YouTube Video Credit: David Hepburn

This video makes a simple but uncomfortable point. Most people lose money in crypto not because they picked bad projects, but because they overtrade, overleverage, and lack patience. TAO is used as the case study.

Watch it below:

The core argument is that price is a distraction during accumulation phases. What actually matters is where you sit on the TAO rich list, because that position becomes exponentially harder to reach once price expands.

TAO has spent nearly two years moving sideways, which the presenter frames as an accumulation window rather than a failure. Development has continued, emissions were cut by 50 percent after the December halving, and institutional interest is increasing. From a lifecycle perspective, TAO is positioned as early adopter stage, while assets like Bitcoin sit firmly in late majority.

To make the point tangible, the video compares TAO to XRP’s rich list. The amount of XRP needed to reach top percentile brackets barely changed over years, but the USD cost rose more than 10x. The lesson is clear. The cheapest time to climb the rich list is before price reprices the asset.

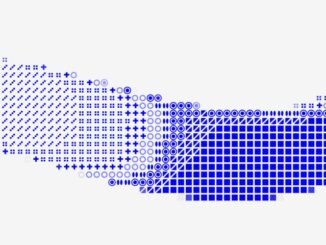

Current TAO rich list data shows how accessible this phase still is:

- Top 10 percent requires about 12.6 TAO, roughly $3,000

- Top 5 percent requires about 50 TAO

- Top 3 percent is around 100 TAO

- Top 1.5 percent sits near 250 TAO

The presenter pushes back on the idea that you need massive size to matter. Holding 50 TAO already places you ahead of 95 percent of wallets.

Fundamentally, the bull case highlighted is familiar but stacked. Largest AI-focused crypto, ETF filings from Bitwise and Grayscale, treasury-style accumulation with over 120,000 TAO staked, and a shrinking supply post-halving. The argument is not that TAO is guaranteed to win, but that the risk-reward during this range favors accumulation, not speculation.

David Hepburn also shares his own approach. Early buys in 2023 between $30 and $60, partial profit-taking between $500 and $700, and a current DCA strategy below $350. Future profit-taking only comes back into play above $600.

The takeaway is blunt. Sideways markets are where positions are built, not during breakouts. If TAO eventually reprices like other major crypto assets, today’s rich list positions will look cheap in hindsight.

Be the first to comment