Note: We enjoyed this piece and wanted to repost it here for visibility. Credit to the original author (0xJeff).

Bittensor $TAO finally broke through accumulation phase after an extremely long period of ranging up & down. A lot of excitements in the community, a lot of new people/new holders interested in diving deeper into the ecosystem

Meanwhile, teams building on Bittensor (subnet owners) are extremely hungry — they’re playing the Darwinian AI games 24/7 in every aspect of their lives. They fight to keep the alpha token price up, to make sure the incentive mechanism contribute to the betterment of their tasks, to make sure miners are not gaming the system, etc.

For those learning about Bittensor for the first time, I highly recommend checking out “Into the Bittensor Ecosystem” article. It’ll give you a primer on Darwinian AI, how it works, and why Bittensor ecosystem is exciting.

In this article, I’ll dive deeper into Bittensor, Darwinian AI, TAO & dTAO dynamic, the state of Bittensor subnets as well as challenges & catalysts pushing the ecosystem forward.

Let’s dig in ↓

What’s Bittensor?

You can think of Bittensor like a talent outsource shop + fundraising engine that’s focused on AI. If you have an idea for an AI infrastructure, product, agent/app, traditionally, you need to raise capital from VCs or bootstrap the capital yourself.

On top of this, you need to find and hire AI & ML talents (engineers, researchers) who can help contribute to your AI product. Often times, this would take at least a few million to start (or more depending on your product idea)

Bittensor allows an enterpreneur (subnet owner) to kickstart your idea with minimal capital, find talents to help you on your journey, keep your idea going, and turn your idea into revenue-generating product (or infrastructure)

Key Vocabulary to keep in mind

- Subnet = essentially a startup

- Subnet Owner = founder/core team of a startup

- Miners = AI/ML talents that help subnets improve whatever they’re working on

- Validators = those who validate miners outputs to make sure it’s quality

- Alpha token = subnet token (often used synonymously with dTAO token)

- dTAO = refers to dynamic TAO, an upgrade to TAO economics where TAO emission to subnet is determined by market-driven mechanism (more on this in a bit)

- Root prop = subnet emissions themselves include an automated “root dividend” component, where a slice of alphas is sold into the pool to fund risk-free yields for root-staked TAO holders. This adds protocol-enforced selling, especially in high-emission subnets

How does it work?

Bittensor continues emitting token emissions on a daily basis (currently 7,200 TAO per day and soon 3,600 after the upcoming halving in December).

7,200 TAO gets distributed to all subnets based on their weights.

How is the weight determined?

Market-driven mechanism — $TAO token holders can stake their TAO to a subnet of their choosing. The staked TAO turns into an alpha token of that subnet.

If a lot of people stake their TAO into that subnet, the price of alpha token goes up, and the weight of emission goes up.

Based on taostats screenshot, you can see emission weight of the top subnets here. Chutes is #1 subnet which net them 7.54% of the emission (this is 7.54% * 7,200 TAO = 542.88 TAO or ~$244,300 per day). The emission is received in the form of alpha tokens.

Dynamic TAO

This is the system that dTAO introduced earlier this year in Feb/Mar. Previously, validators determined the weight (which arguably wasn’t fair). Now as a subnet, you actually need to deliver AI infra/product that people like. Product that can be commercialized and generates revenue.

Continuing with the previous example with Chutes, not all of the emission ($244,300) will go to the team. The split is 18%/41%/41% — subnet owner/validators/miners so only around $44k goes to the team on a daily basis.

This is why the Bittensor dTAO system is powerful, as a startup, you can net >$1M per month, use it to finance OPEX or CAPEX instead of raising from VCs.

But at the same time, this is also a double-edged sword. The emission you receive is in the form of alpha token. If you consistently sell your alpha token back to TAO and sell it to stables to fund your operation, your alpha token faces consistent sell pressure.

This doesn’t signal confidence to all the other stakeholders, nobody would want to buy in and hold your alpha token.

