Contributor: Crypto Pilote

Liquidity in Bittensor is a crucial topic, and several teams are working hard to improve it.

Without liquidity, there are no investors — and the success of the entire network is at risk.

Today, let’s see how you can contribute on your own scale.

I – Early contributor

28% of TAO are sleeping, slowly diluted by inflation.

52% are staked on Root, earning just 6% APY.

Meanwhile, DeFi is blooming on Bittensor.

You can do way better and here’s how (with a map, of course).

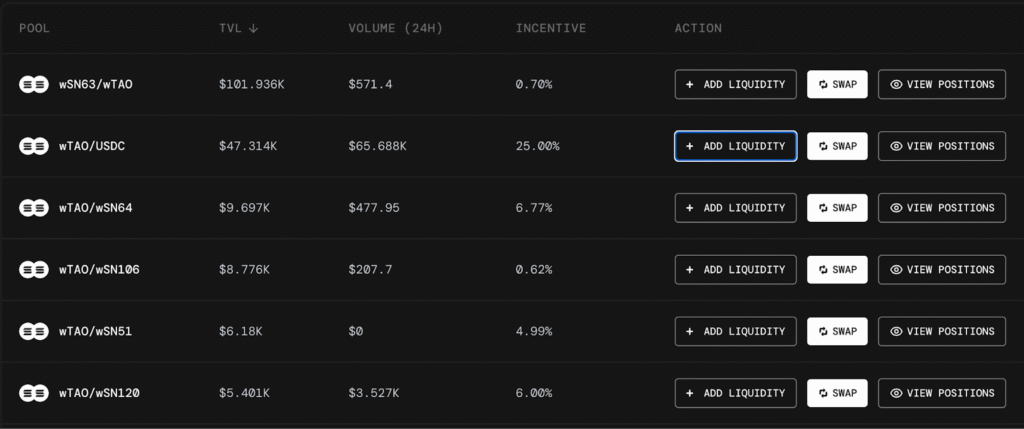

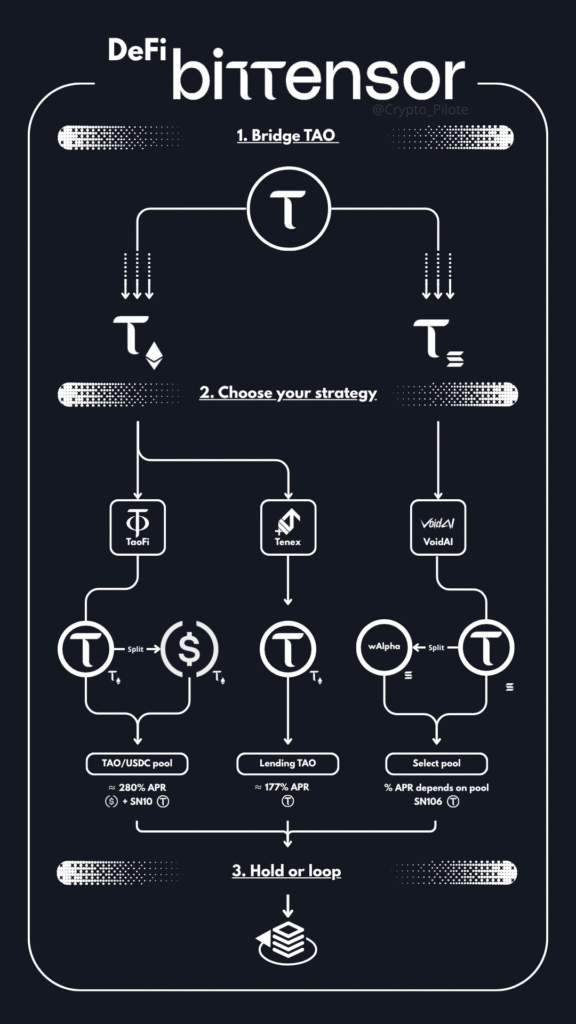

For now, three protocols are live: Swap/TaoFi (SN10), Tenex (SN67), and VoidAI (SN106).

Since Bittensor wasn’t designed to handle this type of transaction, the first step is to bridge your assets to Bittensor EVM or Solana.

You’ll need a Bittensor wallet and an EVM or Solana wallet. Fund your Bittensor wallet and you’re good to go.

