Below is a breakdown of what was discussed in the above TAO talk.

1. Macro First: Bitcoin in Context

Bitcoin is consolidating between $65K–$70K after dropping from $126K. Historically, prior cycles saw deeper drawdowns (e.g., ~77% in 2022), while this cycle has corrected roughly 52–53% so far. That suggests the most aggressive part of the move may already be behind us, but confirmation is still needed. Broader markets are critical. The S&P 500 and NASDAQ companies are showing signs of potential distribution. Bond yields remain a key signal. If they fall, rate expectations adjust lower, increasing the probability of future liquidity expansion. For now, sentiment is bearish. Historically, that’s when long-term opportunity begins forming.

2. TAO Technical Setup: Decision Time

TAO bounced strongly from the $144 region, rallying above $214 before rejecting at a medium-term downtrend. Price is now approaching a critical decision point: break the downtrend and regain momentum, or lose $150 support and potentially revisit lower liquidity zones. There’s also a notable price gap between roughly $80–$120 that could act as a magnet if crypto weakens further. The focus now should be to shift from USD portfolio value to one metric: “how much more TAO can you accumulate?”

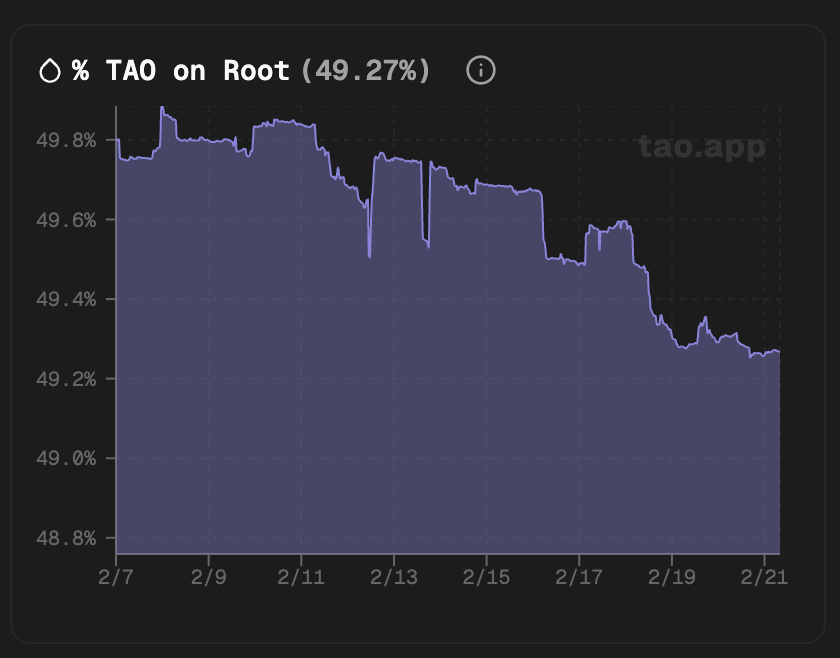

3. One Year of dTAO: Capital Is Rotating

One year into dynamic TAO, capital rotation from root into subnets is accelerating. Root allocation has dropped below 50% for the first time, while subnet allocation continues climbing. Larger, productive subnets are beginning to separate from weaker ones. As TAO price compresses, subnets without revenue or external capital face increased sell pressure due to emission-based funding needs. The next phase may shift toward fundamentals-driven investing, favoring strong teams, revenue generation, clear communication, and sustainable models over pure narrative speculation.

4. New Mining & Liquidity Opportunities

Several developments expand participation pathways for $TAO mining:

• IOTA Subnet 9 introduced “train-at-home” mining via MacOS, lowering entry barriers for decentralized compute contributors.

• Cartha (Subnet 35) launched USDC-based liquidity provisioning tied to 0xMarkets, offering high APYs with varying lock periods. Unlike prior failures such as Tenaxium, this model uses stablecoins rather than TAO as liquidity. Yields are compressing as TVL increases.

• Vanta is building decentralized prop trading with funded accounts and weekly payouts, integrating with Hyperliquid. This enables traders to scale capital without increasing personal risk exposure.

NOTE: Each of these opportunities requires caution. Test small. Use dedicated wallets. Avoid overexposure to new systems.

5. OpenClaw & AI Acceleration

OpenClaw integrations are expanding rapidly across storage, signals, and infrastructure. As decentralized AI agents evolve, they may eventually mine, trade, and allocate capital more efficiently than humans. The ecosystem is shifting toward automation, but competition will intensify as AI agents improve continuously.

8. The Right Mindset

The question isn’t “When price recovery?” It’s: how much can you accumulate before liquidity returns? Every subnet emission earned reduces cost basis. Every skill developed compounds permanently. Markets reward builders during quiet phases. Whether this is consolidation or another leg down, those who focus on stacking TAO, improving strategy, and managing risk will be best positioned when expansion returns.

Be the first to comment