Bittensor has entered a new chapter in user protection and network fairness with the rollout of MEV (Maximal Extractable Value) Shield on testnet.

While a small hotfix (an emergency update that is rushed out to solve one specific, critical problem in a piece of software that is currently being used) temporarily paused subnet ‘$ALPHA’ token-fee payments on mainnet, the bigger story is the arrival of an encrypted mempool that significantly reduces exposure to predatory bots.

This upgrade marks one of the most important moves in Bittensor’s evolution: shifting from reactive fixes to proactive, systemic defense.

What MEV Shield Does in Simple Terms

Every blockchain transaction normally enters a public “waiting room” called the mempool. This is where MEV bots lurk. They scan transactions, jump ahead of them, and profit by manipulating the order of execution.

MEV Shield changes that dynamics completely and lets users send encrypted transactions, so bots cannot see it until after it has been included in a block.

This means they (the bots) cannot:

a. Front-run users trade

b. Make profits by reordering transactions

c. Exploit private ‘subnet’ strategies

d. Force unnecessary slippage or sell pressure

For an ecosystem built around incentives, emissions, and financial competition, this protection is a huge leap forward.

How MEV Shield Works on Testnet

Bittensor has wired MEV Shield directly into the transaction flow as an opt-in feature. Users can choose to encrypt their extrinsic (value of transactions), and it remains hidden until after it executes.

This upgrade protects:

a. Staking

b. Un-staking

c. Transfers

d. Subnet registrations

e. Any custom Bittensor (BTX) transaction

This also unlocks a brand new pattern, “encrypted-until-executed” strategies, ideal for builders who want privacy around algorithms, incentives, or trading logic.

Validators in the current PoA (Proof-of-Authority) setup only decrypt transactions after the block is finalized, greatly reducing MEV attack surfaces.

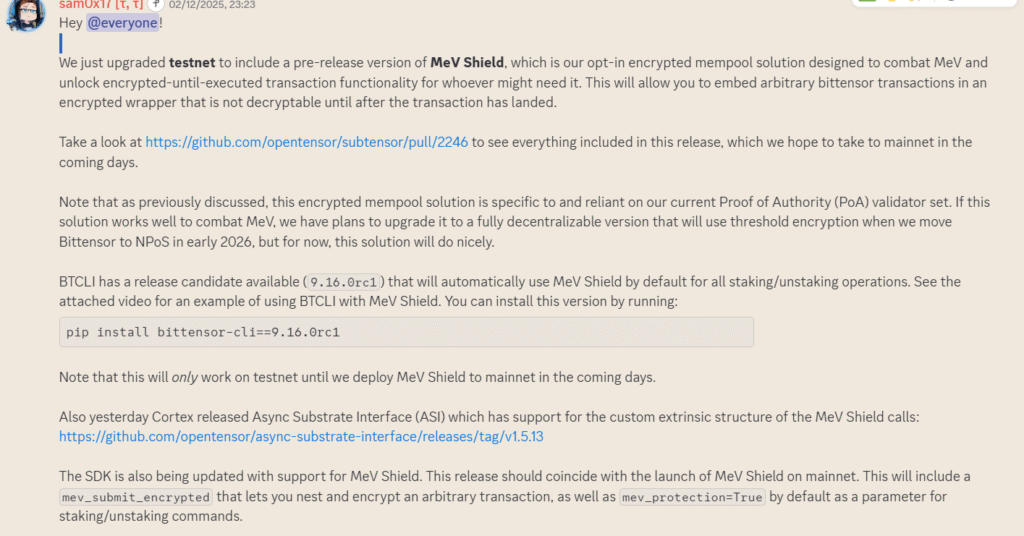

Tooling Support: BTCLI, ASI, and SDK

Two new updates are rolling out on the Bittensor ecosystem, making trades safer and smoother for everyone:

a. BTCLI 9.16.0rc1: Built-In Protection for Your Stakes

The latest version of the Bittensor command line tool now includes automatic MEV Shield protection whenever you stake or un-stake your $TAO. MEV attacks happen when malicious bots try to front-run transactions to profit at users’ expense. This update blocks that automatically, so you don’t have to do anything extra to stay protected.