II – Bridge

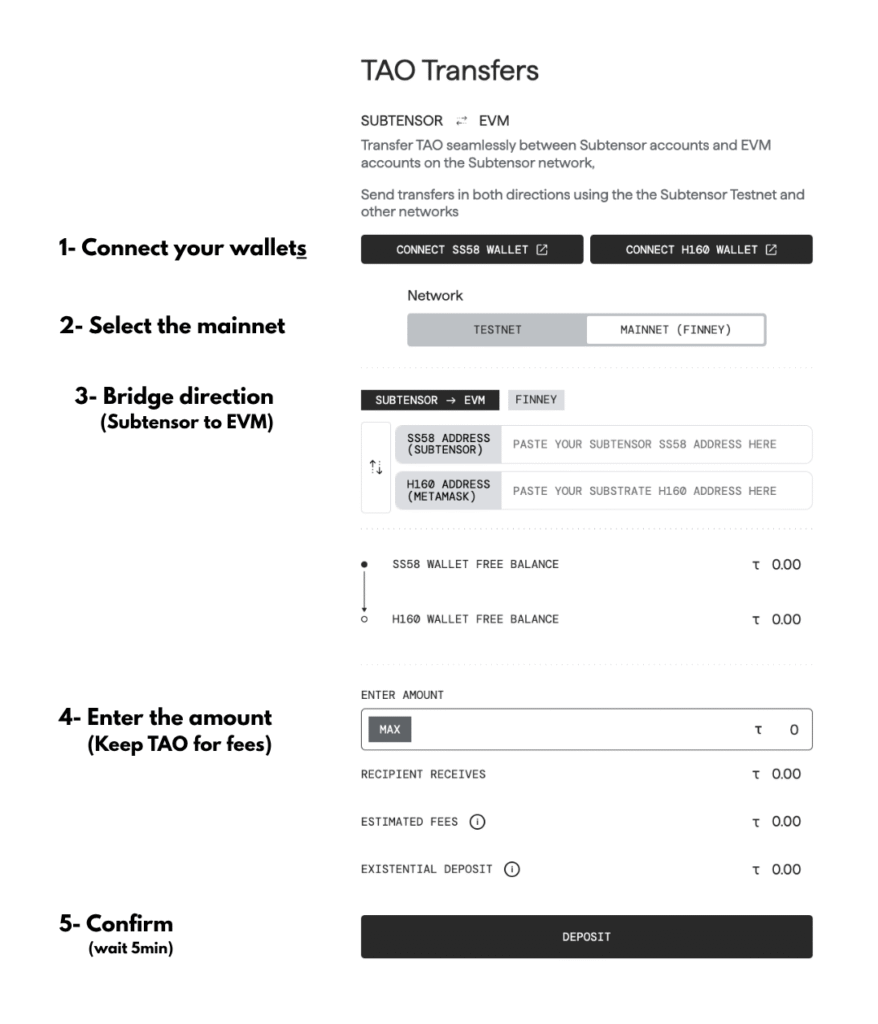

TAO → TAO EVM: Go to https://bridge.bittensor.com/ and refer to the picture below.

