Upcoming HUGE catalysts for $TAO (and thus $TAOX).

All of these will happen:

A) The first halving for $TAO on Dec 13.

TAO is structured exactly like Bitcoin. 21,000,000 tokens fixed supply released over time as incentives for miners.

Every four years, the amount rewarded to miners gets cut in half. The first halving for TAO is on December 13, 2025, give or take a day.

This reduces the amount of tokens that are added to the supply each day.

As demand goes up and potential supply goes down, price, of course goes up. This is Economics 101.

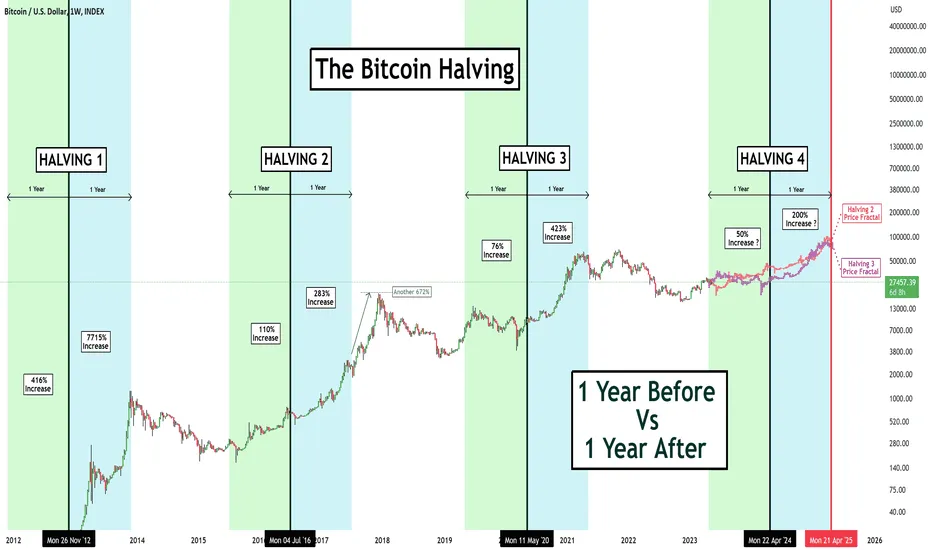

Bitcoin went up 7000% after their first halving. Admittedly, Bitcoin had a lower market cap then than TAO does now. But Bitcoin has gone up significantly after every halving and this is just the first for TAO.

And if that happens in conjunction with below, the result will be explosive.

B) Subnet cap moved to 256 from 128 .

Why is this important?

Every new subnet creates a spike in demand for TAO. To create a subnet, the subnet owner has to stake TAO, and all new validators for the subnet have to stake TAO.

This means they have to buy TAO (increase in demand) and stake it (reduce supply).

If 128 new subnets are created (this will happen, the first 128 took only a few months to create), then the demand for TAO tokens will be for 1,500,000 tokens. Right now there’s almost 10,000,000 tokens with out 90% staked.

The new demand will completely eliminate all supply of TAO. So again, demand will go up (all the new subnets create demand) and supply will almost be zero. I can’t even calculate what that will do to price. Particularly with the halving coming up.

C) Bitcoin going back to all time highs (around rate cut time in September).

Six cabinet members, plus Trump, own $BTC. Don’t forget the saying, “Don’t fight City Hall”.

Well, in this case, City Hall is Trump and his Cabinet. And they want Bitcoin (and all crypto) to go up.

The SEC chairman is repeating Trump’s demand of making the US the “Crypto Capital of the World”. And the CFTC is now looking into making it easier to trade crypto.

The SEC has allowed the rise of public treasury companies holding crypto, greatly increasing demand for all crypto.

And US Treasury Secretary Bessent just backtracked his comments on whether or not the US Strategic Reserve will be buying crypto. He now says they will be in “budge neutral” situations.

There’s been some talk of what budget neutral is but I like the idea being discussed of bitbonds – US issued bonds backed by Bitcoin that give a lower yield but track the price of Bitcoin, giving investors a safer way to get capital appreciation.

The Federal Reserve is going to cut rates this year. Estimates range 1 time to 4 times. EVERY SINGLE TIME they cut rates, Bitcoin goes up and the altcoins like TAO go up more.

D) One of the subnets becoming better than their centralized AI competitors –

BitMind is already there for DeepFake detection. They have beat all competitors in benchmark tests. Get their app, AI or Not, in the app store.

Ridges is close (it’s competitor, Cursor, worth billions, is only 10 points higher on SWE benchmark tests).

Entrepreneurs will realize they can create billion dollar companies for 1% of the costs on $TAO.

E) The first millionaire miners (this will happen. Miners on some subnets are making $10,000s / day).

G) Elon or Chamath or Thiel or whoever will realize that decentralized AI is the most scalable long-term method for building super AI.

There is historical evidence.

The “TCP/IP” protocol (i.e. “The Internet”) which started as a decentralized networking protocol, beat out all commercial networking software to become the ONLY networking software.

Decentralized Linus is now the basis for almost all operating systems.

Even Twitter/X can be thought of as decentralized news and now not a single news organization can compete.

The list goes on and on.

For now, centralized AI has to pay billions of dollars to get good programmers and millions of GPUs to build their AI. So they have to raise tens of billions of dollars. This is not scalable.

This can’t last forever and it never has. It is a race to the bottom. An up and coming example on TAO is Subnet 4, Targon. Targon offers use of 2,000 Nvidia GPUs. That’s $100,000,000 worth of GPUs that they paid zero for (but the miners who are offering the GPUs get rewarded in Targon tokens).

Again, for 1% of the costs or less, you can build better AI than with centralized AI. This is a formula that always works.

When will this happen?

Here’s the thing: it’s not like one of these will happen and we pray it does.

ALL OF THESE WILL HAPPEN.

My guess is, almost all of them will happen by the end of 2025. The halving certainly will. The subnet cap probably will. Bitcoin certainly will. A subnet being better than its centralized AI counterparts has already happened but more will happen by year-end. I don’t know if any millionaire miners have happened but they are definitely on track. And, privately, I have heard that some of the top AI billionaires have looked into or are looking into TAO quite extensively.

This is not a story about greed. It’s good that people working hard get rewarded. But its not about that.

This is about a better future being created.

Be the first to comment