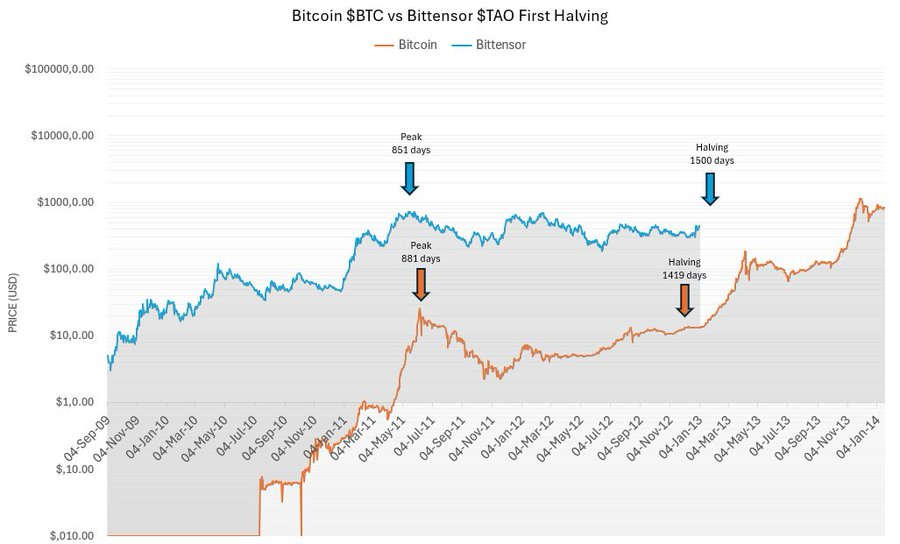

Bittensor’s native asset, $TAO, is heading into one of the most anticipated moments in its history. With the network preparing for its first ever halving, investors are watching closely to see whether $TAO will mirror Bitcoin’s (BTC) famous supply squeeze or chart an entirely new trajectory of its own.

As excitement builds, market analysts are beginning to frame December 2025 as a turning point not just for $TAO, but for the broader decentralized AI landscape.

What Bittensor is and Why the Halving Matters

$TAO powers Bittensor, the decentralized ecosystem where subnets function like open marketplaces for AI services. The network launched in 2021 and has grown rapidly thanks to its unique model of rewarding compute and intelligence rather than traditional mining.

