Bittensor just recorded a major milestone. The network’s native coin $TAO jumped more than 20% percent after Safello, a European company, introduced its first staked $TAO ETP (Exchange Traded Product). The move signals growing institutional interest in decentralized AI assets and arrives during a period of rising anticipation ahead of the upcoming Bittensor halving.

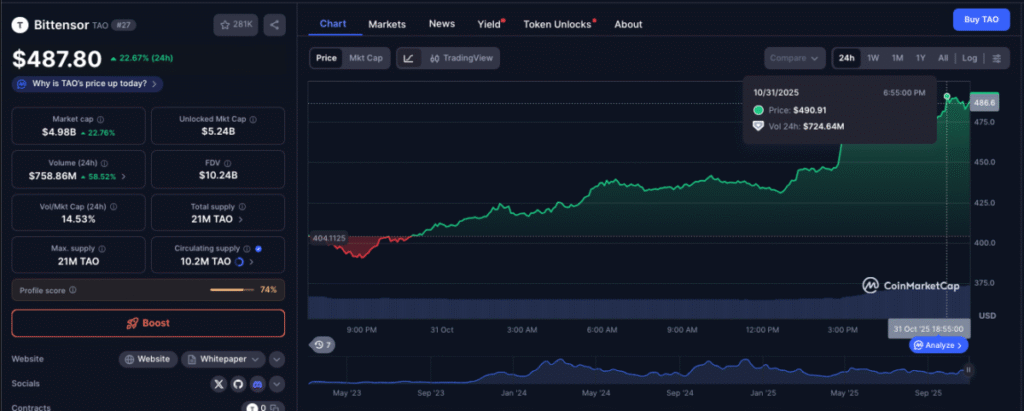

On Friday, $TAO climbed from $414 to $545, following the launch of the Safello Bittensor Staked TAO ETP on the SIX Swiss Exchange.

Created by Safello in partnership with Deutsche Digital Assets, the product gives regulated European investors access to $TAO while allowing them to earn staking rewards through the underlying asset pool. Tokens are held in cold storage, and staking yields are automatically reinvested, presenting a traditional investment wrapper for a rapidly growing AI economy.

This development positions Bittensor alongside a select group of digital networks with institutional-grade products. It also strengthens its reputation as a foundational layer for decentralized intelligence markets. With the rally, $TAO moved into the top thirty cryptocurrencies by market value, now approaching $5 billion.

At the same time, traders are looking ahead to the Bittensor halving, expected in about six weeks. The event will cut mining emissions in half, reducing issued rewards from 7,200 $TAO per day to 3,600 $TAO. This scheduled drop in supply has already increased speculation and contributed to rising trading volumes, which climbed more than fifty percent during the day.

From a market structure perspective, $TAO continues to show constructive momentum. Price action has been forming higher lows since early October, suggesting steady accumulation. Indicators remain supportive, with the relative strength index near sixty-six and a bullish crossover on the moving average convergence divergence signal. Traders are watching for a break above $510. Clearing this level could open a path toward this year’s high near $550. On the downside, support currently sits around $460, with stronger interest near $430.

In short, institutional access has arrived. Liquidity is growing. And with the halving approaching, the market is preparing for a supply-driven period that could shape the next phase of Bittensor’s price trajectory.

Be the first to comment