To install it, users just run this command:

pip install bittensor-cli==9.16.0rc1No additional setup needed, the protection works right out of the box.

b. Async Substrate Interface (ASI): For Developers Building Bots

ASI is specifically built for developers running automated systems or bots that interact with the Bittensor blockchain. This interface supports the new encrypted extrinsic structure, which means bots can work more efficiently with the latest network updates.

While this is mainly for technical builders, it’s an important piece of infrastructure that keeps the ecosystem running smoothly behind the scenes.

Asides these new updates, the ecosystem is also set to drop an updated SDK (Software Development Kit) that intends to make encrypted transactions the default way of doing things on Bittensor ($TAO). This includes:

a. New-MEV Protection for All Transactions: The SDK now includes mev_submit_encrypted, which encrypts any nested transaction, not just basic staking operations.

This means better protection across more complex activities on the network.

b. Automatic Protection Turned On: When $TAO is staked or un-staked, mev_protection=True is now set by default. This means that users don’t have to remember to turn it on themselves, the system automatically turns on the protection.

Why This Matters for Bittensor ($TAO)’s Economy

MEV bots on Bittensor aren’t just an annoyance, they directly harm its economics. What it does is that it:

a. Fraudulently removes $TAO and related-assets from “innocent” users

b. Creates artificial sell/buy pressure in the market

c. Undermines subnet incentives

d. Exposes private strategies to exploitation

e. Destabilizes emission mechanisms

By closing the mempool to bots, the MEV Shield strengthens the full network by ensuring:

a. Fairer execution

b. More consistent emissions

c. Healthier subnet performance

d. Stronger protection for strategies and private logic

It’s a structural defense that aligns with Bittensor’s long term economic goals.

A Glimpse Into the Future: Threshold Encryption in 2026

Today’s version of MEV Shield relies on the current PoA validator set, which makes rapid deployment possible. But Bittensor is already planning the next evolution.

When NPoS (Nominated Proof-of-Stake) arrives in early 2026, it would come with the following:

a. MEV Shield will upgrade to threshold encryption

b. No single validator can decrypt a transaction

c. The system becomes fully decentralizable

d. Decryption happens only through distributed consensus

This turns MEV protection into a trust-minimized protocol feature, not a temporary tool.

Community Invitation: Try to Break It

The team didn’t just roll out MEV Shield, they openly asked users to stress test it. The community is encouraged to get involved and:

a. Install BTCLI 9.16.0rc1

b. Interact with testnet using encrypted transactions

c. Test staking, un-staking, transfers, and registrations

d. Explore the new extrinsic formats via ASI

e. Attempt to uncover bugs or edge cases

The stronger the testnet pressure, the safer the mainnet launch.

Quick Note: $ALPHA Fee Hotfix on Mainnet

Separately, Bittensor pushed a temporary patch disabling $ALPHA-based fee payments. This is a small, protective measure while a bug is being resolved. However, despite these:

a. Regular transactions still work

b. Only $ALPHA-as-fee is paused

c. No security risk is involved

It’s a reminder that the protocol is shipping fast, adapting fast, and prioritizing safety.

Conclusion: The Fairer Bittensor Era Is Beginning

With MEV Shield now active on testnet, Bittensor is moving toward a network where transactions are not just fast or decentralized, but fair and protected by design.

By encrypting intent until execution, the protocol cuts off the most harmful MEV vectors and gives builders a safer foundation for creating economic systems, strategies, and incentives.

This upgrade isn’t just a technical improvement, it’s a foundational shift.

A safer, more predictable, more trustworthy Bittensor is emerging, and as mainnet integration approaches, the ecosystem stands to benefit at every level.

Be the first to comment