Bittensor is still early, but it is no longer simple. The dynamic TAO (dTAO) era has been live for less than a year, with the network already supporting more than a hundred active subnet ‘$ALPHA’ tokens, each competing for emissions, attention, and credibility. What once felt experimental is now capital intensive, reputation sensitive, and increasingly unforgiving.

That tension sat at the center of Subnet Summer’s live discussion with the Alchemist featuring Chris Zacharia (Macrozack) of Bitstarter, and Mark Creaser of DSV Fund. What began as a fun opening conversation quickly turned into a deeper examination of what it now takes to launch a serious subnet and why the old ways are no longer enough.

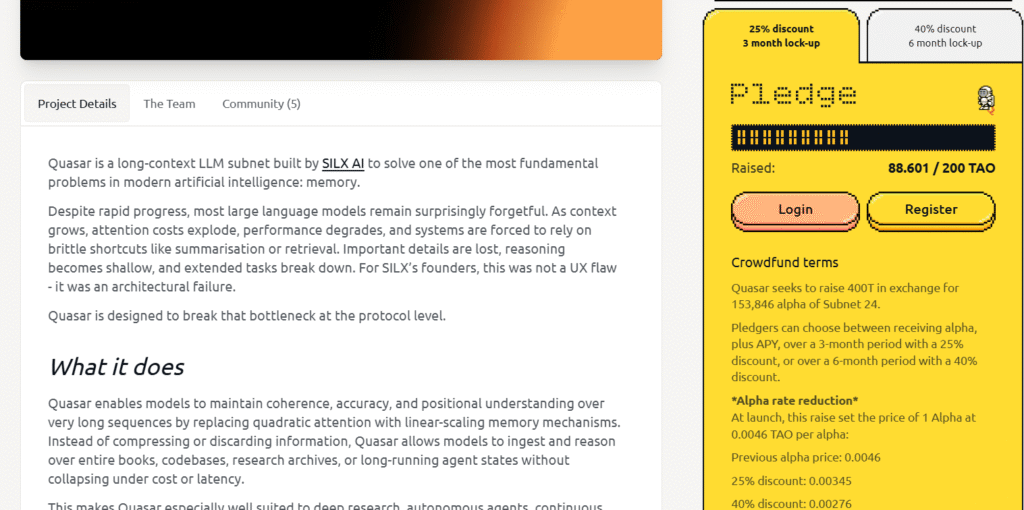

At the center of the discussion was Quasar (Subnet 24), Bitstarter’s second-backed launch and a live example of how the ecosystem may be starting to professionalize.

From Open Experiment to High Stakes System

In the early days, launching on Bittensor was mostly a technical challenge. Teams shipped code, spun up validators, and learned in public. Also, emissions were predictable and mistakes were survivable.

That changed with dTAO which greatly contributed to increased competition within the ecosystem, and a rapidly expanding subnet landscape.

As Macrozack explained, many strong teams began struggling not because their ideas were weak, but because the system had grown too complex to navigate alone. Incentives, validation, token design, fundraising, community building, and execution all had to happen at once.

For new entrants, the learning curve became steep enough to slow the entire ecosystem. Bitstarter emerged as a response to that bottleneck.

What Bitstarter Actually Does

Bitstarter is often described as a launch platform, but that framing undersells its role.

Bitstarter serves as a coordination layer helping subnet teams arrive on Bittensor with the right structure, advice, and alignment before capital and emissions are exposed to market forces.

This includes:

a. Early technical and incentive review,

b. Access to experienced advisors across protocol, engineering, and economics,

c. Structured fundraising designed to favor long term participation, and

d. Ongoing support after launch, not just at the point of entry.

The goal is not to remove risk, it is to prevent avoidable failure.

Quasar and Why This Launch Was Different

Quasar (Subnet 24 on Bittensor) illustrates how this approach works in practice. Rather than appearing on the network cold, Quasar spent months working with Bitstarter before launch. That preparation shaped both how investors evaluated the team and how the subnet itself was designed.

From DSV Fund’s perspective, Mark described the decision to back Quasar as one driven by structure as much as vision. The team’s technical ambition mattered, but so did the support system already surrounding them.

