⚠️ Editor’s Note: This article was originally published by Robert Sun on Substack. It is republished here with full credit to the author. All rights belong to the original author.

Introduction

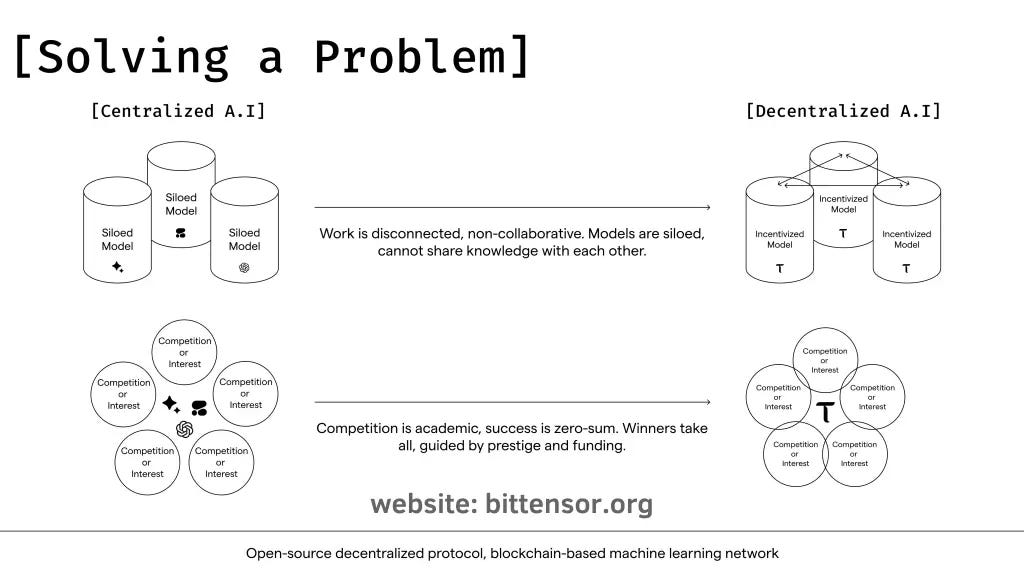

Bittensor ($TAO) is a decentralized protocol that allows open and incentivized machine learning. Built with a custom framework, the blockchain allows AI developers to compete for rewards via TAO by providing outputs, which are validated through peer consensus. Each “subnet” represents a distinct AI domain, from language modeling to financial forecasting.

“Each subnet is an independent community of miners (who produce the commodity), and validators (who evaluate the miners’ work)”

(learnbittesnor.org)

The core structure of Bittensor is composed of:

- Miners – Who work to contribute useful work (like serving models or answering queries).

- Validators – Evaluating the quality of miners’ work.

- Subnet Owners – Managing and building the incentive mechanisms that the miners and validators must follow.

- Stakers – TAO holders are given the option to support specific validators by staking TAO with them.

Yuma Consensus

A core component of Bittensor is the Yuma Consensus (YC), a mechanism that allows subnet owners to create custom reward (emissions) structures for both validator and miner. It ensures both parties are correctly aligned and that only the highest quality outputs are rewarded in the system.

Why does it matter?

- YC ensures rewards (emissions) flow to real and productive AI work, not hype or manipulation.

- It reinforces the competitiveness and integrity of Bittensor, which makes TAO emissions more meritocratic.

- The YC system enables Bittensor to scale DeAI with quality control.

In general, this creates a market where the rewards are based on the quality and usefulness of the services provided, encouraging participants to specialize and excel in areas where they deliver the most value.