Subnet owners are left with a few options

(i) Do OTC with funds/whales to get stables to fund ops & not rekt the chart

(ii) Move fast to productization stage i.e. earn revenue and use that revenue to keep the operation going (and hopefully buyback alpha token as well)

(iii) Use solutions like what SN65 Taofu guys introduced where subnet owners can tokenize a part of future stream of subnet owner emission (tokenize part of the 18%) and sell that to investors to unlock liquidity

Option (ii) is very difficult to achieve and given the nature of TAO and alpha token where emissions are given out everyday in the form of your alpha token, buying back and maintaining the alpha token price is almost impossible UNLESS you’ve hit a breakthrough (the next decentralized OpenAI or the next Cursor, you get the idea). So far no subnet has achieved this stage yet.

Miner POV

Miners = the heart and soul of Bittensor ecosystem. While the term miners suggests that they’re mining incentives, the reality is they have to constantly compete with other miners to perform a task/to meet an objective with the best quality output.

Let’s use a prediction subnet as an example, a subnet need help refining their predictive signals for BTC on a daily timeframe.

This is where miners come in — miners have to run ML models, it could be linear regression, neural network, decision tree, or any ML models with their own proprietary dataset (or public data).

A miner whose model performs the best will receive the highest emission within that period. The competition runs 24/7, like a hunger game that doesn’t end (in this case, nobody dies BUT the winner gets to eat large chunk of the pie)

Often times we’ll see people transition from miners contributing to a subnet to subnet owners creating subnet and building an AI infra/product.

Investor POV

When staking your TAO into a subnet, you choose to delegate your TAO to a validator of that subnet. Choose the right validator (best performing validator) will net you highest APR % (The APR is from 41% validator portion)

As an investor you have 2 primary choices

(i) Buy TAO and stake on Root (SN0) which is like staking your TAO to uphold the security of the network (akin to proof-of-stake on L1s)

(ii) Buy TAO and stake on subnets, thereby holding the exposure of alpha subnet tokens

The latter is high risky as alpha tokens have innate downward pressure in price from emissions BUT if you invest in the right subnet, you can essentially double triple or quadruple your $TAO stack e.g. an alpha token goes up 100% in a month, your original 100 $TAO became 200 $TAO (if TAO price goes up in tandem, your $ amount multiplies).

Alpha tokens behave like any AI project tokens but with tons of emissions to keep the development of the project going. When a subnet goes on Novelty Search by @const_reborn (founder of Bittensor) or Revenue Search by @MarkCreaser & @SiamKidd (DSV fund), the subnet tend to perform well because the community get excited about latest updates, new product/feature, revenue pipeline, etc etc.

Bear in mind most subnet suck at marketing & distribution and only a handful of them know how to do CT marketing. May or may not matter if a product is targeted towards general non-Web3 audience BUT given the presence of a token, it’s usually better if they know how to treat their community and their token holders right.

How to get started in investing into a subnet?

- Download Bittensor Wallet or Talisman Wallet extension. This is your default on-chain wallet on Bittensor Chain

- Buy some $TAO, preferably on Binance because it’s easiest & fastest to bridge.

- If not, you can buy TAO on Ethereum, Arbitrum and use Tensorplex or Taoapp bridge to bridge (there’s also an option to use VoidAI w/ Talisman to bridge but I’ve never tried this so DYOR)

- Go to taostats or taoapp and buy subnet alpha tokens there

Which subnet to buy?

The beauty of Bittensor ecosystem is that you need to dive deep to understand what each subnet is building and form your own thesis.

Many categories for you to explore

- Decentralized compute: possibly highest revenue generating subnets to the addressable market + most straight forward product

- Inference provider: Chutes is the #1 subnet with billions in tokens processed per day on OpenRouter (hosting open-source models like Deepseek, Kimi K2, Qwen, etc)

- Prediction: Predicting sports matches, weather, asset prices, event outcomes, and more. Most popular category due to the demand for high quality predictive signals (demand gets increasingly higher because of prediction markets)

Not going to write everything here but some other cool ones are coding co-pilots, VLM, 3D asset generation engine, Westworld-style AI world, AI x Creator, DeSci, distributed training, and more.

Make sure to do extreme due diligence looking at the team, the stage of the product, traction (users, revenue), commercial pipeline, communications/marketing, etc. You can also check whether subnet owners have consistently dumped their emissions on taostats.

