Bittensor has rolled out one of its most important upgrades of the year, introducing new protections for users, expanding staking options, and preparing the network for its next phase of decentralization.

The update, now live on mainnet, improves both security and user experience across the ecosystem.

A New Era of Protection: Introducing MeV Shield

The highlight of the update is MeV (Maximum Extractable Value) Shield, Bittensor’s new opt-in encrypted transaction system.

For context, MeV is the profit that miners or validators make by manipulating (through reordering, including, or excluding) transactions on public mempool (like transaction waiting bay) within the blocks they produce on a blockchain.

This shield is designed to protect users from several forms of malicious market behavior, including:

a. Transaction front running,

b. Sandwich attacks, and

c. Other forms of short-term, targeted manipulation that rely on reading the public mempool.

With MeV Shield, users can wrap transactions inside an encrypted layer that can only be decrypted by the validator after execution. This ensures that no external party can inspect or interfere with the transaction before it is finalized.

What this Means for Everyday Users

Clients now use MeV Shield automatically in several key situations, including swaps. As a result:

a. The majority of Bittensor users are now protected by default,

b. Most common forms of opportunistic manipulation are eliminated, and

c. The overall trading environment becomes safer and more predictable.

A trustless version of MeV Shield, leveraging threshold encryption, is already in development and will be released in the coming months to support Bittensor’s transition toward decentralized validators.

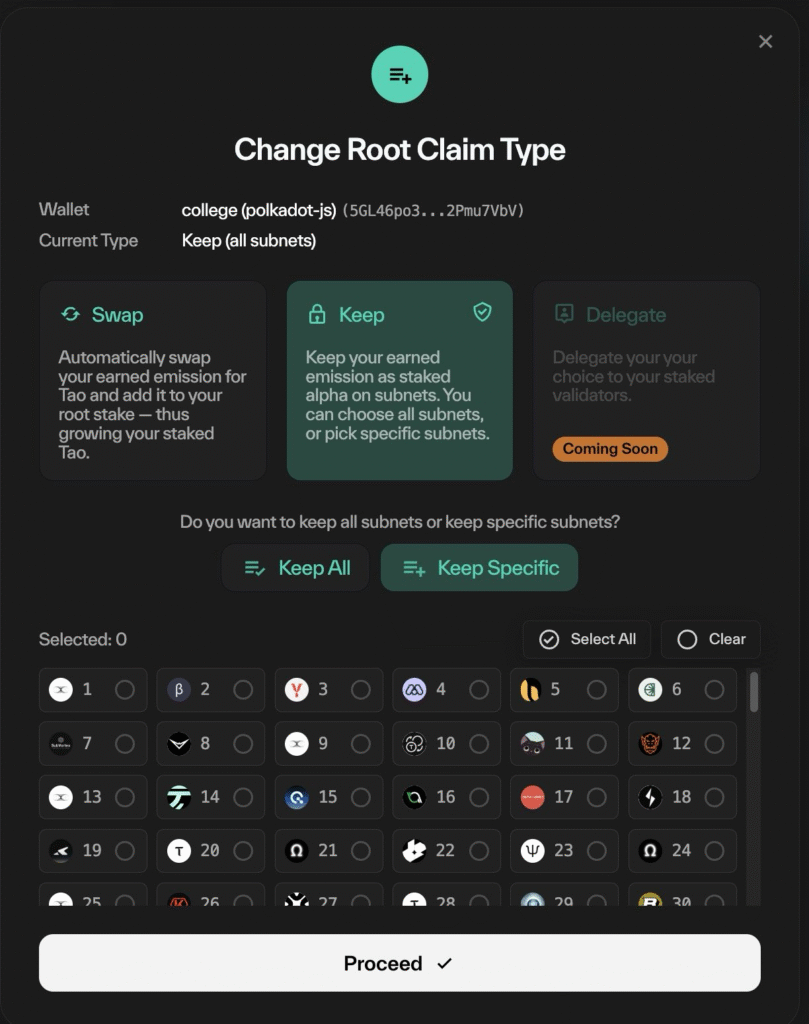

More Flexibility for Stakers: RootClaimTypeEnum Expansion

The upgrade introduces a new option within RootClaimTypeEnum called KeepSubnets. This gives users more control over how they receive emissions in native subnet ‘$ALPHA’ tokens across subnets.

It is part of a broader shift in staking behavior that will be rolled out in stages.

What Users Need to Know About This

Beginning this week, Bittensor will adjust the default claim type for all stakers:

a. Previous Default (SWAP): This allows for $ALPHA rewards to be automatically sold, and received as $TAO on root.

b. New Default (KEEP): This ensures that $ALPHA rewards remain in $ALPHA and stay staked on the subnet.

This change encourages deeper participation within subnet economies and aligns long-term incentives between stakers and subnet operators.

Also, anyone who prefers to continue receiving $ALPHA emission as $TAO must explicitly set their claim type to SWAP.

If this is not set manually, the system will default to KEEP after the upgrade.

Additional Improvements

Alongside the headline features, the release includes a series of smaller enhancements and fixes that improve performance, reliability, and general network robustness.

The full list of changes can be found in the release notes on GitHub.

Why This Upgrade Matters

This update strengthens Bittensor at multiple levels, it introduces the following into the ecosystem:

a. Security: Users gain powerful protection against market manipulation.

b. Choice: Stakers receive greater control over reward behavior.

c. Preparation: The network moves closer to decentralized validators and next-generation staking logic.

d. Stability: Under the hood improvements enhance long-term network performance.

Together, these changes reinforce Bittensor’s position as a rapidly evolving decentralized compute and intelligence network.

Closing Thoughts

Bittensor’s latest upgrade shows a network that continues to mature quickly. MeV Shield provides the kind of protection typically found in advanced financial systems, while the upcoming staking adjustments signal a shift toward stronger subnet level economies.

For users, this assures greater safety, more flexibility, and a network steadily preparing for its decentralized future.

Be the first to comment