Bitstarter had already:

a. Identified weaknesses in incentive design,

b. Connected Quasar with experienced protocol operators,

c. Helped structure a raise that reduced short-term volatility, and

d. Established accountability and transparency.

That combination turned an early stage team into an investable one.

Advisors, Assurance, and Raising the Bar

One of the most important changes Bitstarter has made is tightening how advisory backing works.

Today, Bitstarter will not publicly launch a team unless at least two advisors are willing to attach their name to it. That means reviewing materials, engaging directly with founders, and standing behind the project in public.

This shift reflects a hard earned lesson.

In a fast moving ecosystem, surface level endorsements are cheap. Real assurance takes time, attention, and reputational risk. Bitstarter is increasingly treating that cost as a feature, not a flaw.

For Quasar, this meant deeper early scrutiny, but also stronger credibility once live.

Incentives Are Where Subnets Win or Fail

If there was one theme repeated throughout the discussion, it was incentives.

Designing a mechanism that scores well in simulation is not enough. On Bittensor, miners adapt quickly. Anything gameable will be tested immediately.

To address this, Quasar partnered with Tensora, a group with hands-on experience mining across many subnets. Their role is to stress test and refine Quasar’s incentive mechanism before it faces full market pressure.

For investors, this matters.

Instead of learning through expensive failure, Quasar is benefiting from institutional memory built across the protocol. It significantly increases the odds that the subnet survives its most vulnerable phase.

Crowdfunding, Discounts, and Long-Term Alignment

Another key innovation discussed was Bitstarter’s fundraising model.

Rather than offering a single price, Quasar’s raise introduced multiple tracks. Participants willing to commit for longer periods received deeper discounts, while $ALPHA was distributed gradually over time.

This structure:

a. Encourages long-term holding,

b. Reduces sudden sell pressure,

c. Aligns investors with subnet performance, and

d. Prevents short-term pump dynamics.

Bitstarter itself is paid in $ALPHA which is distributed alongside pledgers. Advisors and service providers are similarly aligned.

Everyone wins or loses together.

Subnet 67 (Tenex) and the Cost of Avoidable Failure

The collapse of Tenex provided a sobering backdrop to the conversation.

Alchemist described organizing community support for those affected, while Macrozack addressed a harder truth, stating that permissionless systems still require responsibility.

Repeated failures that stem from poor preparation erode trust, they discourage serious capital, and they make the ecosystem harder to take seriously from the outside.

Bitstarter’s response is not regulation or gatekeeping, it is earlier intervention and better education.

Transparency, Doxxing, and Institutional Reality

Mark was clear about one constraint many overlook: Regulated capital cannot deploy into anonymous teams without documentation, accountability, and legal clarity. This is not ideological, it is structural.

Bitstarter-backed teams, including Quasar, are visible. Founders are known and communication happens in public. While that transparency does not guarantee success, it enables participation from capital that would otherwise remain on the sidelines.

As the ecosystem grows, that distinction becomes increasingly important.

Where This Leaves Bittensor

Zooming out, Quasar’s launch is less about a single subnet and more about a changing process.

Bittensor is moving from an experimental phase into an operational one. This shift demands better onboarding, stronger incentives, and clearer alignment between builders and backers.

Bitstarter is positioning itself as the connective layer that makes that transition possible. This is achieved not by centralizing power, but by reducing friction and raising standards.

Closing Thoughts

The most revealing part of the discussion was not any single mechanic or policy change, but intent.

Quasar has not yet proven itself on mainnet but that story will be written through execution, not only by its structure.

Still, the process behind its launch offers a glimpse of a more mature Bittensor; One where teams arrive prepared, incentives are stress tested, and capital is aligned with long-term outcomes rather than short-term momentum.

If this model holds, Bitstarter may end up shaping not just how subnets launch, but how the network itself evolves.

And at this stage of Bittensor’s development, that may matter more than the performance of any single token.

Finally, if 2025 was about expansion, conversations like this suggest 2026 could be about refinement.

Be the first to comment