The Challenges & The Network Effect

Key challenges for Bittensor ecosystem are the lack of external capital + too tight knitted of a community + Bittensor Chain isolated from EVM & Solana (friction in UI/UX) + Slow Defi implementation/not enough builders building Defi legos and tools to make it easier to buy alpha tokens & engage with Bittensor ecosystem

First of all, the culture is very different on Bittensor — it’s professional, it’s not crypto-native, it’s refreshing BUT at times it can feel a bit closed off/too corporate.

This is a good in a way because TradFi & suits may prefer this over being “degen” and crypto-native. But at the same time, most people on CT don’t really understand Bittensor because it takes too long to learn + there’s no immediate upside to do so (no Kaito/Cookie leaderboard, no incentives to spread the word) + there’s no builder program or ecosystem grant designed to attract builders to build better tools OR defi legos (there’s only hackathon/support for subnet builders)

On the bright side, things are slowly changing

- SN10/Sturdy guys are building Defi layer for Bittensor ecosystem starting with lending/borrowing using Root staked TAO + users can directly purchase alpha tokens directly on EVM

- SN65 Taofu is building subnet owner emission tokenization so subnet owners unlock immediate liquidity and avoid selling alpha tokens

- OTCs are becoming more prominent e.g. OTC between validators/miners and investors to avoid rekting the chart

- Efforts are being made to list alpha tokens on DEXes and CEXes (some will likely land on Base soon)

At the same time, institutional interest in Bittensor ecosystem is growing — @chamath took an interest Bittensor, All-in podcast host @Jason launched @stillcorecap Bittensor-focused fund w/ @markjeffrey, Grayscale filed form 10 for Bittensor Trust signaling a path towards TAO ETF, and a growing list of TAO DATs.

The network effect is growing really fast on the institutional side, more capital is coming to $TAO and is likely to spill over to subnets. If this happens, we’ll see more AI/ML talents becoming miners, farming incentives, further accelerating the progress of subnets.

As $TAO price increases, the market cap & FDV of subnets increase (as subnets are denominated in TAO). In order to maintain or lift the floor valuation of subnets, newer capital needs to enter into subnets, otherwise existing participants may dump their alpha tokens into $TAO.

What’s Next?

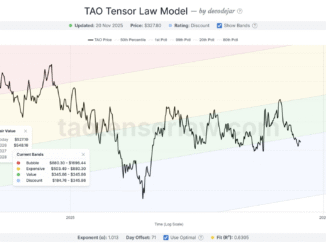

A lot of challenges but also a lot of tailwinds for Bittensor. Metrics are pointing towards alpha tokens price bottoming out while halving is about to happen in less than 2 months.

The network effect of Bittensor is expanding — more investors more, wealth distribution, better talents working & improving AI systems, better infra & product that generates revenue, more revenue goes back into the system, and the flywheel continue positioning Bittensor as the internet of decentralized intelligence where decentralized AI proliferate, where intelligence becomes monetizable and ownable.

Whether you’re an investor, an entrepreneur looking to start an idea, or a miner looking to contribute, now is literally the best time to get into Bittensor.

Who to follow for Bittensor updates

Beyond following the subnets & the founders,

- @const_reborn — consistent Bittensor content

- @markjeffrey — comprehensive subnets overview

- @Old_Samster — quality long forms on anything Bittensor

- @brodydotai — extensive Bittensor newsletter / updates

- @DreadBong0 — consistent posts highlighting subnets

- @Victor_crypto_2 — weekly subnets updates

- @CryptoZPunisher — deep dives on newer subnets

- @gtaoventures — subnets overview/podcast

- @VenturaLabs — long form vids w/ Bittensor stakeholders/subnets

- @mikecontango — give normie-friendly/bullish Bittensor talks

- @JosephJacks_ — posts on anything Bittensor

- @KeithSingery — subnet-specific podcast

- @SiamKidd & @MarkCreaser — good vids w/ subnets (Siamkidd got best Bittensor 101 for normies vid)

- @BarrySilbert — driving instos adoption onto Bittensor

- @bittingthembits — one of the biggest TAO bull

Personal Note: Thanks a lot for reading! This article that you see here is a slightly shorter version (if you want my unfiltered thoughts do check out the Substack version)

And if you want to see on upcoming DeAI projects that I’m excited for, check out The After Hour series on my Substack.

Since this is a beginners guide how about answering another investing question- where do we find the value of Tao and how does TAOX (traded on NASDAQ) determine its profitability? TAOX just buys TAO, right?