Bittensor-focused investment firm DSV Fund has announced its first incubator deal, backing Leadpoet (Subnet 71) to launch, operate, and scale what it calls “one of the most commercially promising projects” on the decentralized AI network.

Unlike DSV’s previous investments, which typically support existing subnets already producing emissions, Leadpoet did not yet have a live subnet. DSV changed that, funding the subnet slot and providing operational runway to bring the project online.

In exchange, DSV will receive a share of owner key emissions, a first for the fund, creating what it describes as “strong long-term alignment” between DSV and the Leadpoet team.

“Leadpoet represents the next phase of our thesis,” said Siam Kidd, DSV’s Chief Investment Officer.

“Most subnets we invest in are already operational. This time, we’re helping build one from the ground up — a project with clear real-world utility and a path to revenue.”

Building Applied AI for Real-World Sales

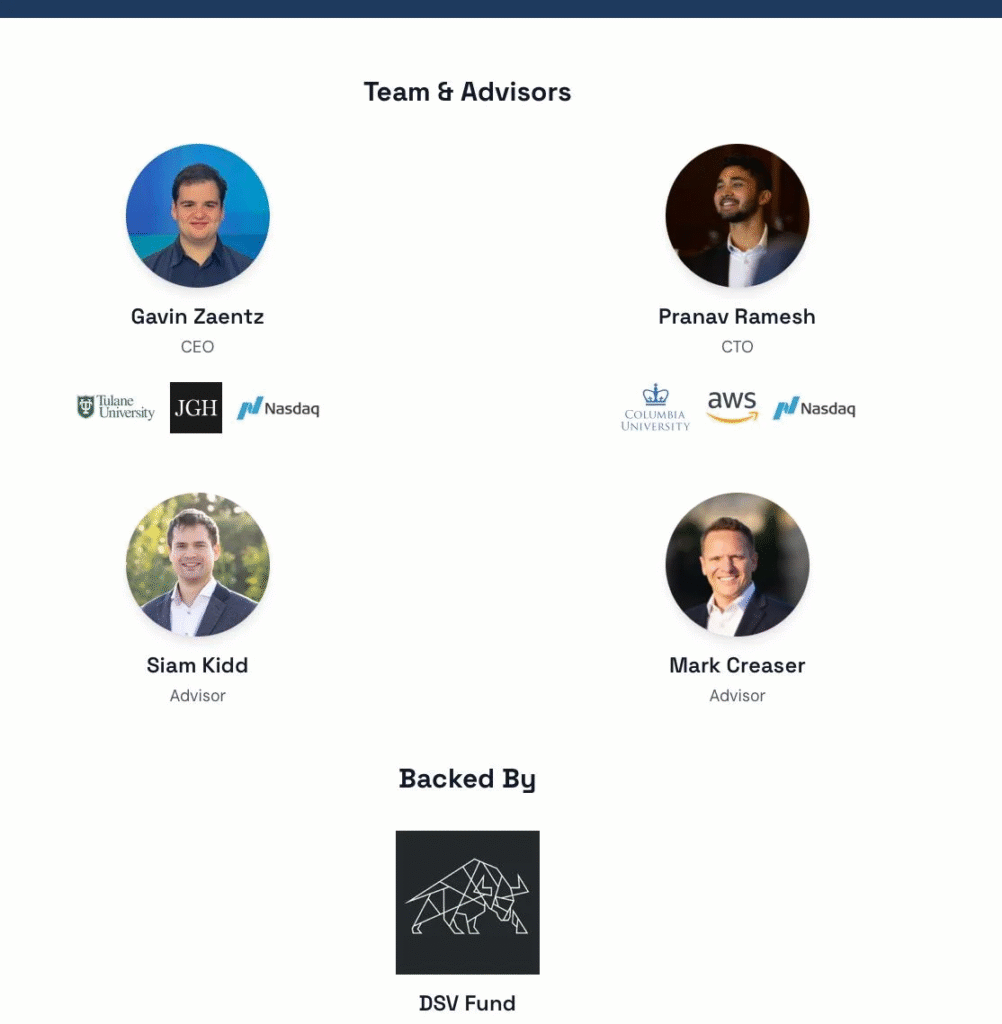

Founded by Gavin Zaentz (CEO) and Pranav Ramesh (CTO), Leadpoet is building an autonomous AI sales agent network that aims to redefine how businesses identify and qualify real buyers.

Rather than relying on scraping or spam, Leadpoet’s distributed AI learns intent, context, and timing, transforming traditional cold outreach into what it calls “precision engagement.”

The project’s focus on practical, revenue-generating AI aligns closely with DSV’s thesis that Bittensor’s long-term sustainability will come from subnets delivering tangible commercial value.

“This is the early blueprint for our incubator model,” said Mark Creaser, CEO of DSV.

“Identify a great team early, fund the launch, share the risk, and help them compound long after the subnet goes live.”

Expanding Beyond Capital: DSV’s Incubator Model

As part of the partnership, Creaser and Kidd have joined Leadpoet as strategic advisors, supporting subnet setup, tokenomic design, and go-to-market execution.

The launch of the incubator program marks a strategic evolution for DSV, which has previously made OTC investments in prominent subnets such as Synthdata (SN50) and Hippius (SN75). With the new model, the firm aims to accelerate the formation of new, high-utility subnets within the Bittensor ecosystem.

The fund is now actively seeking to partner with builders and researchers who want to launch new decentralized AI projects on Bittensor, offering a combination of capital, infrastructure, and strategic support to get subnets live.

Interested teams are encouraged to contact DSV directly via @dsvfund or email mark@dsvfund.com.

Be the first to comment