Website / X (Twitter) / Discord

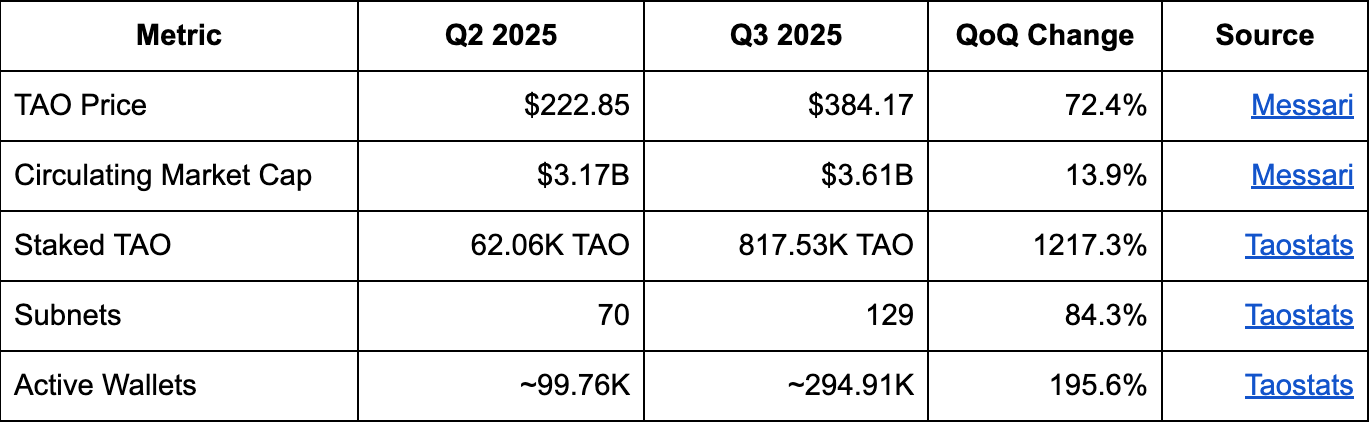

Key Metrics

Performance Analysis

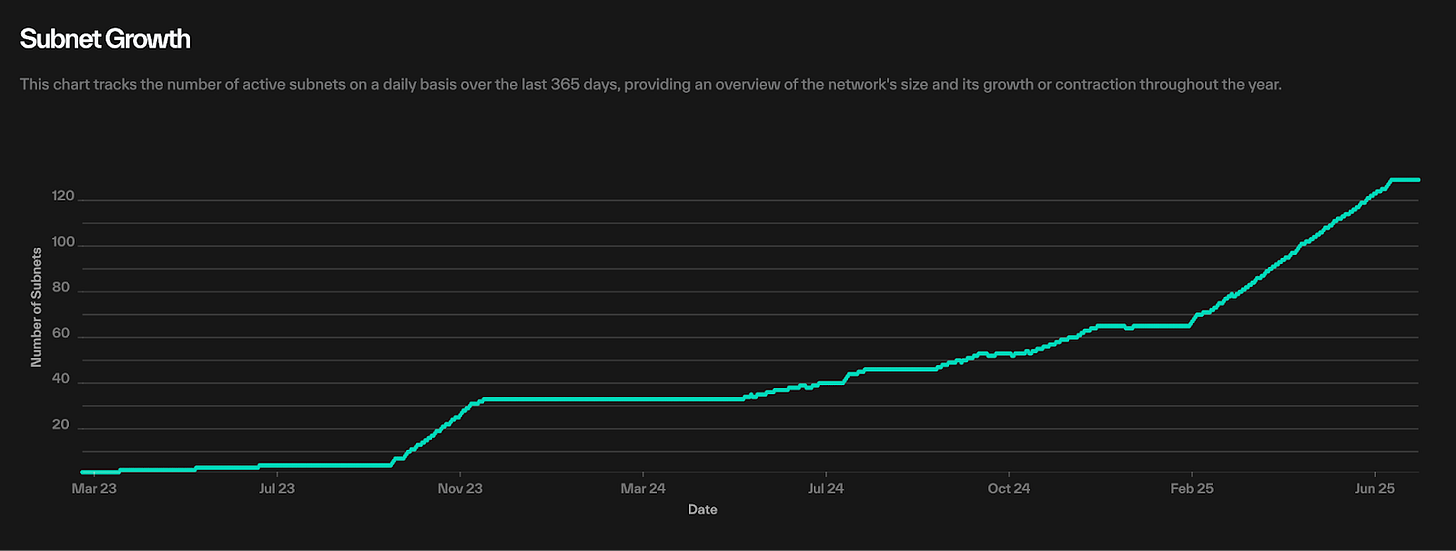

Subnet Growth

Bittensor’s expansion to 129 subnets (includes non-active subnets) marks a milestone increase from 70 in the last quarter. This reflects increasing experimentation across domain-specific AI tasks.

(Taostats, Subnet Growth, https://taostats.io/analytics/subnets)

Notable subnets include:

- Subnet 8 (Proprietary Trading Network): Trading network where AI and human strategies compete for $TAO.

- Subnet 33 (ReadyAI): Data labeling that converts raw text into structured, AI-ready data.

- Subnet 34 (BitMind): Decentralized deepfake AI detection.

The protocol’s architecture enables rapid deployment of custom and tailored machine learning ecosystems, drawing early-stage developers who require composable and incentive-aligned infrastructure.

TAO Staking

Staking in Bittensor occurs within each subnet, where TAO is converted into alpha (α) units via a local AMM. These α units reflect real-time demand within each subnet, and they directly affect validators’ influence and rewards given to stakers and miners.

This model introduces:

- Transparent and market-driven price discovery for subnets.

- Stronger incentives for early and accurate validators.

