In crypto, timing is everything. Traders have long relied on closed bots, opaque algorithms, or fragmented dashboards that lock insights behind paywalls. BitQuant, Subnet 15 on Bittensor, flips that model with an open, decentralized AI quant that delivers real-time, verifiable market intelligence through simple, natural language queries.

Its network of AI agents competes to answer questions about tokens, DeFi pools, or portfolio risks, with rewards tied to accuracy and every output recorded on-chain. This creates a transparent marketplace for actionable insights. Now, BitQuant is going beyond intelligence: with features onboard, traders can move from analysis to execution seamlessly, in one platform.

What’s New?

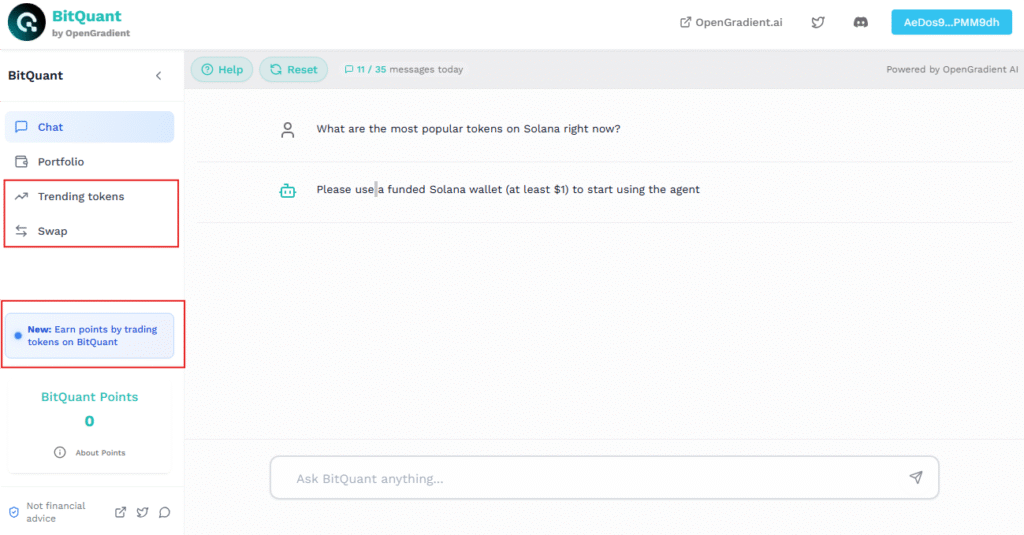

The new release transforms BitQuant from an analytics layer into an integrated trading hub. Users can now:

a. Swap tokens instantly, without leaving the platform

b. Track Trending Tokens in real time through this discovery feed agent. Note that users are required to have at least $1 in their Solana wallet before this chat agent.

c. Earn points on trade. This upgrade makes BitQuant more than a passive analysis tool—it becomes a place where traders can see opportunities and immediately act on them.

Why It Matters

Most platforms in DeFi offer either analytics or execution, but not both. BitQuant unifies the two. Traders no longer need to toggle between dashboards, exchanges, and bots. Instead, the same system that identifies opportunities also provides the mechanism to capture them.

The addition of incentives creates an extra layer of engagement. Traders are not only executing faster but are also rewarded for activity, building a competitive environment that encourages consistent participation.

How It Works

The new swaps feature is built to be easy for anyone to use, so you can go from spotting opportunities to executing trades without friction:

a. Connect your wallet to BitQuant.

b. Search or select the tokens you want to swap.

c. Monitor the trending feed to identify ‘hot coins’.

d. Execute swaps instantly, earn and stack points with each trade. Note that these points are awarded based on the value and volume of swaps executed.

The more trades processed, the more points accumulated by users, with higher-value trades earning greater rewards. There is no cap on the number of swaps users can perform, but a minimum trade size of $2 is required to earn points.

Conclusion

BitQuant has always been about more than raw data—it is about transforming complex market signals into actionable intelligence. With the launch of swaps, it now closes the loop, enabling users to go from insight to execution in a single environment.

The future of DeFi lies in collapsing complexity into simplicity. By uniting AI-driven insights with direct on-chain trading, BitQuant positions itself as one of the few platforms where intelligence and execution converge. For traders, that means fewer missed opportunities and a faster, smarter path to action.

Useful Resources

Official Website: https://www.bitquant.io/

X (Formerly Twitter): https://x.com/BitQuantAI

Be the first to comment