Bittensor began 2026 on a strong footing. During the first trading week of the year, $TAO posted a sharp rally, signaling a return of bullish momentum after months of consolidation.

The move followed reports that Grayscale has filed to launch the first Bittensor-focused ETF (Exchange-Traded Fund) in the United States. As altcoin ETFs increasingly dominate market narratives, the filing served as a clear catalyst, pulling decentralized AI assets back into focus and reigniting institutional curiosity around Bittensor’s ecosystem.

$TAO’s price reaction reflects more than short-term speculation. Historically, regulated investment products have improved liquidity, expanded access, and strengthened credibility for emerging crypto assets. For Bittensor, the ETF narrative arrives at a moment when decentralized AI is gaining broader relevance beyond crypto-native audiences.

Holder Behavior Remains Supportive Despite the Rally

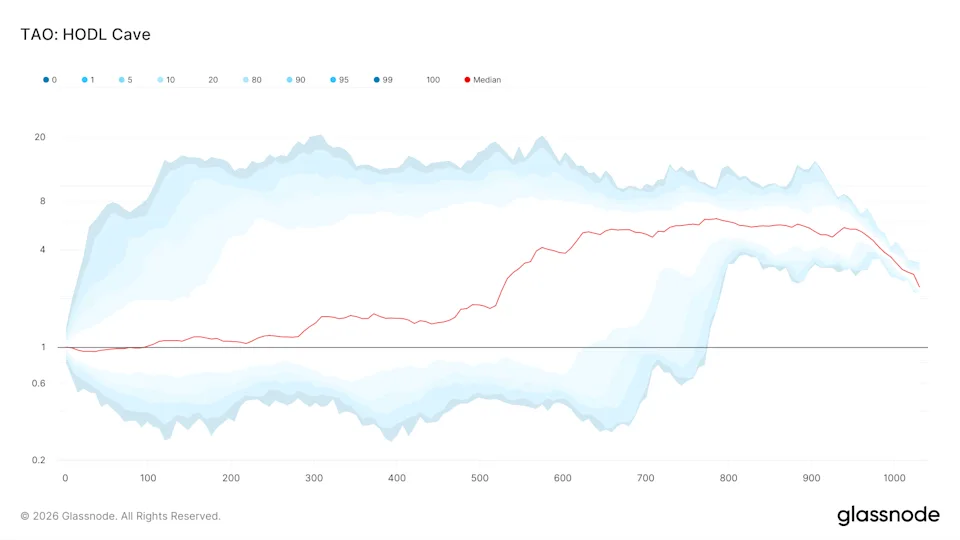

Even after a 27% weekly gain, on-chain data suggests that $TAO holders are not rushing to exit positions.

According to Glassnode’s HODL Caves data, most wallets that accumulated $TAO over the past seven months remain either underwater or only marginally profitable at current prices.

This cost-basis structure typically discourages aggressive distribution, as holders often wait for more substantial upside before realizing gains.

As a result, near-term selling pressure appears muted. Instead of encountering immediate profit-taking, $TAO’s recovery is unfolding in an environment where supply remains relatively constrained. This dynamic provides room for price discovery without the constant headwind of large-scale distribution.

Momentum Signals Are Improving, But Confirmation is Still Needed

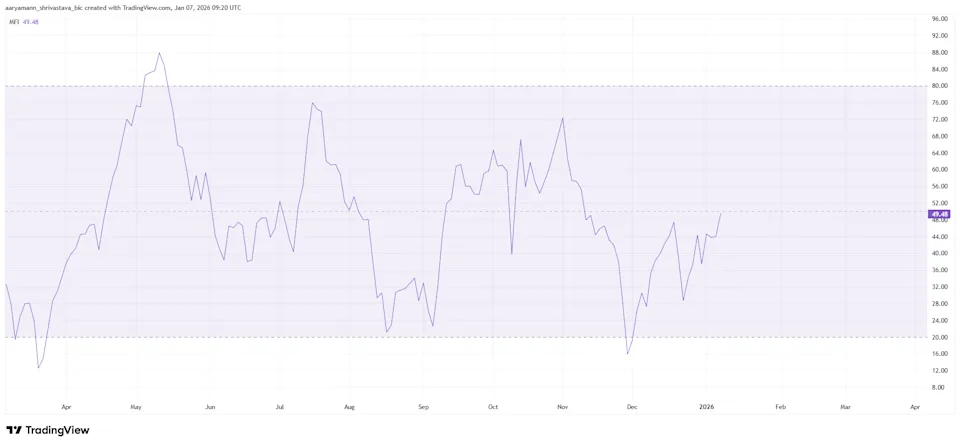

From a technical perspective, momentum indicators are beginning to align with the improving sentiment.

$TAO’s Money Flow Index (MFI), which tracks buying and selling pressure using both price and volume, is approaching its neutral threshold. A decisive move above this level would indicate that buyers are regaining control following the recent consolidation phase.

This shift matters as rising capital inflows would reinforce liquidity conditions and support higher price levels during the current market cycle. If MFI turns decisively positive, it would complement the supportive holder behavior and ETF-driven optimism already present in the market.

Together, these signals suggest that the rally may have structural backing, rather than being purely reactionary.

What $TAO’s Historical Price Behavior Reveals

$TAO’s past performance adds further context to the current setup.

Historically, the token has rebounded multiple times from the $217 support zone, with recoveries often extending toward or beyond the $500 level. These patterns reflect long-term confidence among holders when accumulation aligns with improving sentiment.

The current market structure resembles earlier recovery phases, though within a different macro backdrop. If accumulation persists and selling pressure remains limited, $TAO may once again follow a similar trajectory, supported by growing institutional interest and reduced short-term supply.

Key Levels to Watch as the Trend Develops

Currently, $TAO trades around $280, following a brief pullback over the past 24 hours. The broader weekly move still stands at roughly 27%.

Key technical levels include:

a. Immediate resistance: $312,

b. Higher confirmation zones: $335 and $412, and

c. Major downside support: $263, followed by $217.

Reclaiming $312 and turning it into support would mark an important step toward trend continuation. Establishing higher support zones would strengthen the case for a broader move toward the $500 region, which remains nearly 80% above current prices.

However, downside risks remain. A resurgence in selling pressure could push TAO back below $263. A deeper move toward $217 would invalidate the current recovery attempt and reset the bullish thesis.

A Measured Start to 2026 for Bittensor

Bittensor’s early 2026 performance reflects a convergence of improving sentiment, supportive holder behavior, and renewed institutional interest driven by the ETF narrative.

While confirmation is still required, the absence of aggressive profit-taking, combined with strengthening momentum indicators, gives $TAO a credible foundation for continued recovery. If these conditions persist, the token may be positioning itself for a broader move within the current cycle.

For now, $TAO’s rally appears less like a fleeting reaction and more like the early stages of a structurally supported trend.

Be the first to comment