- Efficient allocation of capital based on individual subnet activity.

In Q3, the total TAO staked in Alpha has continued a steady upward trend, now exceeding 800,000 TAO. This staking momentum is largely driven by:

- Validator incentives (high real yield for uptime and accuracy).

- Delegator’s confidence in network stability.

- New subnets requiring TAO and α.

(Taostats, Tao staked in Alpha Over Time)

Qualitative Analysis

Technical Standpoint

- Scaleable AI: Bittensor’s subnet architecture allows different models to run in parallel, which supports rapid scaling across various AI domains.

- Incentive Structure: Each subnet can configure its own rules for miners and stakers, which enables custom solutions for each challenge the subnet owner sets.

- Interoperability: Ongoing updates to the blockchain target smart contract integrations and cross-chain support, such as Bittensor EVM.

Narrative Standpoint

- AI Demand Alignment: Bittensor is well-positioned to benefit from the growing interest in building and deploying AI models.

- Incentive Flywheel:

- Miners and validators earn more fiat as $TAO increases over time.

- Higher $TAO value attracts higher-quality contributions.

- Higher-quality contributions increase the value of $TAO.

- Repeat.

- The “Hub” of Open-Source Potential: While not confirmed, Bittensor is definitely on track to become the leading platform for open, censorship-resistant AI models.

Investment Standpoint

- Institutional Involvement: Growing institutional interest has been signaled through significant amounts of TAO purchases being made and staked by these funds, for example:

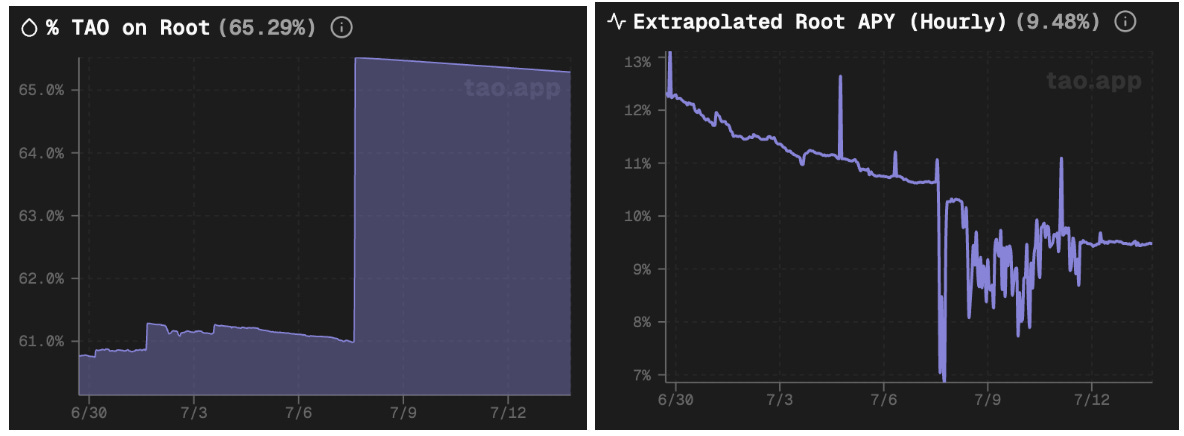

- Staking & Rewards: ~65% of TAO supply is staked in Root (into TAO itself), which reflects strong holder conviction. Current staking yields in Root average ~9.5% APY, offering highly competitive returns relative to other protocols.

(TAO on Root & Extrapolated Root APY, https://www.tao.app/metrics)

Closing Summary

In 2025, Bittensor stands out to be the leading decentralized protocol for incentivized and collaborative AI projects. Its unique subnet architecture, driven by the Yuma Consensus, enables rapid scaling and specialization across vast machine learning models, from trading algorithms to deepfake detection. Bittensor is on track to become a “hub” for permissionless and open-source deAI projects.

Institutional adoption is also accelerating its exposure with TAO, as seen with multi-million-dollar funds like xTAO, Oblong, and Grayscale’s Bittensor Trust, validating TAO’s emergence as a core asset in the deAI narrative.

As the demand for transparent, open-sourced, and decentralized AI grows, Bittensor’s position as the leading protocol services all of those needs makes it a protocol worth following.

Sources

- Taostats.io

- Messari.io

- Learnbittensor.org

- Tao.app

- Docs.bittensor.org

- Bittensor.com/whitepaper

- WonderFi co-founder’s new startup xTAO to list on TSXV following merger with Adrianna Ventures | BetaKit

- Oblong Announces $7.5 Million Private Placement to Launch Bittensor-Centric AI and Digital Asset Strategy

- Grayscale Bittensor Trust

Be the first to comment