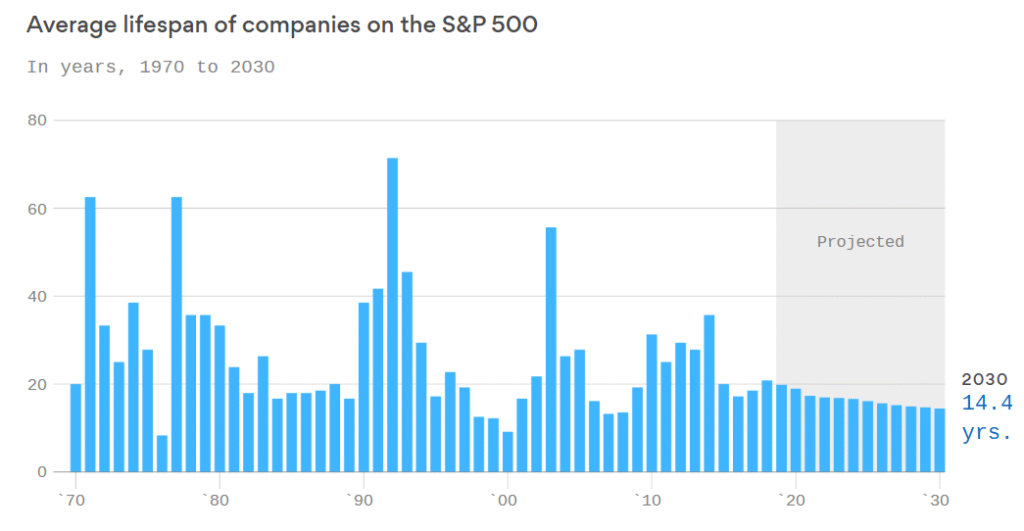

From statistical projections, an average S&P 500 company is expected to survive just 12 years by 2027, and that is down from 67 years in the 1960s.

Yet investors are still trying to pick long-term winners.

This article, curated from a thesis by Andy ττ, explores why that strategy is breaking down, how artificial intelligence is accelerating corporate turnover, and why Bittensor and its native coin, $TAO, present a fundamentally different way to gain exposure to AI without betting on individual companies.

The Quiet Collapse of Corporate Longevity

The modern stock market is built on a fragile assumption that leading companies endure. From empirical facts, they don’t:

a. 88% of Fortune 500 companies from 1955 no longer exist,

b. Average S&P 500 tenure fell from 33 years in 1964 to 21 years by 2020,

c. Innosight projects a drop to 12 years by 2027, and

d. At current churn rates, half of today’s index will be replaced within a decade.

This is not cyclical, it is structural.

AI is Making the Problem Worse

Artificial intelligence is compressing innovation cycles across every industry, with this, capital and advantage are concentrating faster than ever.

Consider the imbalance:

a. The Magnificent Seven (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla) now account for ~30% of S&P 500 market cap,

b. Each spends roughly $36 billion per quarter on AI infrastructure, and

c. The average S&P 500 company spends closer to $2 billion.

For investors, the choice is increasingly binary:

a. Concentrate heavily in a few dominant tech giants, or

b. Attempt to identify which AI-native challengers will replace incumbents.

Both paths carry significant risk.

Meanwhile, the irony is stark. Despite massive spending:

a. McKinsey estimates AI could add $2.6 to $4.4 trillion annually to the global economy,

b. BCG finds that only 5% of companies generate meaningful value from AI at scale, and

c. 60% generate no material return at all.

This is not just a stock-picking challenge, it is arguably the stock-picking problem of the century. So, what if you did not have to pick at all?

Bittensor: A Marketplace, Not a Company

Bittensor is not a startup, it is not an application, and it is not even a protocol in the traditional sense.

Bittensor is a decentralized marketplace for AI production.

Instead of betting on which company will win, participants gain exposure to the infrastructure where AI competition itself takes place.

A useful analogy is industrial history:

a. You could have tried to pick the best railroad company, or

b. You could have owned the steel.

Bittensor is the steel.

How the Network Works

As of January 2026, Bittensor supports 128 active subnets, and each of them is an incentive-driven competition producing a specific AI commodity.

Examples include:

a. Serverless inference and compute,

b. GPU marketplaces,

c. Autonomous coding agents,

d. Financial forecasting and trading signals,

e. Deepfake detection and verification,

f. Protein folding and drug discovery, and

g. Physical world data from cameras and sensors.

Collectively:

a. Subnet market capitalization grew from $100 million in March 2025 to $1.4 billion by November 2025, and

b. That represents 1,300% growth in 8 months.

The Role of $TAO

$TAO is the native asset of the network and serves three core functions:

a. Staking asset for validators and delegators,

b. Universal trading pair for all subnet ‘$ALPHA’ tokens, and

c. Settlement layer for value flowing through the ecosystem.

Every $ALPHA trades exclusively against $TAO, and participation anywhere within the network requires $TAO conversion.