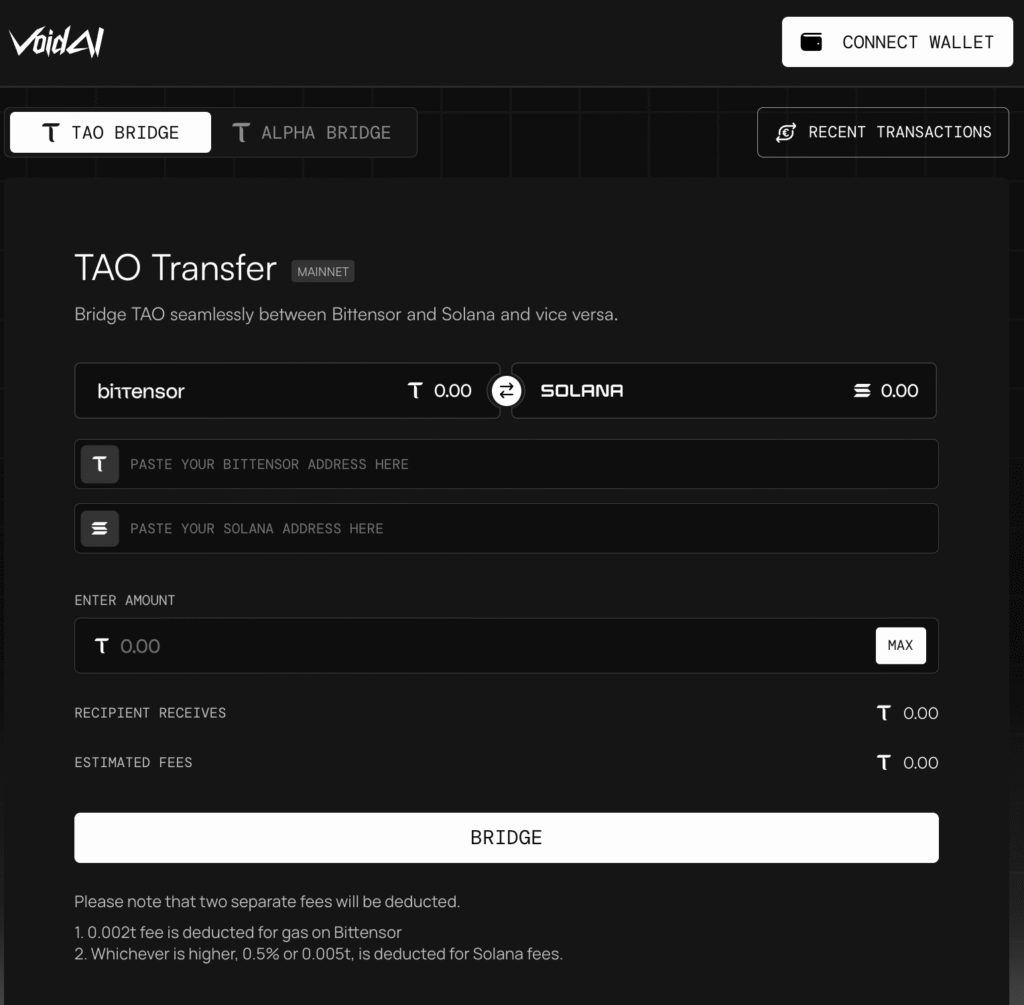

TAO → Solana: It’s a bit simpler on VoidAI. You just need to connect your Bittensor wallet and paste your Solana address.

However, don’t forget that you’ll also need to bridge your $ALPHA. Make sure to buy some first on Taostats, Neuraleq, Taoapp, Backpropfinance, or your preferred platform.

II – Deposit on Protocol

Blockchain fees are paid in TAO (EVM) or SOL for the VoidAI strategy, so make sure you have a small amount in your wallet (around $5 should be enough).

1. Tenex

Simply send your TAO to the pool and that’s it.

You’ll currently earn around 177% APR.

2. TaoFi / VoidAI

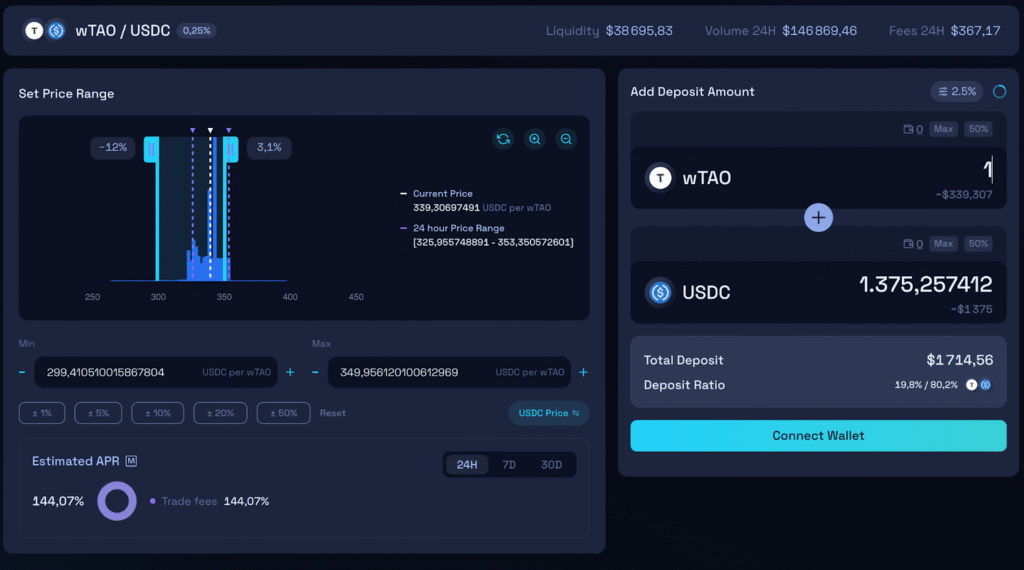

These protocols use concentrated liquidity pools (CLMMs).

