⚠️ Editor’s Note: This article was originally published by Asymmetric Jump on Substack. It is republished here with full credit to the author. All rights belong to the original author.

0. Introduction

Today I bring you different article, not about a subnet but about a project that could be revolutionary for the whole Bittensor Ecosystem!

TaoFi is building the missing DeFi layer for decentralized AI. By bringing bridges, stablecoins, staking, and trading tools directly onto Bittensor, TaoFi unlocks a frictionless experience for both AI agents and users. This research is based on live data and protocol updates from TaoFi, Hyperlane, and Bittensor’s ecosystem.

I hope you enjoy it. Please give me feedback!

1. Quick Overview

• Purpose: Build foundational DeFi tools natively on Bittensor for both agents and humans

• Launch Date: May 27, 2025

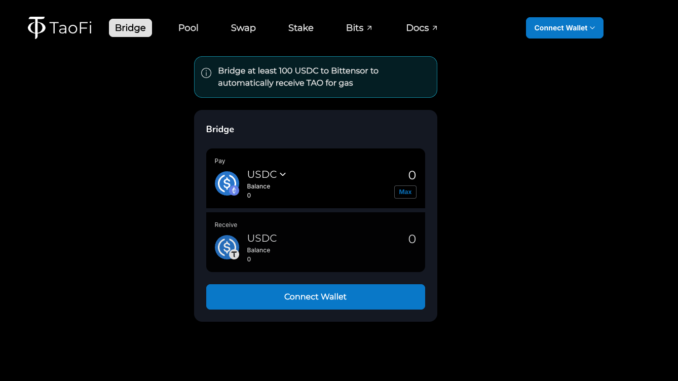

• Bridge Assets: USDC from Ethereum, Base (soon: ETH, SOL)

• Core Tools: Bridge, Uniswap v3 deployment, taoUSD (stablecoin), sTAO (liquid staking)

• Trading Pair: TAO-USDC on Bittensor EVM

• Fee Model: 0.3% swap fee goes to LPs

• Gas Incentive: Bridge >100 USDC → receive 0.01 TAO

• Tech Partners: Hyperlane (interchain comms + ICAs)

2. TL;DR

• TaoFi is the native DeFi suite for Bittensor’s AI network

• It uses bridges + Uniswap pools to let users and bots buy TAO or alpha tokens easily

• No complicated setup — anyone can use it without special wallets or extra steps

3. Product & Features

• Bridge: USDC from Ethereum/Base → Bittensor EVM (1:1, gas-incentivized)

• DEX: Uniswap v3 pools live, starting with TAO-USDC

• Stablecoin: taoUSD (backed by bridged assets, not yet deployed)

• Staking: sTAO (liquid staked TAO, accruing yield from root network)

• Interchain Infra: Hyperlane’s Warp Routes + Interchain Accounts enable seamless backend swaps

• LP Tools: Users can add liquidity or create permissionless limit orders via single-sided LPs

• Coming Soon: One-click buy of alpha tokens using ETH/SOL/USDC

4. Moats

• UX Advantage: First to reduce alpha buying to a single-click action — massive unlock for user and agent access

• Infra Lock-In: Uses Hyperlane’s Interchain Accounts to abstract away wallets and bridges

• Bittensor-First: Native positioning on Bittensor aligns perfectly with TAO’s decentralized AI vision

• Early Network Effects: Anchored in Subnet 10’s tech and builder talent

• Composable by Design: Future alpha token integrations can plug into TaoFi’s backend routing

5. Users, Usage & Growth

TaoFi is rapidly becoming the financial gateway to Bittensor. It lowers the barrier for new users (human or agent) to interact with decentralized AI by eliminating the need for custom wallets or multi-step setups.

The current user funnel includes:

• Bridgers: Users can bring USDC from Ethereum/Base to mint taoUSD

• Swappers: Users can permissionlessly buy TAO via Uniswap V3 on Bittensor EVM

• Stakers: TAO holders receive sTAO for liquid staking

• Liquidity Providers: LPs earn fees on the TAO-USDC pool and soon on sTAO/taoUSD

A major user growth catalyst is the TaoFi Bits Campaign, a gamified rewards program that tracks on-chain activity and pays users in “Bits” for helping bootstrap the ecosystem.

6. Team

- Sam Forman – Founder of TaoFi and Sturdy

- Background – Left Stanford in 2021 to build AI-powered DeFi protocols

- Previous project – Creator of Sturdy Protocol, now incubated by Yuma on Bittensor SN10 (I covered it here)

- Team – Likely includes Sturdy devs with AI + blockchain expertise

- Backers – Pantera Capital, DCG, taostats, Lyrik Ventures

- Affiliations – Connected to Yuma and Bittensor core builders

- Why credible – Proven execution, deep AI x DeFi focus, aligned with TAO ecosystem

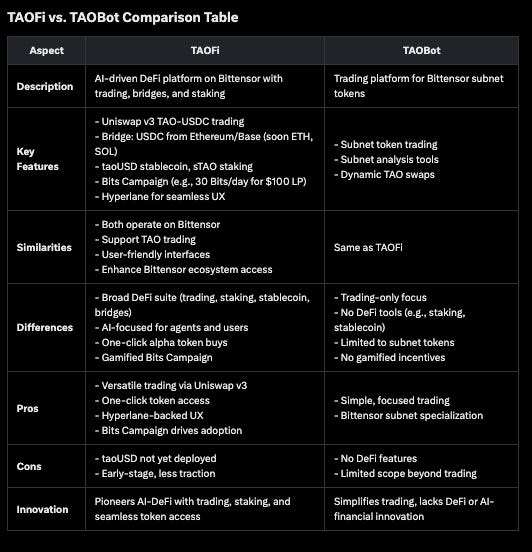

7. TAOFi vs TAOBot – Comparison

TAOFi’s integration of Uniswap v3 trading, cross-chain bridges (USDC from Ethereum/Base, soon ETH/SOL), taoUSD, and sTAO creates a robust DeFi hub for Bittensor’s AI ecosystem.

Its one-click alpha token access and Bits Campaign (e.g., 100 Bits for following @taofi on X) drive adoption, setting it apart from TAOBot’s trading-only focus. Hyperlane’s interchain infrastructure further enhances TAOFi’s seamless UX, making it a revolutionary financial layer for decentralized AI

8. Catalysts & Why It Matters

TaoFi solves the final frontier of decentralized AI: making it economically autonomous.

Why use it now?

• Unlocks Alpha Liquidity: Enables one-click purchases of alpha tokens using USDC/ETH/SOL

• Reduces UX Friction: Removes multi-step setup to access Bittensor’s network

• Liquidity Engine: Incentivizes staking, LPs, and bridges with real DeFi rewards (via Bits)

• Growth Hooks: Bits campaign aligns users, LPs, and influencers around shared incentives

• Protocol Flywheel: More volume → more LP fees → better markets → more adoption → more TAO utility

Upcoming features like ETH/SOL routing, alpha token one-click swaps, and expanded LP tools will solidify TaoFi as the financial OS of decentralized AI.

Sources

https://docs.taofi.com/

https://app.fuul.xyz/incentives/taofi

https://www.taofi.com/bridge

https://x.com/_taofi_

Disclaimer

This report was AI-assisted and refined by the researcher. It is provided for informational purposes only and does not constitute financial advice. Always DYOR. The researcher may hold or trade the tokens discussed.

Be the first to comment