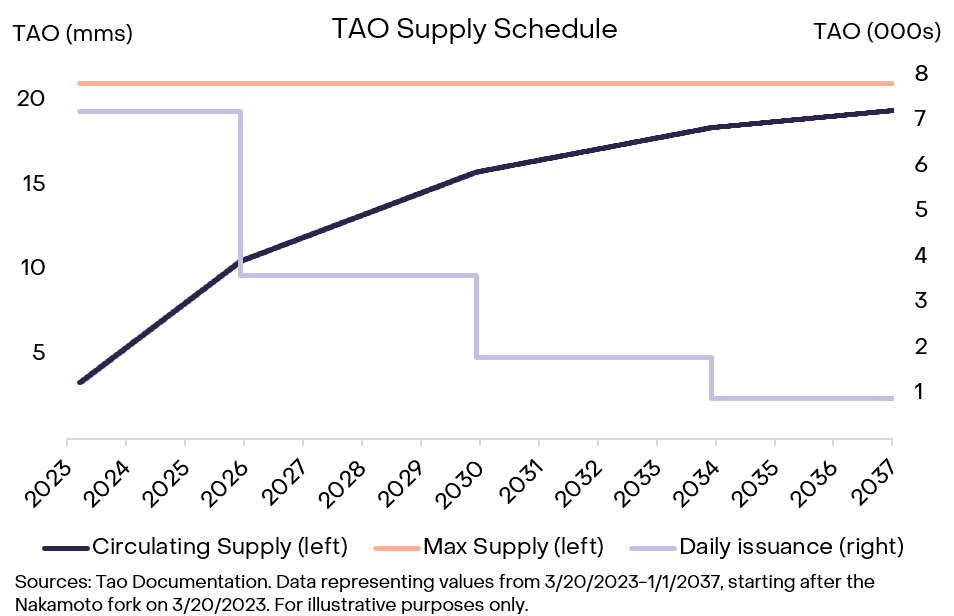

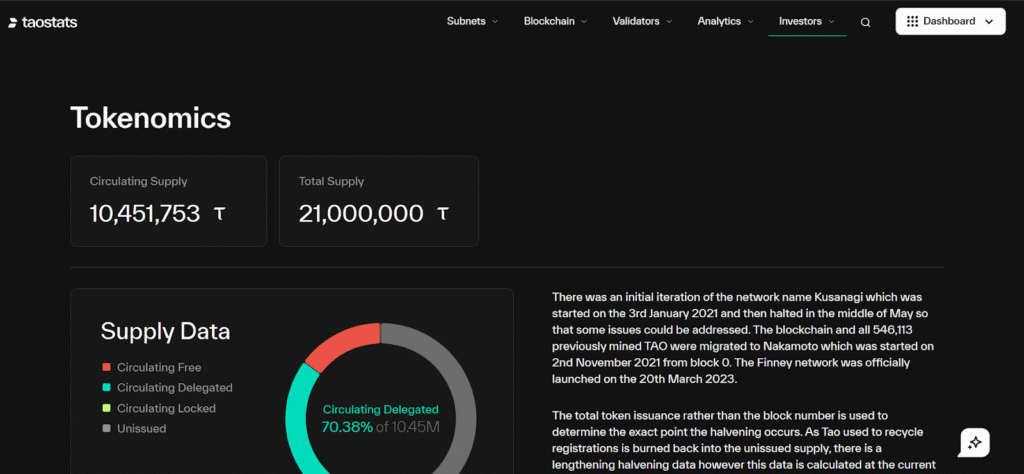

The upcoming halving will cut $TAO’s daily issuance from 7,200 tokens to 3,600.

Analysts view this as a critical milestone for three reasons:

a. It reinforces $TAO’s hard cap. model, which mirrors Bitcoin’s scarcity approach.

b. It accelerates the network’s maturation, signaling Bittensor is entering a new economic phase.

c. It introduces real constraints on supply, which may shift long term price dynamics.

Many have highlighted this moment as a “key milestone” on $TAO’s path toward its 21 million capped supply.

Why Scarcity Could Shift Market Expectations

Historically, assets with fixed supply and growing adoption tend to attract stronger market interest.

$TAO fits that profile, it has:

a. Fixed total supply

b. Increasing real world AI-utility

c. Expanding user base through commercial subnets

d. A growing share of traders positioning for a supply shock

When supply decreases and demand increases, price tends to follow. If Bittensor continues gaining real adoption, a halving driven scarcity narrative could strengthen $TAO’s appeal.

Recent Price Action: A Market Waking Up

$TAO entered November under downward pressure, falling from about $350 to the $250 range. That trend, however, shifted sharply as halving anticipation intensified.

Current momentum signals a revived appetite:

a. Up 7% in the last 24 hours

b. Up 11% on the weekly chart

c. Trading near $291, reclaiming key moving averages on the 4-hour chart

d. Momentum indicators showing room for further upside

The RSI (Relative Strength Index) hovering around 59 suggests the market is heating up but not yet stretched.

Key Levels Traders Are Watching

$TAO’s behavior near a few critical levels will likely define its next major trend.

a. Support Zones ($250 to $265): This area has historically triggered strong rebounds and losing this zone may weaken bullish sentiment.

b. Upside Targets: If halving enthusiasm accelerates, $TAO might hit $540 to $610. This is the broader range many analysts consider possible during an aggressive post halving run, based on prior cycles and price structure.

Why These Levels Matter:

a. $TAO has repeatedly rallied after retesting the lower band.

b. Its previous consolidation between $298 and $471 suggests a base for expansion.

c. Breaking above the long held ceiling could open new price exploration territory.

What Makes TAO’s Setup Different from Other Assets

Three elements distinguish Bittensor from typical altcoins heading into a halving:

a. Strong Fundamental Use Case: Real AI services power the network.

b. Actual Scarcity Model: A hard supply cap similar to Bitcoin, but for decentralized machine intelligence.

c. Growing Institutional Attention: Grayscale and other research arms are closely tracking $TAO’s economic model.

With AI markets accelerating globally, $TAO sits at the intersection of two strong narratives: decentralized intelligence and algorithmic scarcity.

Could This Be the Biggest Move of 2026?

With the volatility of cryptocurrencies, it might be too early to make an accurate prediction but it’s worthy to note that various elements are aligning:

a. A major supply shock

b. A recovering technical structure

c. Rising ecosystem adoption

d. Stronger market recognition

e. Historical patterns that favor upside moves during supply cuts

The halving will not guarantee a parabolic rally, but it substantially increases the probability of volatility and directional expansion.

If demand rises even modestly during a period of reduced issuance, $TAO could indeed be set for one of its most dramatic price cycles yet.

Final Outlook

Bittensor’s first halving is more than a supply schedule adjustment. It marks a psychological shift in how the market perceives $TAO’s long term value.

If the network continues to grow, and if the decentralization of AI keeps attracting global attention, $TAO may emerge as one of the most closely watched assets of 2026.

For now, all eyes remain on $TAO’s halving event, the day the network’s economics change forever.

Be the first to comment