For beginners, here’s a quick reminder of how they work:

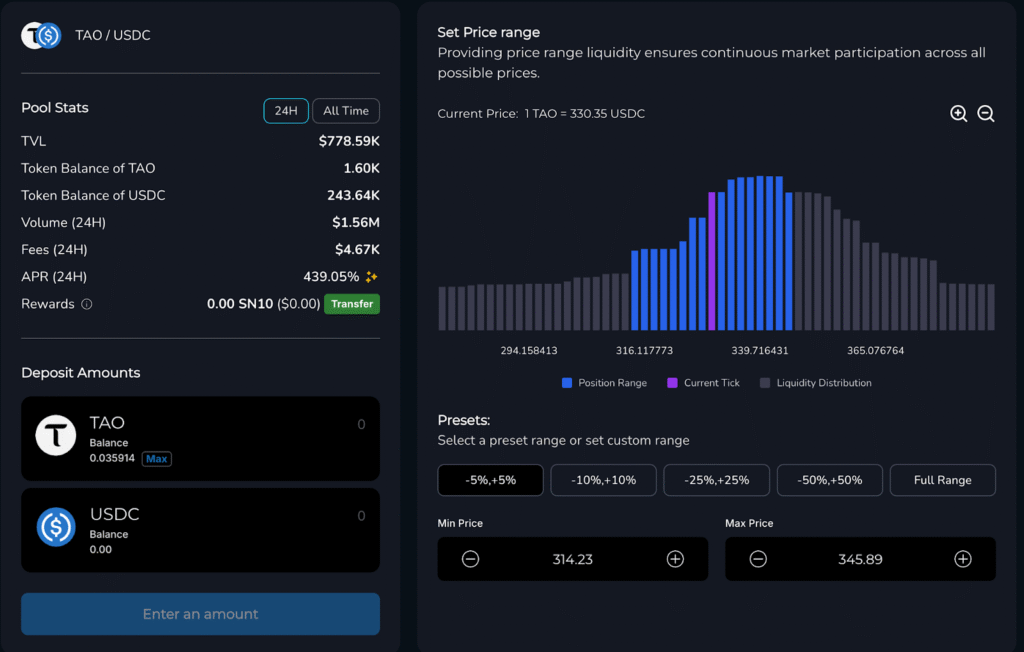

You choose a price range in which to provide liquidity.

When the market price stays within your range, you earn fees.

When it moves outside your range, you stop earning, and your position becomes 100% one asset.

Liquidity isn’t evenly distributed. You earn more in the middle of your range and less at the edges.

So choose your range carefully according to your strategy:

- A narrower range captures more fees but requires more frequent rebalancing.

- A wider range captures fewer fees but needs less maintenance.

The mix of assets will depend on the range you select.

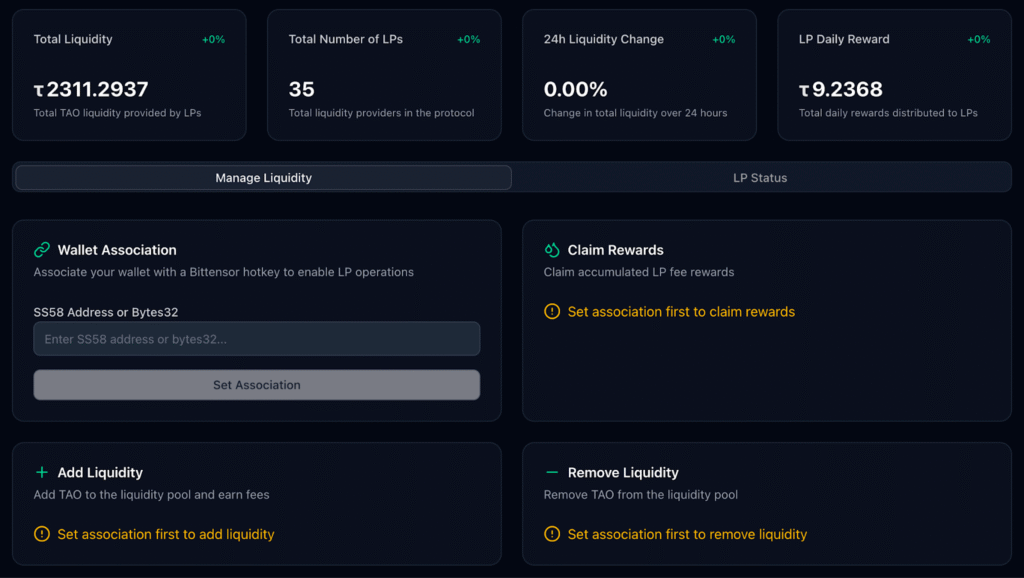

Before adding liquidity, use the LP dashboard to simulate your position and check how much of each asset you’ll need.

