Almanac has officially launched its closed beta, marking a major milestone for Sportstensor (Subnet 41 on Bittensor) and the broader Bittensor prediction market ecosystem.

The aim of this infrastructure is to improve the signal quality of miners by aligning rewards with real performance, not simulated outputs.

The early results already show strong engagement, and the platform’s design is laying the groundwork for a new class of prediction market intelligence powered by actual trading activity.

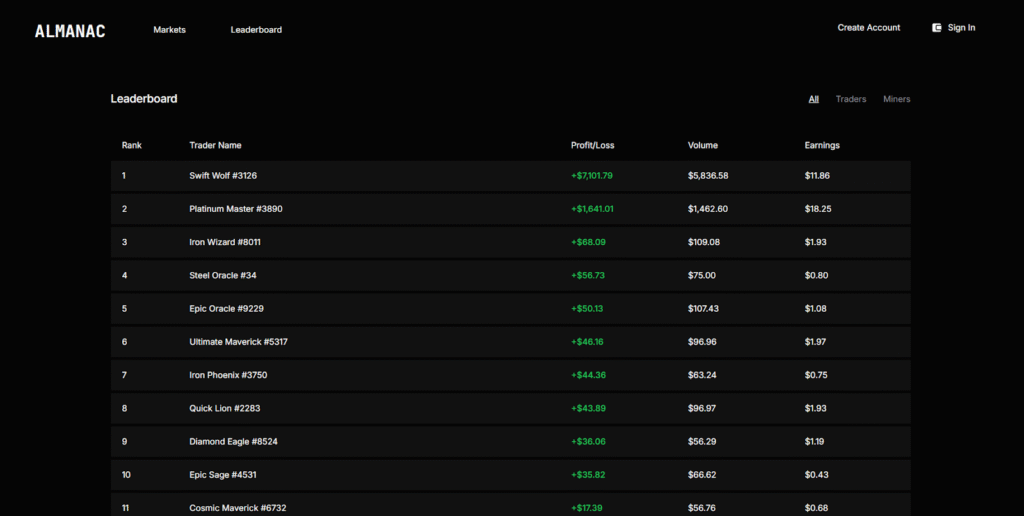

Closed Beta Launch: Early Results at a Glance

The closed beta opened last week exclusively for Bittensor miners. This limited rollout allowed the team to stress test the platform under controlled conditions.

From usage, the platform was able to record the following:

a. 40 registered traders actively participating

b. $19,148 total trading volume generated

c. $478.70 average volume per user

d. $7.86 in rewards distributed so far from a $72,324 rewards pool

Rewards unlock progressively as participants hit performance thresholds determined by Almanac’s incentive model.

Why Almanac Is Different

Traditional prediction systems score miners based on simulated trades. Almanac replaces this with something far more grounded in reality: actual trades, real capital, real performance.

This shift creates stronger, cleaner, and more reliable signals for ranking intelligence.

But wait, what changes with Almanac?

Before, miners submitted ‘only’ predictions, scores based on simulated performance and these miners have no skin in the game (nothing to lose at all from incorrect predictions)

With Almanac:

a. Miners (and soon all traders) place real trades on Almanac.

b. Scores determined by real results and real risk-taking.

c. Skin in the game which translates to higher-quality predictions.

This structure aligns incentives with the people capable of producing accurate models, better research, and more consistent insights.

How Rewards and Incentives Work

The reward pool, currently over $70,000, is unlocked based on actual trader performance.

Almanac evaluates multiple factors, including:

a. Trading volume

b. Return on investment (ROI)

c. Consistency and accuracy over time

This approach rewards traders who not only get the direction right but also manage risk responsibly.

In addition:

a. A 1% trading fee flows back into the system.

b. Fees fuel buybacks and further rewards for top performers.

c. The entire cycle strengthens incentives for high-quality predictions.

Built for Everyone, Starting With Miners

The closed beta is currently restricted to Bittensor miners and traders as well, Almanac is being built for a much wider audience.

It allows:

a. Anyone to trade.

b. Anyone to climb the leaderboard.

c. Anyone to be eligible for rewards.

This opens the ecosystem to thousands of traders who can contribute signals, generate volume, and compete directly (dramatically improving market accuracy).

Why Almanac Matters for the Future of Prediction Markets

Prediction markets are only as good as the information flowing into them. Almanac introduces:

a. Aligned incentives

b. Real-world risk-taking

c. Performance-based scoring

d. Lower barriers to entry

This produces more truthful markets, better intelligence, and a stronger feedback loop between skill and reward. Almanac isn’t just a trading platform.

It is the first information incentivization layer built to improve how prediction markets understand and price reality.

How to Get Involved

Almanac is expanding access, to participate in the ecosystem:

a. Watch out for public beta announcement

b. Follow Almanac for updates

c. Prepare to trade, compete, and climb the leaderboard

d. Bring insights and get rewarded for accuracy

Almanac offers a direct way to turn intelligence into measurable rewards for everyone (miners, traders, researchers, or market enthusiasts).

Be the first to comment