Key supply dynamics:

a. Fixed supply of 21 million $TAO,

b. No pre-mine, no ICO (Initial Coin Offering), no insider allocation,

c. First halving completed in December 2025 resulting in the reduction of daily emissions from 7,200 to 3,600 $TAO, and

s. Approximately 76.5% of supply is currently staked.

The design is deliberate and familiar for a reason.

What is Actually Being Built

Bittensor is often misunderstood as experimental. In reality, much of the network already generates revenue and serves real users.

Below is a curated view of the ecosystem, organized by function rather than hype:

a. Infrastructure and Compute

Several subnets form the backbone of decentralized AI infrastructure:

1. Chutes (Subnet 64): Serverless inference platform processing massive volumes at costs materially lower than centralized clouds. Now a leading open source inference provider.

2. Lium (Subnet 51): A decentralized GPU marketplace where rental demand exceeds emissions. Real customer revenue has overtaken token incentives.

3. Targon (Subnet 4): Confidential compute using secure enclaves, powering consumer and enterprise workloads with meaningful annual revenue.

4. Templar (Subnet 3): A decentralized training network enabling large-scale model training across heterogeneous hardware. Cited by frontier AI researchers as the largest active decentralized training system.

b. Training, Research, and Reasoning

Beyond raw compute, Bittensor hosts advanced AI development primitives:

1. Gradients (Subnet 56): Zero-code AutoML for fine tuning large models. Performance and cost benchmarks consistently rival or exceed centralized platforms.

2. Affine (Subnet 120): A reinforcement learning arena where reasoning models compete under adversarial pressure. Often described as mining reasoning itself.

3. IOTA and Apex (Subnets 9 and 1): Permissionless foundation model training and adversarial intelligence experiments that push beyond static benchmarks.

c. Autonomous Agents and Software

One of the clearest signs of progress is in autonomous software agents:

1. Ridges (Subnet 62): A marketplace for autonomous coding agents that match or exceed proprietary systems on benchmark performance at a fraction of the cost.

2. Autoppia and Sundae Bar (Subnets 36 and 121): Decentralized web automation and generalist enterprise agents aimed at replacing repetitive digital labour.

These systems are no longer demos, they are moving toward production deployment.

d. Financial Intelligence

Bittensor also supports several financial intelligence subnets:

1. Vanta (Subnet 8): A decentralized proprietary trading network focused on transparency and verifiable performance.

2. Synth and Mantis (Subnets 50 and 123): Probabilistic forecasting and trading signal generation with documented live performance.

3. Sportstensor (Subnet 41): Sports prediction intelligence used in prediction markets.

These subnets demonstrate how decentralized AI can outperform centralized models in trust sensitive domains.

e. Detection, Verification, and Physical AI

As synthetic media and real world data grow more important:

1. BitMind (Subnet 34): provides deepfake detection used by consumers and enterprises

2. NATIX StreetVision (Subnet 72): converts real world imagery into machine intelligence for mapping and autonomy

3. Yanez MIID (Subnet 54): stress tests financial compliance systems using adversarial identity generation

These are not speculative markets. They address regulatory and infrastructure needs measured in billions of dollars.

How $TAO Captures Value

$TAO’s value capture is structural, not narrative-driven. Key mechanisms of this include:

a. All $ALPHA trade exclusively against $TAO

b. Subnet registration burns $TAO during periods of demand

c. Root staking provides passive exposure to the entire network

d. Revenue-driven buybacks from multiple subnets recycle value

e. Emissions increasingly favor productive subnets through market signals

$TAO does not depend on one application succeeding, it benefits from competition itself.

Institutional Capital is Arriving

Over the past year:

a. Grayscale launched a Bittensor trust and filed for a spot ETP,

b. Europe listed a staked $TAO product on SIX Swiss Exchange,

c. DCG backed Yuma Asset Management’s subnet focused fund,

d. Hedge funds and public companies began accumulating $TAO, and

e. Chainlink-CCIP bridged multiple subnets to Base for DeFi integration.

This is no longer a retail-only ecosystem.

The Moat Question

Does $TAO have a moat? The S&P 500 does not. Corporate longevity is collapsing precisely because moats erode faster in an AI accelerated economy.

Bittensor’s defensibility comes from:

a. Programmatic scarcity,

b. A mandatory settlement asset,

c. Market-driven capital allocation,

d. Composable subnet interdependence, and

e. Continuous replacement of underperforming units.

The marketplace persists even as participants change.

A Different Kind of Index

The conclusion may sound extreme, but it is worth stating plainly that Bittensor increasingly resembles an index of AI economic activity, not a collection of companies.

While the S&P 500 indexes corporations with shrinking lifespans, Bittensor indexes AI production units that evolve continuously.

In both cases, constituents change. The only difference is that $TAO remains constant, as $TAO is not a bet on which AI company wins.

It is a bet that AI matters, that infrastructure will outlast applications, and that owning the settlement layer of competition is more durable than stock picking in the fastest-moving sector in history.

The marketplace is live, the subnets are shipping and deploying real products, and institutions are paying attention.

The only open question is timing, and whether you see it before everyone else does.

Be the first to comment