Note: This is an article version of Lucas’s tweet.

We’re now less than two weeks away from the first $TAO halving, but this post isn’t about that.

This is about fundamentals.

Regardless of short-term volatility, Bittensor looks increasingly inevitable because one of the most important chain-level metrics in crypto (revenue) is already strong. Many people simply haven’t looked at the data.

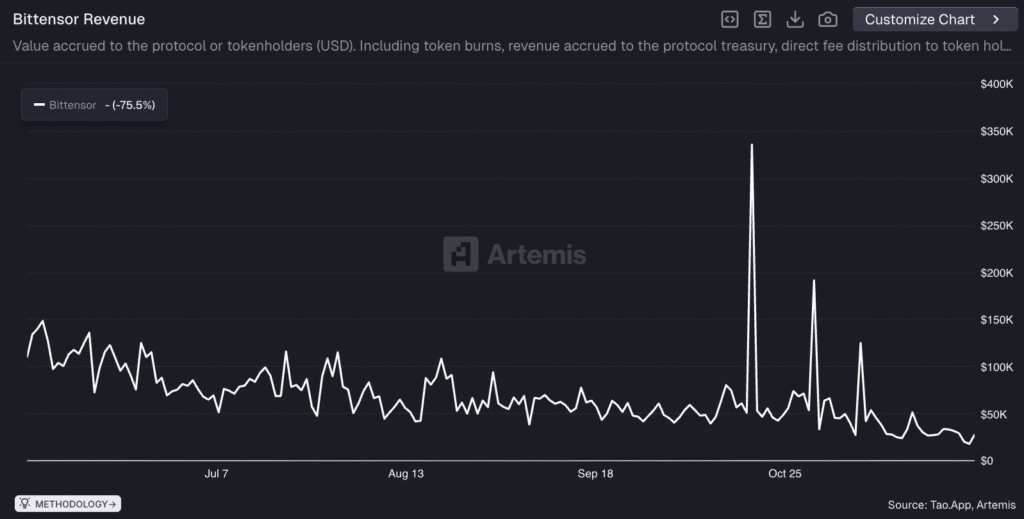

Bittensor Is Producing ~$78K in Daily Revenue

Fact: Bittensor has averaged ~$78,000 in daily revenue over the past six months.

That’s not just impressive, it’s a signal. Especially when you compare its market cap-to-revenue ratio with other chains.

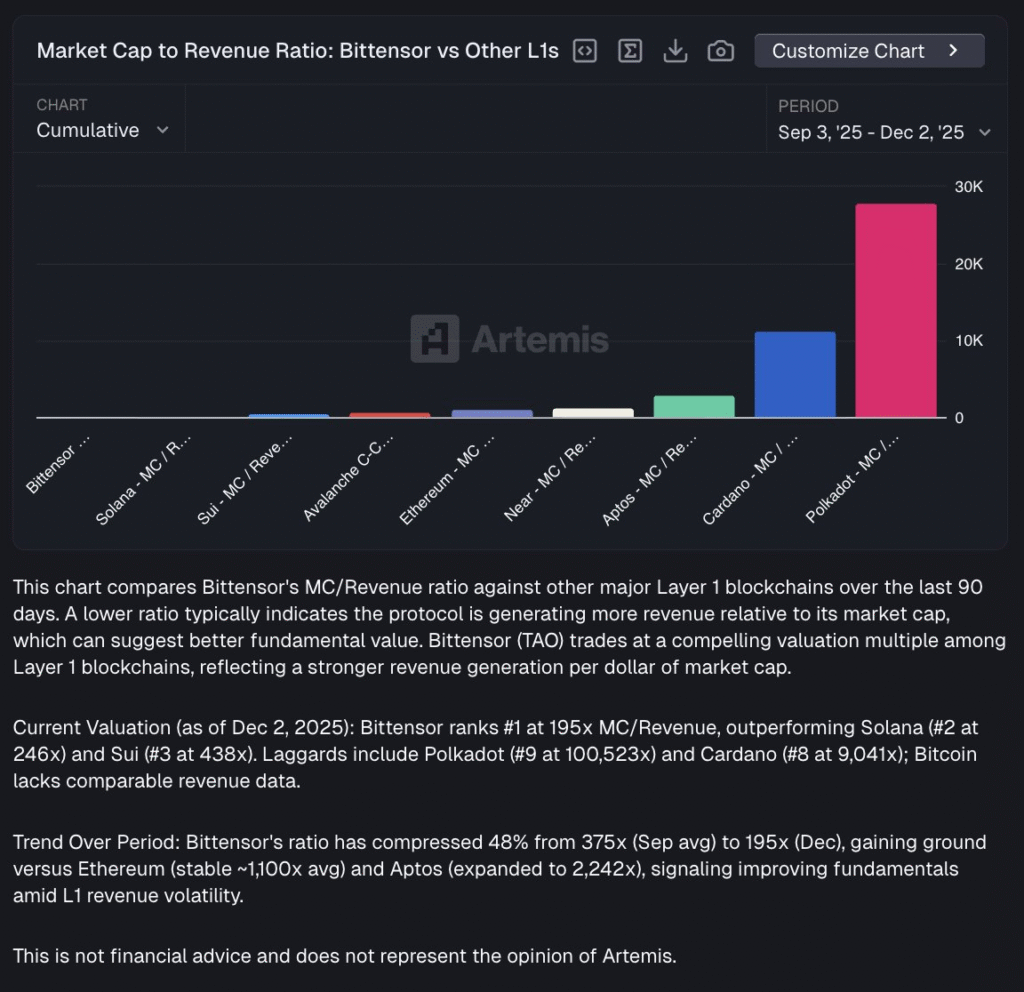

I asked ART Chat:

“Show me Bittensor’s market cap-to-revenue ratio relative to major L1s.”

