity pools, users also benefit from deep liquidity and minimal slippage, making large trades more efficient.

Security and Simplicity First

Bridge hacks have historically been a major concern in crypto. To address this, Swap’s architecture avoids creating wrapped or synthetic assets.

“Instead of holding wrapped tokens, users hold the real $ALPHA — controlled from another chain through smart contracts,” Sam said.

All of Swap’s smart contracts are audited and open-source, using Hyperlane’s interchain accounts for cross-chain operations. This makes the system lighter, more secure, and less vulnerable than custom bridge contracts.

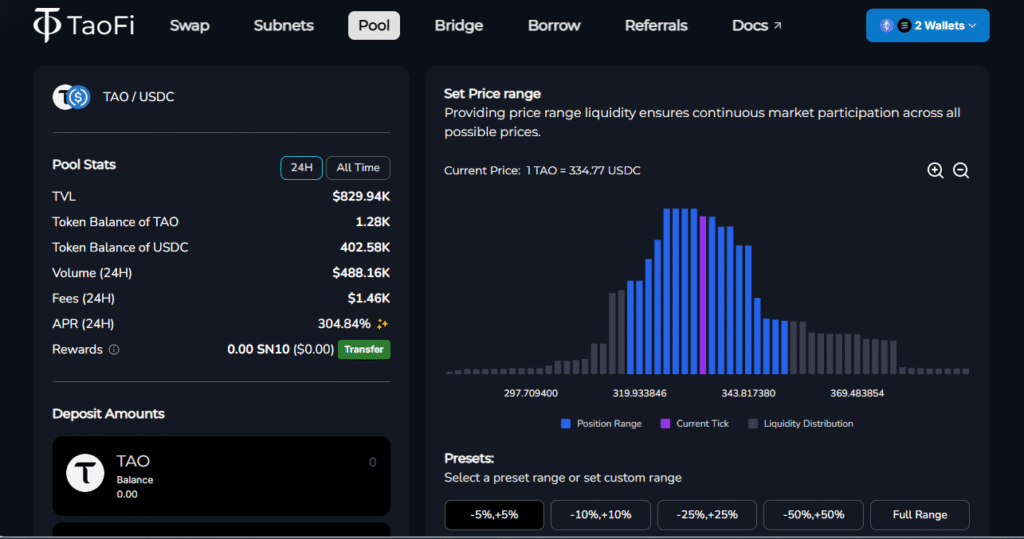

TAO-USDC’s Role: Powering Liquidity

At the core of TaoFi is its TAO-USDC pool Liquidity providers (LPs) deposit $TAO, $USDC, or both — and automatically earn:

1. Trading fees from swaps

2. Subnet 10 token emissions (Subnet 10’s $ALPHA)

Unlike many DeFi systems, users don’t need to manually register as miners. Simply providing liquidity automatically mines Subnet 10’s Alpha token — an innovative design that merges staking, liquidity provision, and mining into one seamless experience.

With liquidity providers were earning APYs of up to 400%, driven by growing trading volumes and Subnet 10 emissions.

Rapid Growth and Real Revenue

Subnet 10 has quietly become one of the most commercially active parts of the Bittensor ecosystem.

1. Daily volume: $1–2 million

2. Monthly volume: On track for $50 million this month (up from $30 million last month)

3. Monthly fees: ~$150,000 in total trading fees

4. Buybacks: 25% of all trading fees are used to buy SN10 tokens

That buyback mechanism directly supports token value and ensures that subnet activity drives real, on-chain utility.

“We’re diverting 25% of all fees to a smart contract that automatically buys SN10 tokens. It’s transparent, verifiable, and designed to strengthen the subnet economy,” Sam explained.

Bringing Liquidity and Users into Bittensor

For hosts Mark and Sam, Swap’s value was clear: it lowers the barrier for new liquidity to flow into the Bittensor network.

“It’s a backdoor into Bittensor,” Mark summarized. “Users can just attach their regular wallet and invest in subnets without needing to figure everything out.”

That simplicity is key to attracting new investors from the wider crypto world — not just existing Bittensor holders.

Team, Operations, and Profitability

Subnet 10 operates under a small but dedicated five-person team. TaoFi manages Swap as its core product, alongside other DeFi tools such as lending and borrowing protocols (though these are separate from Subnet 10).

Currently, all of the subnet’s trading revenue is being reinvested into token buybacks rather than team profit, with the goal of long-term sustainability.

“There are no gimmicks,” Sam said. “All fees collected go directly into SN10 through a smart contract — not through manual allocation.”

Integrations and Expansion

So far, Swap operates primarily on Base, but expansion to Ethereum Mainnet and Solana is underway. The team’s vision is to become the default backend for Alpha and TAO trading — powering swaps across all major wallets, DEXs, and interfaces.

“We don’t want to be the only front-end,” Sam emphasized. “We want to power every front-end — every wallet, every DEX, every trading terminal.”

The Road Ahead

Looking forward, Sam hinted at ongoing research into optimizing $ALPHA emissions to reduce network-wide sell pressure — echoing broader tokenomic discussions happening across Bittensor.

He also shared his excitement about the future:

“Our goal is to make buying $ALPHA as simple as buying any ERC-20 token — and to bring millions of new users into Bittensor in the process.”With growing volume, strong incentives, and a focus on real-world usability, Subnet 10 (Swap) is emerging as a critical bridge between traditional DeFi users and the decentralized AI economy that Bittensor represents.

Be the first to comment