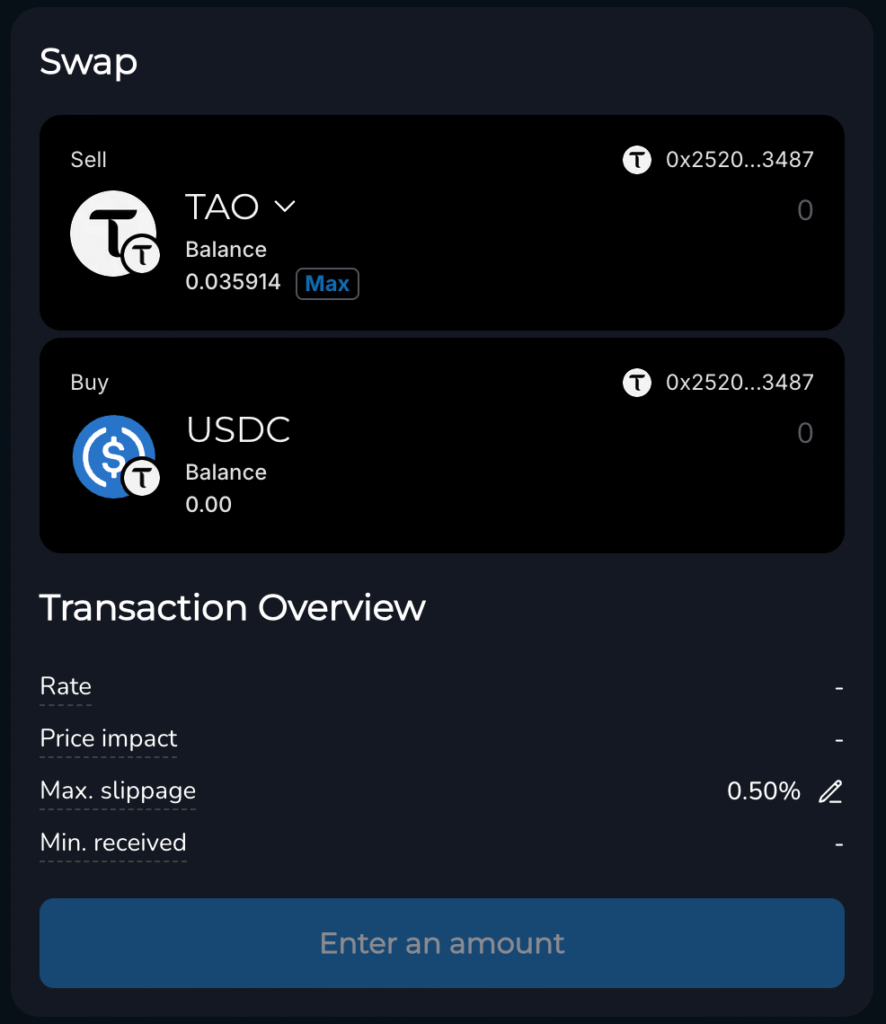

If the ratio isn’t perfectly 50/50, you’ll need to swap assets accordingly using the swap page of the protocol.

And that’s it! You’re now earning a solid APR while contributing to Bittensor’s liquidity.

You can either reinvest your rewards to compound your strategy or simply hold them.

III – Risks

DeFi on Bittensor is still in its early stages, and most of these protocols are young. Some liquidity pools have not yet been audited by certified external firms, so it’s important to stay cautious and do your own research before depositing funds.

Also, one of these risks is impermanent loss. It happens when the prices of the two assets in your liquidity pool diverge for example, if one goes up while the other stays stable. Because your liquidity is constantly rebalanced between the two assets, you might end up with less total value than if you had simply held them separately.

The loss is called impermanent because it only becomes real if you withdraw your liquidity while prices are still unbalanced. If prices move back toward their original ratio, the loss can shrink or even disappear.

Furthermore, given the high APRs, the strategy could remain profitable even if your position is affected by impermanent loss.

IV – DeFi cheat sheet

Be the first to comment