The comparison was surprising:

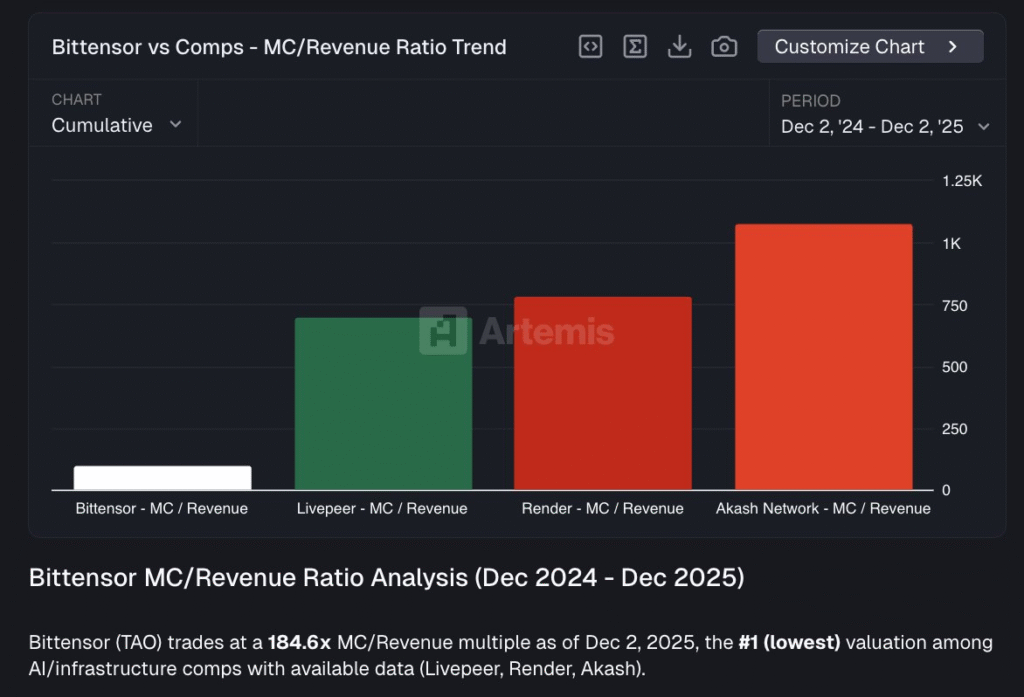

So I asked again: “Okay, what about within the AI / DePIN sector?”, because maybe Bittensor shouldn’t be compared to other L1s.

Why MC/Revenue Matters

For those unfamiliar, the market cap-to-revenue (MC/Rev) metric works a lot like price-to-earnings:

- Lower = undervalued

- Higher = market is pricing in more growth

Right now, Bittensor sits around ~197x.

Verdict: A lower number means the protocol is generating more value relative to what the market is pricing it at. From an investment standpoint, lower is better.

Compare that with:

- Livepeer — ~700x

- Render — ~785x

- Akash — ~1,100x

If Bittensor simply moves part of the way toward these sector valuations, price appreciation would be a natural consequence. That’s what fundamentals suggest.

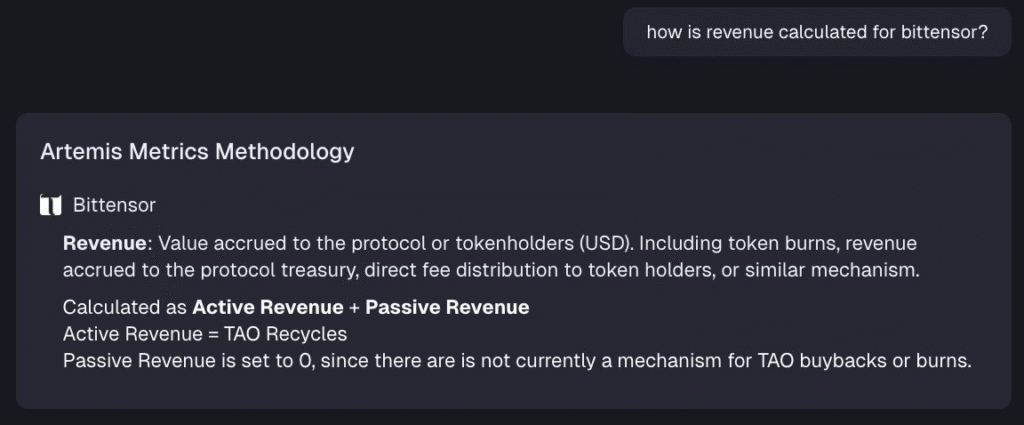

How Bittensor Revenue Is Calculated

Revenue is computed by analyzing:

- Fees paid across subnets

- Network-level incentives

- TAO burned or recycled back into the economy

- Validator/miner economic flows

- Supply emissions minus sink mechanisms

This gives a far more accurate picture of real economic activity flowing through the network.

Final Take

Even before the halving, the fundamentals look compelling:

- Real revenue

- Low MC/revenue compared to AI peers

- Growing economic activity

- A proven model of decentralized compute incentives

Remember: Short-term volatility is noise. Fundamentals are signal.

Be the first to comment